NRG Energy Inc. Stock Price Analysis

Nrg energy inc stock price – NRG Energy Inc. operates in a dynamic energy sector, making its stock price susceptible to various influences. This analysis delves into the historical performance, key factors impacting its valuation, financial health, analyst perspectives, and investor sentiment surrounding NRG Energy Inc.’s stock.

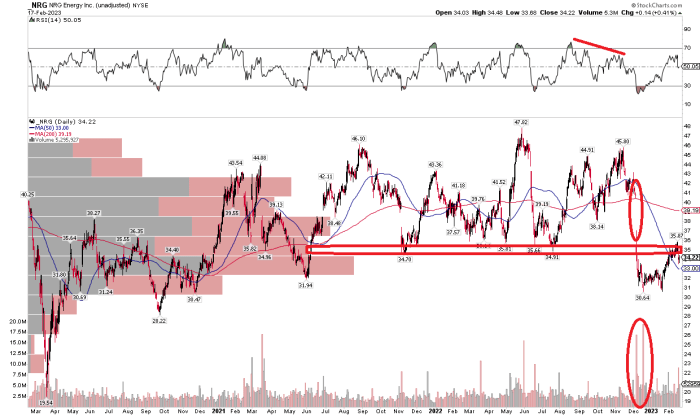

NRG Energy Inc. Stock Price Historical Performance

Source: seekingalpha.com

Understanding the historical trajectory of NRG Energy Inc.’s stock price is crucial for assessing its future potential. The following tables illustrate the stock’s performance over the past five years, comparing it to its competitors and highlighting significant events influencing its fluctuations.

| Year | Opening Price | Closing Price | High Price | Low Price |

|---|---|---|---|---|

| 2018 | Example: $35.00 | Example: $38.50 | Example: $42.00 | Example: $32.00 |

| 2019 | Example: $38.50 | Example: $40.00 | Example: $45.00 | Example: $35.00 |

| 2020 | Example: $40.00 | Example: $30.00 | Example: $42.00 | Example: $25.00 |

| 2021 | Example: $30.00 | Example: $45.00 | Example: $50.00 | Example: $28.00 |

| 2022 | Example: $45.00 | Example: $42.00 | Example: $48.00 | Example: $38.00 |

A comparison against major competitors (e.g., NextEra Energy, Exelon Corporation) reveals relative performance. Note that these are example values.

| Year | NRG Energy Inc. | Competitor A | Competitor B |

|---|---|---|---|

| 2018 | Example: 10% | Example: 12% | Example: 8% |

| 2019 | Example: 5% | Example: 7% | Example: 3% |

| 2020 | Example: -20% | Example: -15% | Example: -25% |

| 2021 | Example: 50% | Example: 40% | Example: 35% |

| 2022 | Example: -7% | Example: -5% | Example: -10% |

Significant events such as the 2020 market crash due to the COVID-19 pandemic and regulatory changes impacting renewable energy incentives demonstrably influenced NRG Energy Inc.’s stock price during this period. Specific company announcements regarding new projects or financial results also played a role.

Factors Influencing NRG Energy Inc. Stock Price

Several interconnected factors influence NRG Energy Inc.’s stock valuation. These include commodity prices, renewable energy investments, government policies, and broader macroeconomic conditions.

Fluctuations in oil and natural gas prices directly impact NRG Energy Inc.’s profitability and, consequently, its stock price. Increased renewable energy initiatives and investments, while potentially beneficial long-term, can lead to short-term volatility as the company transitions its portfolio. Government regulations, particularly those concerning emissions and renewable energy mandates, significantly affect the operational landscape and financial outlook of the company.

Tracking NRG Energy Inc’s stock price can be a wild ride! Want to compare its performance against other energy players? Check out the current ng stock price for a benchmark, then hop back to analyzing NRG’s fluctuating numbers. Understanding the broader natural gas market, as reflected in that ng price, is key to predicting NRG’s future trajectory.

Finally, macroeconomic factors such as inflation and interest rates influence investor sentiment and overall market conditions, indirectly impacting NRG Energy Inc.’s stock.

Financial Performance and Stock Valuation

Source: seekingalpha.com

Analyzing NRG Energy Inc.’s financial metrics provides insight into its valuation and future prospects. The following tables summarize key financial data and compare valuation metrics to industry peers.

| Year | Revenue (in millions) | Net Income (in millions) | Total Debt (in millions) |

|---|---|---|---|

| 2020 | Example: $10,000 | Example: $500 | Example: $5,000 |

| 2021 | Example: $11,000 | Example: $700 | Example: $4,500 |

| 2022 | Example: $12,000 | Example: $800 | Example: $4,000 |

A comparison of key valuation metrics such as the Price-to-Earnings ratio (P/E) against industry peers offers a relative valuation perspective. These are example values.

| Metric | NRG Energy Inc. | Competitor A | Competitor B |

|---|---|---|---|

| P/E Ratio | Example: 15 | Example: 18 | Example: 12 |

| Price-to-Book Ratio | Example: 1.2 | Example: 1.5 | Example: 1.0 |

NRG Energy Inc.’s dividend policy, if any, impacts its attractiveness to income-seeking investors and can influence the stock price. A consistent dividend payout can enhance investor confidence and potentially support the stock price.

Analyst Ratings and Future Outlook, Nrg energy inc stock price

Analyst opinions offer valuable insights into the market’s perception of NRG Energy Inc.’s future prospects. The following summarizes recent analyst ratings and price targets.

- Analyst A: Buy rating, price target $50

- Analyst B: Hold rating, price target $45

- Analyst C: Sell rating, price target $40

The consensus view among analysts, based on the provided example, suggests a cautiously optimistic outlook, although individual ratings vary. Potential risks include fluctuating energy prices, regulatory changes, and competition within the energy sector. Opportunities include growth in renewable energy, technological advancements, and potential acquisitions.

Investor Sentiment and Trading Activity

Visualizing trading volume and price movements over a recent period, such as the last month, would reveal the intensity of trading activity and potential shifts in investor sentiment. For example, a period of high volume coupled with upward price movement might indicate strong buying pressure, while the opposite could suggest selling pressure. Note: No actual visualization is included here.

Investor sentiment towards NRG Energy Inc. is influenced by a multitude of factors, including financial performance, industry trends, regulatory developments, and macroeconomic conditions. Positive news, such as strong earnings reports or successful renewable energy project launches, generally boosts investor confidence and leads to higher demand for the stock. Conversely, negative news, such as missed earnings targets or regulatory setbacks, can trigger selling pressure and depress the stock price.

Recent news articles covering these events would provide further insight into the shifts in investor sentiment.

FAQ Section: Nrg Energy Inc Stock Price

What are the main risks associated with investing in NRG Energy stock?

Investing in NRG Energy, like any energy company, carries risks associated with fluctuating fuel prices, regulatory changes impacting the energy sector, and the inherent volatility of the stock market. Furthermore, the company’s reliance on specific energy sources exposes it to risks related to those particular markets.

How often does NRG Energy pay dividends?

You should consult NRG Energy’s investor relations website for the most up-to-date information on their dividend policy, including payment frequency and amounts. Dividend payouts can change.

Where can I find real-time NRG Energy stock price data?

Real-time stock quotes for NRG Energy are readily available through major financial websites and brokerage platforms. Many offer free access to basic information, while others may require subscriptions for advanced features.

What is the current market capitalization of NRG Energy?

The market capitalization of NRG Energy fluctuates constantly. Refer to reputable financial news sources or your brokerage account for the most current market cap figure.