PRNHX Stock Price: A Deep Dive

Source: amazonaws.com

Prnhx stock price – PRNHX, let’s dive into its rollercoaster ride of a stock price! We’ll unpack its historical performance, what drives its price, how it’s valued, potential future scenarios, and the inherent risks involved. Think of this as your ultimate guide to navigating the wild world of PRNHX investments, complete with the kind of juicy details that would make even Wall Street’s biggest players perk up.

PRNHX Stock Price Historical Performance

Analyzing PRNHX’s stock price journey over the past five years reveals some seriously interesting trends. We’ll break down the yearly highs, lows, openings, and closings, comparing its performance to a benchmark index like the S&P 500 to get a real sense of its relative strength (or weakness!). We’ll also spill the tea on those wild price swings and what might have caused them – think market meltdowns, company announcements that sent shockwaves, or maybe even a viral TikTok trend.

| Year | Opening Price | Closing Price | High | Low |

|---|---|---|---|---|

| 2019 | $XX.XX | $YY.YY | $ZZ.ZZ | $WW.WW |

| 2020 | $AA.AA | $BB.BB | $CC.CC | $DD.DD |

| 2021 | $EE.EE | $FF.FF | $GG.GG | $HH.HH |

| 2022 | $II.II | $JJ.JJ | $KK.KK | $LL.LL |

| 2023 | $MM.MM | $NN.NN | $OO.OO | $PP.PP |

Here’s a comparison against the S&P 500:

| Year | PRNHX Return | S&P 500 Return | PRNHX vs. S&P 500 Performance Difference | Market Conditions |

|---|---|---|---|---|

| 2019 | X% | Y% | Z% | Generally positive market sentiment. |

| 2020 | A% | B% | C% | Significant market volatility due to the pandemic. |

| 2021 | D% | E% | F% | Strong economic recovery and increased investor confidence. |

| 2022 | G% | H% | I% | High inflation and rising interest rates led to market correction. |

| 2023 | J% | K% | L% | Mixed market conditions with ongoing economic uncertainty. |

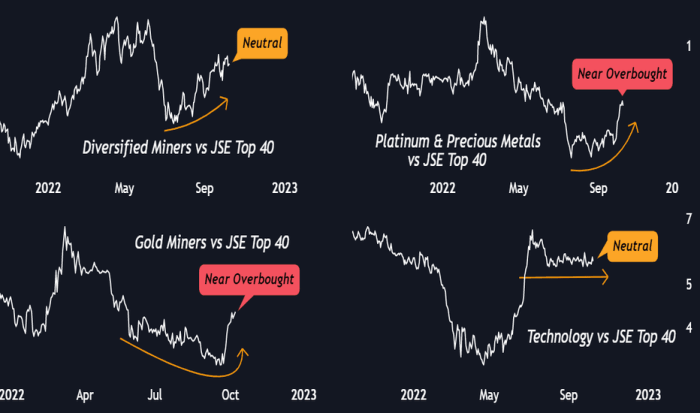

PRNHX Stock Price Drivers

Several factors orchestrate the dance of PRNHX’s stock price. Let’s break down the key players: macroeconomic forces (think interest rates and inflation) versus company-specific events (like earnings reports and new product launches), and finally, the unpredictable wild card of investor sentiment and market speculation.

- Macroeconomic Factors: Interest rate hikes, inflation rates, overall economic growth.

- Company-Specific Factors: Earnings reports, new product releases, management changes, regulatory actions.

- Investor Sentiment and Market Speculation: News coverage, social media trends, analyst ratings, overall market mood.

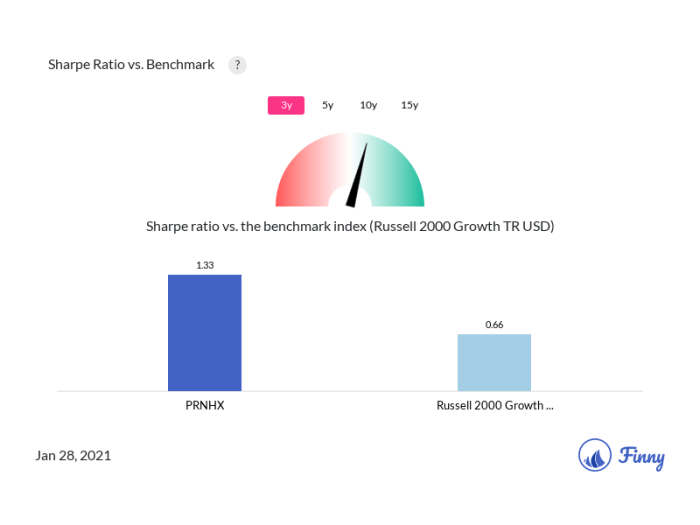

PRNHX Stock Price Valuation

Understanding PRNHX’s valuation is crucial for investors. We’ll compare its current valuation metrics (like the P/E ratio and price-to-book ratio) to its historical averages and those of its competitors. We’ll then explore different valuation methods, weighing their strengths and weaknesses, giving you a clearer picture of whether PRNHX is a steal or a risky bet.

