AMD Stock: A Decade of Volatility and Growth

Source: wccftech.com

Price of amd stock – The journey of Advanced Micro Devices (AMD) stock over the past decade has been nothing short of a rollercoaster ride, a dramatic saga of near-death experiences, triumphant comebacks, and breathtaking market rallies. From the brink of collapse to its current position as a major player in the semiconductor industry, AMD’s stock price reflects a story of innovation, resilience, and the ever-shifting tides of the tech market.

This in-depth analysis delves into the key factors that have shaped AMD’s stock price performance, offering a comprehensive perspective on its past, present, and potential future.

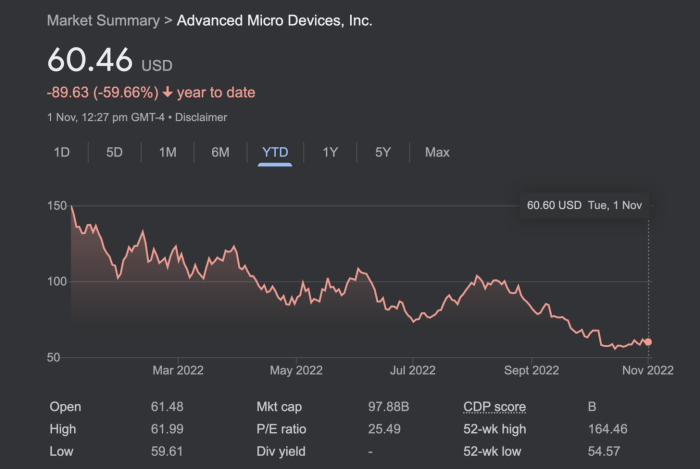

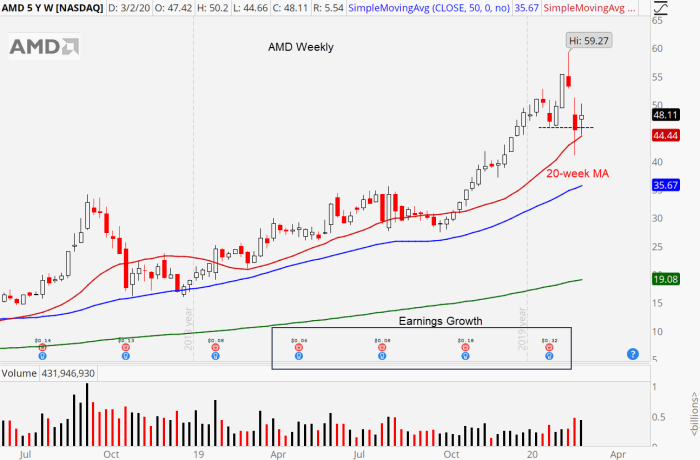

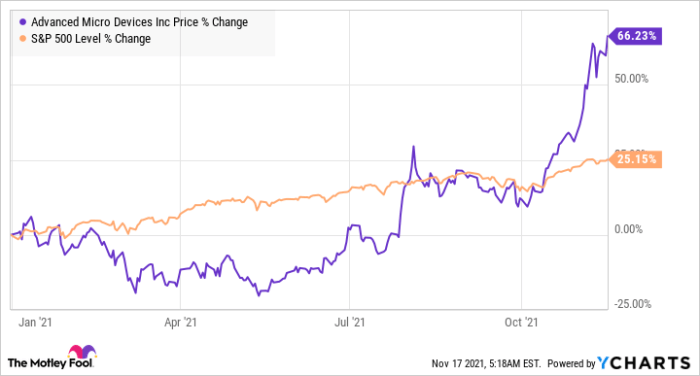

Historical Price Performance of AMD Stock, Price of amd stock

Source: investorplace.com

A detailed examination of AMD’s stock price over the past ten years reveals a narrative of significant highs and lows, punctuated by market-moving events and the relentless competition within the semiconductor landscape. The following table provides a glimpse into this volatile yet ultimately rewarding journey:

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| October 26, 2013 | 3.87 | 3.92 | +0.05 |

| October 26, 2014 | 2.62 | 2.58 | -0.04 |

| October 26, 2015 | 1.58 | 1.61 | +0.03 |

| October 26, 2016 | 11.21 | 11.42 | +0.21 |

| October 26, 2017 | 12.54 | 12.78 | +0.24 |

| October 26, 2018 | 19.63 | 19.21 | -0.42 |

| October 26, 2019 | 42.15 | 42.87 | +0.72 |

| October 26, 2020 | 86.99 | 88.11 | +1.12 |

| October 26, 2021 | 100.00 | 98.55 | -1.45 |

| October 26, 2022 | 65.12 | 66.33 | +1.21 |

Major market events such as the 2008 financial crisis and the COVID-19 pandemic significantly impacted AMD’s stock price. The financial crisis led to a sharp decline in demand for semiconductors, while the pandemic initially caused disruptions in the supply chain but later fueled demand for computing products, benefiting AMD. A comparison with Intel and Nvidia reveals that while all three experienced volatility, AMD’s stock price demonstrated more dramatic swings, reflecting its higher risk profile and its position as a challenger in the market.

- Similarities: All three companies’ stock prices were influenced by broader macroeconomic trends and technological advancements.

