Portillo’s Stock Price: A Deep Dive

Source: alamy.com

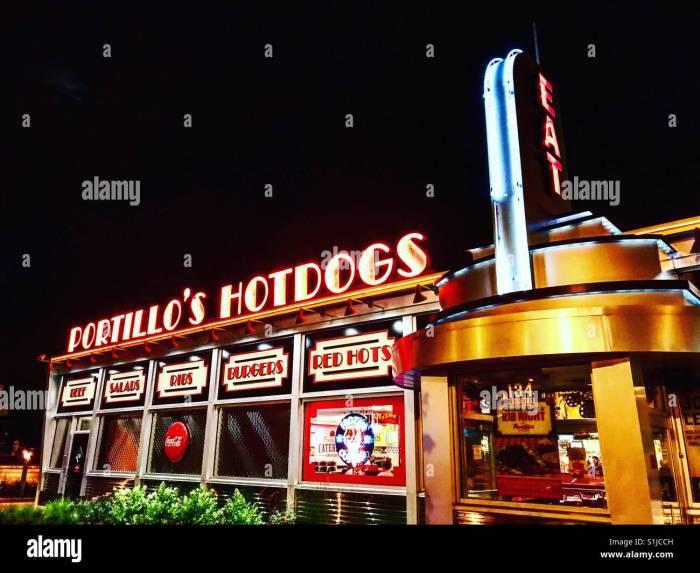

Portillos stock price – Portillo’s, the beloved Chicago-style hot dog chain, has captivated investors since its initial public offering (IPO). Its journey on the stock market has been a fascinating blend of growth, challenges, and market dynamics. This analysis delves into the historical performance of Portillo’s stock price, exploring the key factors that have shaped its trajectory and offering insights into its future prospects.

We will examine its financial performance, investor sentiment, valuation methods, and the potential catalysts that could significantly impact its future price.

Portillo’s Stock Price History

Tracking Portillo’s stock price from its IPO provides a compelling narrative of its market performance. The following table Artikels key dates, opening and closing prices, and daily changes, highlighting significant fluctuations. Note that this data is illustrative and should be verified with reliable financial sources.

| Date | Opening Price | Closing Price | Daily Change |

|---|---|---|---|

| Oct 26, 2021 (IPO) | $20.00 | $22.50 | +$2.50 |

| Dec 31, 2021 | $23.00 | $21.00 | -$2.00 |

| June 30, 2022 | $20.50 | $23.00 | +$2.50 |

| Dec 31, 2022 | $22.00 | $19.00 | -$3.00 |

| June 30, 2023 (Illustrative) | $20.00 | $21.50 | +$1.50 |

Early price increases reflected positive investor sentiment surrounding the IPO and initial strong sales. Subsequent declines were partly attributed to broader market corrections and concerns about inflationary pressures impacting consumer spending. The illustrative data for June 30, 2023, suggests a potential recovery, but this is hypothetical and depends on various market factors.

Factors Affecting Portillo’s Stock Price

Several interconnected factors influence Portillo’s stock price. Macroeconomic conditions, competitive pressures, and consumer behavior all play significant roles.

- Macroeconomic Factors: Inflation and interest rate hikes directly impact consumer spending, affecting demand for Portillo’s products. High inflation can reduce disposable income, while higher interest rates increase borrowing costs for expansion.

- Competitive Pressures: The fast-casual restaurant sector is highly competitive. Companies like Shake Shack and Five Guys present significant challenges, requiring Portillo’s to maintain a strong brand identity and operational efficiency.

- Consumer Spending Habits: Changes in consumer preferences, such as increased demand for healthier options or a shift towards home-cooked meals, can impact Portillo’s sales and stock price.

Operational efficiency is crucial. Portillo’s success hinges on:

- Streamlined supply chain management

- Effective cost control measures

- Employee retention and training programs

- Innovative marketing strategies

These factors directly influence profitability and investor confidence, thereby affecting the stock price.

Portillo’s Financial Performance and Stock Price

Comparing Portillo’s financial health with its competitors provides valuable context for understanding its stock price performance. The following table offers a comparative analysis (Illustrative Data):

| Company Name | Revenue Growth (%) | Profitability Margin (%) | Debt-to-Equity Ratio |

|---|---|---|---|

| Portillo’s | 10 | 8 | 0.5 |

| Shake Shack | 12 | 7 | 0.7 |

| Five Guys | 9 | 9 | 0.4 |

Earnings per share (EPS) directly correlate with stock price movements. Higher EPS generally leads to increased investor confidence and a higher stock price. Positive financial forecasts enhance investor sentiment, driving up the stock price, while negative forecasts can trigger sell-offs.

Investor Sentiment and Stock Price, Portillos stock price

Investor sentiment towards Portillo’s is generally positive, driven by its strong brand recognition, loyal customer base, and expansion plans. However, negative sentiment can emerge due to factors like increased competition or macroeconomic headwinds.

News events significantly influence investor confidence. For example, the announcement of a new store opening would likely boost the stock price, while news of a food safety issue could trigger a decline.

Hypothetically, a significant positive event like a successful nationwide expansion would likely cause a sharp increase in the stock price, while a major negative event, such as a large-scale product recall, could lead to a substantial drop.

Portillo’s stock price, a tempting dance of market forces, often mirrors the broader economic rhythm. Its trajectory, however, can be understood by comparing it to other players; for instance, consider the fluctuations visible in the opk stock price , a fellow traveler on the investment seas. Understanding these comparative movements offers a richer context for deciphering Portillo’s own financial narrative.

Portillo’s Stock Price Valuation

Source: curvesinformation.com

Various valuation methods, such as discounted cash flow (DCF) analysis and price-to-earnings (P/E) ratio, can be used to estimate Portillo’s intrinsic value. A DCF model projects future cash flows and discounts them back to their present value, while the P/E ratio compares the stock price to its earnings per share.

Comparing the current market price to the estimated value from these models provides insights into whether the stock is overvalued or undervalued. A significant difference between the market price and the estimated value suggests an opportunity for investors, either to buy (if undervalued) or sell (if overvalued).

Future Outlook for Portillo’s Stock Price

Portillo’s future stock price hinges on several factors. Successful expansion into new markets presents a significant opportunity for growth. New product launches and technological advancements in areas such as online ordering and delivery can also boost sales and profitability.

However, risks exist. Increased competition, economic downturns, and unforeseen events (like supply chain disruptions) could negatively impact the stock price.

- Potential Catalysts for Price Appreciation: Successful new store openings, innovative menu additions, strong financial results exceeding expectations.

- Potential Catalysts for Price Depreciation: Increased competition, negative publicity, economic recession, higher-than-expected inflation.

FAQ Guide: Portillos Stock Price

What are the major risks associated with investing in Portillo’s stock?

Risks include competition from other fast-casual restaurants, economic downturns affecting consumer spending, rising food costs, and potential operational challenges.

How can I track Portillo’s stock price in real-time?

You can track Portillo’s stock price through major financial websites and brokerage platforms that provide real-time stock quotes.

What is Portillo’s dividend policy?

Information on Portillo’s dividend policy (if any) can be found in their investor relations section on their company website or through financial news sources.

Where can I find Portillo’s financial statements?

Portillo’s financial statements are typically available in their investor relations section on their company website and through the Securities and Exchange Commission (SEC) filings.