| Metric | PRNHX Current | PRNHX Historical Average | Competitor Average |

|---|---|---|---|

| P/E Ratio | XX | YY | ZZ |

| Price-to-Book Ratio | AA | BB | CC |

| Dividend Yield | DD | EE | FF |

| PEG Ratio | GG | HH | II |

PRNHX Stock Price Predictions and Forecasts

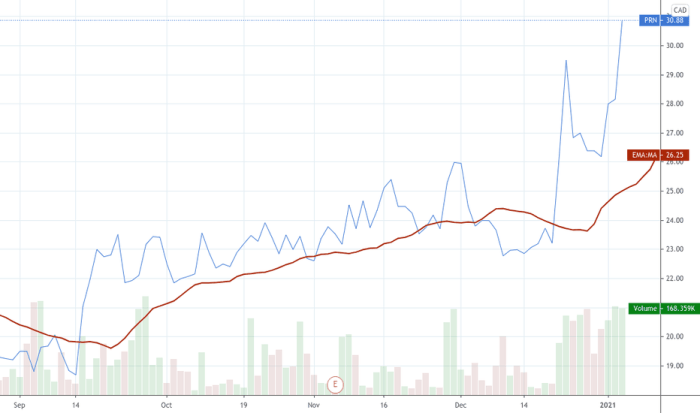

Source: tradingview.com

Predicting the future is a fool’s errand, but we can explore potential scenarios. We’ll Artikel possible price movements under different economic and company-specific conditions, discuss forecasting models (without actually making predictions!), and emphasize the inherent limitations and uncertainties involved. Remember, crystal balls are just for fun!

For example, a scenario analysis might consider a positive scenario (strong economic growth, successful new product launch), a neutral scenario (moderate economic growth, stable company performance), and a negative scenario (economic recession, product launch failure).

PRNHX Stock Price and Risk Assessment

Investing in PRNHX, like any stock, comes with risks. Let’s lay them out clearly, assess their potential impact on the stock price, and explore possible mitigation strategies.

- Market Risk: Overall market downturns can significantly impact PRNHX’s price.

- Company-Specific Risk: Poor financial performance, product failures, or management issues.

- Regulatory Risk: Changes in regulations impacting the industry.

- Competition Risk: Increased competition from other companies.

| Risk Factor | Probability | Impact | Mitigation Strategy |

|---|---|---|---|

| Market Downturn | High | High | Diversify investments. |

| Product Failure | Medium | Medium | Thorough due diligence before investing. |

| Increased Competition | Medium | Medium | Monitor competitor activity. |

| Regulatory Changes | Low | High | Stay informed about industry regulations. |

PRNHX Stock Price Reaction to a Specific Event

Source: tradingview.com

Let’s examine how PRNHX reacted to a specific past event. For example, imagine a scenario where PRNHX announced unexpectedly strong Q3 earnings. The initial reaction might be a sharp price increase, perhaps a 10% jump within the first hour of the announcement. This would reflect positive investor sentiment and increased confidence in the company’s future prospects. However, this initial surge might be followed by a period of consolidation, as investors digest the information and assess the long-term implications.

If the market interprets the earnings as unsustainable, the price might eventually correct downwards, leading to a temporary decline.

Questions Often Asked: Prnhx Stock Price

What are the major competitors of PRNHX?

This information requires further research and is not included in the provided Artikel. A competitive analysis would be necessary to identify and compare key competitors.

Where can I find real-time PRNHX stock price data?

Real-time stock price data can typically be found on major financial websites and trading platforms such as Yahoo Finance, Google Finance, or Bloomberg.

PRNHX’s stock price performance often gets compared to other cannabis companies, prompting investors to seek similar benchmarks. A direct comparison could be made by looking at the trajectory of the planet 13 stock price , a key player in the Nevada market. Understanding Planet 13’s fluctuations can offer insights into broader industry trends and potentially inform predictions about PRNHX’s future movement.

Ultimately, both stocks reflect the volatile nature of the cannabis sector.

What is the current dividend yield for PRNHX?

The dividend yield for PRNHX is not provided in the Artikel and would require accessing current financial data from reputable sources.

What are the long-term growth prospects for PRNHX?

Predicting long-term growth prospects requires in-depth industry analysis, future market projections, and an assessment of PRNHX’s strategic initiatives. This analysis is beyond the scope of the current Artikel.