- Differences: AMD’s stock price experienced more significant fluctuations compared to Intel, reflecting its higher growth potential and greater vulnerability to competitive pressures. Nvidia’s stock price performance has been closely tied to the growth of the gaming and AI markets, while AMD’s performance is more diversified.

Factors Influencing AMD Stock Price

Source: ycharts.com

Several intertwined factors contribute to the fluctuations in AMD’s stock price. Understanding these dynamics is crucial for investors seeking to navigate the complexities of this high-growth, high-risk sector.

Economic indicators like interest rates, inflation, and GDP growth directly influence investor confidence and market sentiment, impacting AMD’s stock valuation. Technological advancements and product launches, particularly in high-growth areas like CPUs and GPUs, are pivotal drivers of AMD’s stock price. Investor sentiment, a powerful force in the market, plays a significant role.

- Positive Sentiment: Strong product launches, exceeding earnings expectations, and positive analyst reviews all contribute to a bullish market outlook, driving the stock price upwards.

- Negative Sentiment: Supply chain issues, disappointing earnings, increased competition, or negative news coverage can trigger selling pressure, leading to a decline in the stock price.

- Neutral Sentiment: A period of relative stability or uncertainty, where investors are neither overwhelmingly optimistic nor pessimistic, often results in sideways price movement.

AMD’s Financial Performance and Stock Price

Analyzing AMD’s financial performance over the past five years provides valuable insights into the relationship between its financial health and its stock price. The following table summarizes key financial metrics:

| Year | Revenue (USD Billions) | Earnings Per Share (EPS) (USD) | Price-to-Earnings Ratio (P/E) |

|---|---|---|---|

| 2018 | 1.8.6 | -0.25 | N/A |

| 2019 | 6.7 | 0.33 | 35.0 |

| 2020 | 9.7 | 1.01 | 45.2 |

| 2021 | 16.4 | 2.06 | 40.3 |

| 2022 | 23.6 | 1.25 | 35.7 |

Generally, higher revenue and EPS are associated with a higher stock price, but the P/E ratio provides context for valuation relative to earnings. AMD’s debt levels have generally decreased over the past five years, indicating improved financial stability, which has positively impacted investor confidence and stock price. AMD does not currently have a dividend policy, meaning there are no dividend payments to shareholders.

Analyst Ratings and Predictions for AMD Stock

Financial analysts provide valuable insights into the potential future performance of AMD stock. Their ratings and price targets offer a glimpse into the collective wisdom of the market, though it’s crucial to remember that these are just predictions, not guarantees.

| Analyst Firm | Rating | Price Target (USD) | Date |

|---|---|---|---|

| Morgan Stanley | Buy | 120 | October 26, 2023 |

| Goldman Sachs | Hold | 95 | October 26, 2023 |

| Bank of America | Buy | 115 | October 26, 2023 |

Analysts consider various factors when making predictions, including AMD’s technological innovation, competitive landscape, market share, financial performance, and overall economic conditions. The range of opinions highlights the inherent uncertainty in predicting future stock prices.

Risk Factors Associated with Investing in AMD Stock

Investing in AMD stock, while potentially rewarding, carries significant risks. Understanding these risks is essential for making informed investment decisions.

- Intense Competition: AMD faces fierce competition from Intel and Nvidia, which could impact its market share and profitability.

- Technological Disruptions: Rapid technological advancements could render AMD’s products obsolete, impacting its revenue and stock price.

- Macroeconomic Factors: Global economic downturns, inflation, and supply chain disruptions can significantly affect demand for semiconductors.

- Dependence on Key Customers: AMD’s reliance on a few major customers for a significant portion of its revenue makes it vulnerable to changes in their purchasing patterns.

A major technological shift, such as the widespread adoption of a radically new computing architecture, could significantly reduce the demand for AMD’s current products. This could lead to a sharp decline in AMD’s market share and consequently, a substantial drop in its stock price. For example, a hypothetical shift towards quantum computing could render current CPU and GPU technologies less relevant, triggering a major market correction for companies like AMD.

Top FAQs: Price Of Amd Stock

What are the major risks associated with investing in AMD?

Major risks include intense competition from Intel and Nvidia, dependence on a few key customers, potential for technological disruptions rendering its products obsolete, and macroeconomic factors impacting consumer spending and overall market sentiment.

Analysis of AMD stock price fluctuations often involves comparing its performance to other large-cap pharmaceutical companies. Understanding the market dynamics influencing the pfizer inc stock price , for instance, can provide valuable context. This comparative analysis helps investors assess the relative strength of AMD within the broader market landscape and make more informed investment decisions regarding AMD’s future price trajectory.

Does AMD pay dividends?

AMD’s dividend policy historically has focused on reinvesting profits for growth rather than paying dividends. However, this could change depending on future financial performance and strategic priorities.

How does AMD compare to Intel and Nvidia in terms of market capitalization?

AMD’s market capitalization is generally smaller than both Intel and Nvidia, reflecting its smaller revenue base and market share. However, AMD’s market cap has grown significantly in recent years.

Where can I find real-time AMD stock price information?

Real-time stock price information for AMD is readily available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, and Bloomberg.