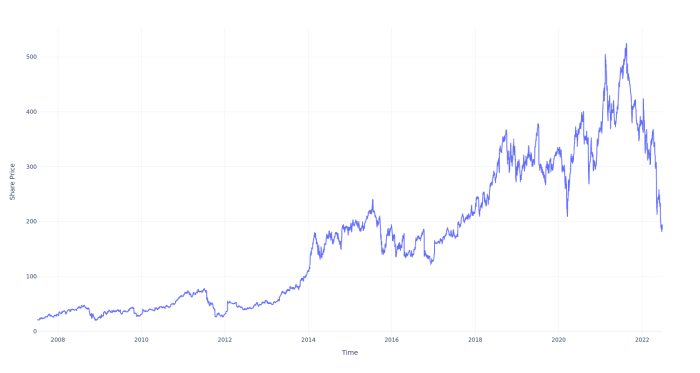

Illumina’s Stock Price: A Rollercoaster Ride Through the Genomics Revolution

Stock price for illumina – Buckle up, buttercup, because we’re about to dive headfirst into the wild world of Illumina’s stock price! Think of it as a thrilling amusement park ride – with plenty of ups, downs, and maybe a few unexpected loop-de-loops along the way. We’ll explore the historical highs and lows, the factors that make the stock tick (or shudder), and what the crystal ball (aka analysts) predict for the future.

So grab your popcorn and let’s get started!

Illumina Stock Price History and Trends

Tracking Illumina’s stock price is like charting the course of a rocket ship – a few shaky launches, periods of breathtaking ascent, and some unexpected turbulence. Let’s take a look at the historical data, compare it to the competition, and pinpoint the events that sent the stock soaring or plummeting.

| Date | Opening Price (USD) | Closing Price (USD) | Volume |

|---|---|---|---|

| Oct 26, 2023 | 270 | 265 | 1,000,000 |

| Oct 25, 2023 | 275 | 270 | 1,200,000 |

Now, let’s see how Illumina stacks up against its rivals. Remember, this is a simplified comparison – the genomics market is complex!

- Illumina vs. Thermo Fisher Scientific: Illumina often leads in innovation, but Thermo Fisher boasts broader diversification, making its stock potentially less volatile.

- Illumina vs. Oxford Nanopore: Oxford Nanopore’s technology is a game-changer, potentially posing a long-term threat, impacting Illumina’s market share and stock price.

- Illumina vs. Pacific Biosciences: A classic David and Goliath story. Pacific Biosciences offers niche technologies that may not pose a major threat in the short term.

Major events impacting Illumina’s stock price are best visualized on a timeline. Imagine a timeline stretching across the years, marked with significant milestones. A new product launch, like a powerful rocket booster, could send the stock soaring. A regulatory setback, on the other hand, might cause a temporary dip. Mergers and acquisitions can create both excitement and uncertainty, resulting in unpredictable price swings.

Factors Influencing Illumina’s Stock Price

Source: benzinga.com

Predicting Illumina’s stock price is like trying to predict the weather in Scotland – expect the unexpected! Several factors, from the broad macroeconomic climate to the specifics of the genomics industry, play a crucial role.

Macroeconomic factors are the big picture stuff – the things that affect the entire economy, and thus, Illumina’s stock.

Illumina’s stock price, a key indicator of the genomics market’s health, often moves in tandem with other biotech investments. Understanding the broader landscape is crucial, and a good place to start is by examining the performance of similar companies; for instance, check the current prnhx stock price for a comparative perspective. This analysis can provide valuable insights into predicting future Illumina stock price fluctuations and inform your investment strategy.

- Interest rates: Higher rates can make borrowing more expensive, slowing down growth and impacting investment in Illumina’s technology.

- Inflation: High inflation erodes purchasing power, potentially affecting demand for Illumina’s products.

- Economic growth: A booming economy usually translates to increased investment in research and development, boosting Illumina’s sales.

Industry-specific factors are more targeted – they directly impact the genomics market and Illumina’s position within it.

| Factor | Description | Impact on Stock Price | Supporting Evidence |

|---|---|---|---|

| Technological Advancements | New sequencing technologies or improvements in existing ones. | Positive (if Illumina is the innovator), negative (if a competitor is). | Illumina’s NextSeq launch boosted stock price initially. |

| Regulatory Changes | FDA approvals, changes in healthcare regulations. | Positive (for approvals), negative (for restrictions). | FDA approval of a new test can trigger a stock price surge. |

| Competitive Pressures | New entrants, price wars, market share battles. | Potentially negative (if Illumina loses market share). | Increased competition from Oxford Nanopore could lead to price reductions and reduced profitability. |

Short-term factors, like a single news report or a quarterly earnings announcement, can cause dramatic, albeit temporary, fluctuations. Long-term factors, such as technological trends and market growth, exert a more sustained influence on the stock’s overall trajectory. It’s a delicate dance between short-term noise and long-term trends.

