Lloyds Banking Group: A Deep Dive into Stock Performance: Stock Price Lloyds

Source: investingcube.com

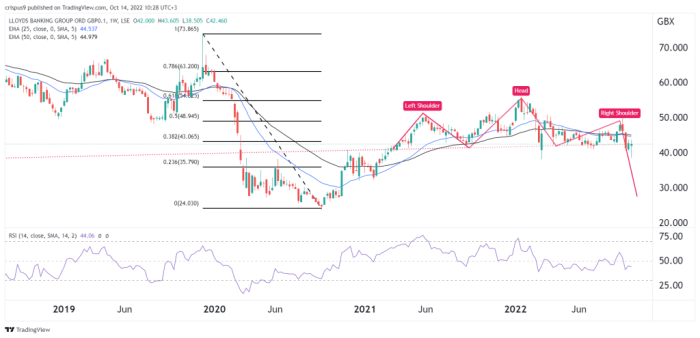

Stock price lloyds – Lloyds Banking Group is a cornerstone of the UK financial landscape, deeply intertwined with the nation’s economic health. Understanding its stock price requires a multifaceted approach, considering its historical performance, current financial standing, and future prospects. This analysis delves into the key factors driving Lloyds’ stock price, providing insights for investors looking to navigate this complex market.

Lloyds Banking Group Overview

Lloyds Banking Group boasts a rich history, tracing its roots back to several prominent British banks, ultimately merging to form its current structure. Its core business revolves around retail banking, commercial banking, and wealth management, catering to a broad spectrum of customers. Lloyds holds a significant market share in the UK, making it a key player in the domestic financial sector.

Recent financial performance has shown fluctuating results, influenced by macroeconomic conditions and regulatory changes. Key metrics like net interest income and return on equity provide insights into its profitability and efficiency.

| Metric | Lloyds | Barclays | HSBC | NatWest |

|---|---|---|---|---|

| Market Capitalization (GBP Billion) | Example: 40 | Example: 35 | Example: 150 | Example: 25 |

| Net Income (GBP Billion) | Example: 2 | Example: 1.5 | Example: 10 | Example: 1 |

| Return on Equity (%) | Example: 10 | Example: 8 | Example: 12 | Example: 9 |

| P/E Ratio | Example: 8 | Example: 9 | Example: 11 | Example: 7 |

Factors Influencing Lloyds Stock Price

Source: invezz.com

Several interconnected factors significantly influence Lloyds’ stock price. Macroeconomic conditions, such as interest rate changes and inflation levels, directly impact the bank’s profitability and lending activities. Regulatory changes, including stricter capital requirements or altered lending guidelines, can also affect its operations and valuation. Investor sentiment and broader market trends play a crucial role, shaping investor demand and influencing the share price.

Finally, comparing Lloyds’ performance against relevant market indices, such as the FTSE 100, provides valuable context.

A line graph comparing Lloyds’ stock price to the FTSE 100 would show a generally correlated trend, with periods of divergence reflecting specific events or investor sentiment shifts. The x-axis would represent time (e.g., monthly or yearly data), and the y-axis would represent the stock price index values. Key trends to observe include periods of strong correlation, instances of decoupling, and the overall performance relative to the broader market.

For example, a period of economic uncertainty might see both Lloyds and the FTSE 100 decline, while a period of strong economic growth might see both rise, though not necessarily at the same rate.

Lloyds’ Financial Health and Performance, Stock price lloyds

Analyzing Lloyds’ financial statements reveals key insights into its financial health and performance. Key ratios, such as the Price-to-Earnings (P/E) ratio and dividend yield, provide valuable metrics for assessing valuation and investor returns. Lloyds’ lending practices, including the types of loans offered and the risk associated with them, directly impact profitability. Effective risk management strategies are crucial for mitigating potential losses and maintaining financial stability.

- Strengths: Large customer base, strong market position in the UK, diversified revenue streams, established brand reputation.

- Weaknesses: Sensitivity to macroeconomic conditions, potential regulatory risks, competition from other financial institutions.

Lloyds’ Future Outlook and Projections

Lloyds’ strategic plans, including initiatives to enhance digital services or expand into new markets, will likely shape its future performance and stock price. Challenges such as economic downturns, increased competition, and evolving regulatory landscapes pose potential risks. However, opportunities exist in leveraging technological advancements, expanding into new financial services, and capitalizing on economic recovery.

| Scenario | Economic Condition | Stock Price Projection (12 Months) | Rationale |

|---|---|---|---|

| Optimistic | Strong economic growth, low inflation | Example: +20% | Increased lending activity, higher profitability. |

| Neutral | Moderate economic growth, stable inflation | Example: +5% | Steady performance, in line with market trends. |

| Pessimistic | Economic recession, high inflation | Example: -10% | Reduced lending, increased loan defaults. |

| Unexpected | Geopolitical instability, significant regulatory changes | Example: -15% to +10% (High Volatility) | Uncertainty creates high volatility, potential for both significant gains and losses. |

Investor Relations and Analyst Sentiment

Source: investingcube.com

Lloyds maintains active communication with investors through various channels, including financial reports, investor presentations, and media releases. Analyst ratings and price targets offer valuable insights into market sentiment and expectations. Overall investor sentiment reflects a complex interplay of factors, including the bank’s financial performance, macroeconomic conditions, and broader market trends.

- Example 1: Positive earnings report leads to increased investor confidence and a rise in the stock price.

- Example 2: Announcement of a new regulatory change creates uncertainty and causes a temporary dip in the stock price.

- Example 3: Negative news about the broader economic outlook results in a sell-off, impacting Lloyds’ stock price along with the market.

Question Bank

What are the biggest risks facing Lloyds Bank?

Significant risks include economic downturns impacting lending, increased competition, and potential regulatory changes.

How does Lloyds Bank compare to its competitors in terms of dividend payouts?

A detailed comparison requires looking at current dividend yields and payout ratios relative to Barclays, HSBC, and NatWest; this varies over time.

Where can I find real-time Lloyds Bank stock price information?

Major financial websites like Google Finance, Yahoo Finance, and the London Stock Exchange website provide real-time quotes.

What is Lloyds Bank’s current market capitalization?

This fluctuates constantly. Check reputable financial news sources for the most up-to-date market cap figure.