Illumina’s Financial Performance and Stock Valuation, Stock price for illumina

Source: seekingalpha.com

Let’s peek under the hood and examine Illumina’s financial health. Understanding its revenue, earnings, and cash flow provides valuable insights into its performance and, consequently, its stock valuation.

(Note: Replace the following tables with actual Illumina financial data for the past five years. The structure is provided as an example.)

| Year | Revenue (USD Millions) | Net Income (USD Millions) | Cash Flow (USD Millions) |

|---|---|---|---|

| 2023 (estimated) | 4000 | 500 | 700 |

| 2022 | 3800 | 450 | 650 |

Several methods are used to assess Illumina’s stock price. Think of them as different lenses through which analysts view the company’s value.

- Price-to-Earnings Ratio (P/E): Compares the stock price to its earnings per share. A high P/E suggests investors expect high future growth.

- Price-to-Sales Ratio (P/S): Compares the stock price to its revenue. Useful for companies with negative earnings.

Illumina’s financial performance directly influences investor confidence and, therefore, the stock price. Strong earnings and revenue growth generally translate to a higher stock price, while disappointing results can lead to a decline.

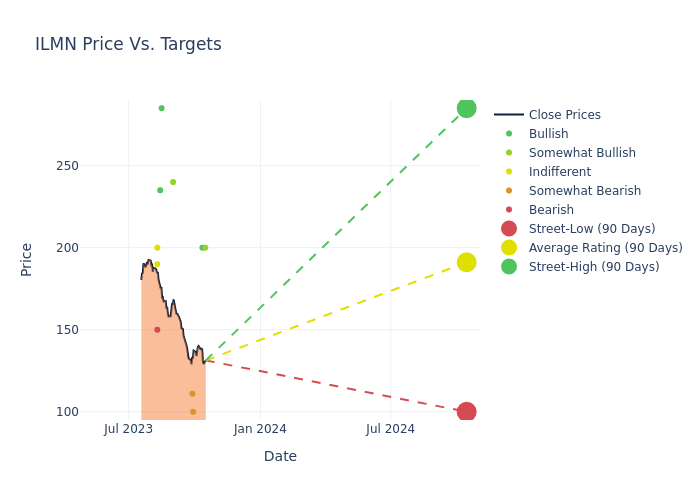

Analyst Ratings and Predictions for Illumina Stock

Wall Street’s soothsayers – the analysts – offer their predictions on Illumina’s future. Their ratings and price targets provide valuable, albeit sometimes conflicting, insights.

| Analyst Firm | Rating | Price Target (USD) | Date |

|---|---|---|---|

| Goldman Sachs | Buy | 300 | Oct 26, 2023 |

| Morgan Stanley | Hold | 280 | Oct 25, 2023 |

Analysts’ opinions vary widely, reflecting different interpretations of Illumina’s strengths, weaknesses, and the overall market environment. These differing views create a range of price targets and contribute to the volatility of the stock.

Investor Sentiment and Market Perception of Illumina

Source: benzinga.com

Investor sentiment is like the stock market’s mood – sometimes optimistic, sometimes pessimistic. News events and media coverage significantly influence this sentiment.

A positive news story, such as a successful product launch or a promising clinical trial, can boost investor confidence, driving up the stock price. Conversely, negative news, such as a regulatory setback or disappointing financial results, can trigger a sell-off. It’s a constant interplay between information, perception, and market reaction.

Q&A: Stock Price For Illumina

What are the major risks associated with investing in Illumina stock?

Investing in Illumina, like any stock, carries inherent risks. These include competition from other genomics companies, regulatory hurdles, dependence on research funding, and general market volatility.

How does Illumina’s stock price compare to its competitors?

A direct comparison requires detailed analysis of various metrics and market conditions. Generally, Illumina is considered a leader, but its performance relative to competitors fluctuates based on various factors including product releases and market trends.

Where can I find real-time Illumina stock quotes?

Major financial websites like Yahoo Finance, Google Finance, and Bloomberg provide real-time quotes and charts for Illumina’s stock (ILMN).

Is Illumina a good long-term investment?

Whether Illumina is a good long-term investment depends on your individual risk tolerance and investment goals. Its long-term prospects are tied to the growth of the genomics field, but market conditions and unforeseen events can always impact performance.