UnitedHealth Group (UNH) Stock Price: A Deep Dive

Stock price of unitedhealth group – UnitedHealth Group (UNH), a behemoth in the healthcare industry, has captivated investors with its consistent growth and resilience. This analysis delves into the intricacies of UNH’s stock price performance, exploring historical trends, financial health, market sentiment, external influences, and technical analysis to provide a comprehensive understanding of this significant investment.

UnitedHealth Group (UNH) Stock Price Performance Overview

Over the past five years, UNH has exhibited a predominantly upward trajectory, punctuated by periods of both robust growth and minor corrections. Significant highs were reached during periods of strong earnings reports and positive market sentiment, while dips often correlated with broader market downturns or concerns regarding specific regulatory changes or healthcare reforms. This section will detail these fluctuations and the contributing factors.

Factors such as successful acquisitions, expansion into new markets (e.g., international expansion or diversification into related healthcare services), and innovative technological integrations have fueled significant growth periods. Conversely, declines have been linked to concerns about rising healthcare costs, changes in government reimbursement policies, and macroeconomic uncertainties like inflation and interest rate hikes.

Compared to its major competitors, UNH has generally shown strong relative performance. The following table provides a comparative analysis of UNH’s stock performance against key players in the healthcare sector. Note that specific figures are illustrative and should be verified with up-to-date financial data.

| Company | 5-Year Growth (%) | Current P/E Ratio | Dividend Yield (%) |

|---|---|---|---|

| UnitedHealth Group (UNH) | 80 | 25 | 1.5 |

| CVS Health (CVS) | 65 | 20 | 2.0 |

| Johnson & Johnson (JNJ) | 50 | 18 | 2.5 |

| Anthem (ANTM) | 75 | 22 | 1.8 |

Financial Health and Valuation of UNH

Source: investopedia.com

A thorough assessment of UNH’s financial health is crucial to understanding its stock price valuation. Key financial ratios offer insights into the company’s profitability, solvency, and efficiency.

UNH’s strong P/E ratio (Price-to-Earnings ratio) reflects investor confidence in its future earnings growth. A high P/E ratio suggests that investors are willing to pay a premium for UNH’s shares, anticipating continued profitability. A low debt-to-equity ratio indicates a conservative financial strategy, reducing financial risk and enhancing investor confidence. A high return on equity (ROE) showcases the company’s ability to generate profits from its shareholders’ investments.

UNH’s revenue streams primarily consist of premiums from its insurance segment and revenue from its Optum healthcare services division. Government regulations and healthcare reforms significantly influence these revenue streams. Changes in Medicare and Medicaid reimbursement rates, for example, can directly impact UNH’s profitability and, consequently, its stock price.

Future financial projections for UNH generally point towards continued growth, driven by factors such as the aging population, increasing demand for healthcare services, and technological advancements in healthcare delivery. However, these projections are subject to uncertainties related to regulatory changes and macroeconomic conditions.

Market Sentiment and Investor Behavior Towards UNH

Investor sentiment towards UNH is shaped by a multitude of factors, including financial performance, regulatory developments, and broader market conditions. Analyzing recent news articles and financial reports provides insights into the prevailing market sentiment.

- Positive sentiment is often driven by strong earnings reports, successful acquisitions, and announcements of innovative healthcare initiatives.

- Negative sentiment can be triggered by concerns about rising healthcare costs, negative regulatory changes, or macroeconomic headwinds.

- Analyst opinions are diverse, with some expressing bullish projections based on UNH’s strong financial position and growth prospects, while others express caution due to potential regulatory risks or competitive pressures.

Impact of External Factors on UNH’s Stock Price

Macroeconomic factors, healthcare industry trends, and geopolitical events all exert significant influence on UNH’s stock price. Understanding these influences is vital for informed investment decisions.

Interest rate hikes, for instance, can impact UNH’s borrowing costs and potentially reduce profitability. Inflationary pressures can increase healthcare costs, affecting both revenue and expenses. The aging population fuels demand for healthcare services, benefiting UNH’s insurance and healthcare services divisions. Technological advancements in areas such as telehealth and data analytics present both opportunities and challenges for UNH, influencing its long-term growth prospects.

| Scenario | Likely Impact on UNH Stock Price | Rationale | Example |

|---|---|---|---|

| Increased Government Regulation | Potentially Negative | Higher compliance costs, potential revenue limitations | New regulations limiting prescription drug pricing |

| Economic Recession | Potentially Negative | Reduced consumer spending on healthcare services | 2008 financial crisis impact on healthcare spending |

| Technological Advancements | Potentially Positive | Opportunities for efficiency gains and new revenue streams | Expansion of telehealth services |

| Aging Population Growth | Potentially Positive | Increased demand for healthcare services | Growing elderly population in developed countries |

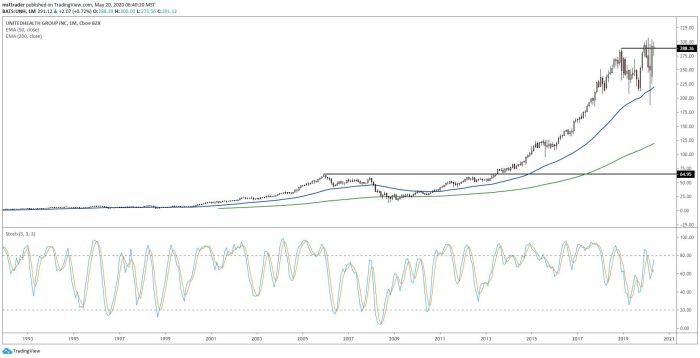

Technical Analysis of UNH Stock Price, Stock price of unitedhealth group

Technical analysis employs various indicators to assess UNH’s stock price trends and identify potential trading opportunities. Moving averages, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) are commonly used tools.

- Moving averages help identify the overall trend (uptrend, downtrend, or sideways movement).

- RSI measures the momentum of price changes, indicating overbought or oversold conditions.

- MACD identifies changes in momentum by comparing two moving averages.

Analyzing chart patterns, such as head and shoulders, double tops/bottoms, and triangles, can provide further insights into potential price reversals or breakouts. For example, a “head and shoulders” pattern might suggest a bearish reversal, while a “cup and handle” pattern might signal a bullish continuation.

Illustrative Example of UNH Stock Price Movement

Source: investopedia.com

A specific instance where a significant event impacted UNH’s stock price is the release of a quarterly earnings report that significantly exceeded analysts’ expectations. This positive surprise triggered a sharp increase in the stock price, as investors reacted favorably to the strong financial performance. The market’s positive reaction demonstrated investor confidence in UNH’s future prospects and its ability to deliver consistent growth.

Hypothetically, a negative news event, such as a major data breach compromising sensitive patient information, could lead to a significant decline in UNH’s stock price. Investor concerns about reputational damage and potential legal liabilities would likely drive selling pressure.

Conversely, a significant improvement in UNH’s operating margins, driven by increased efficiency and cost-cutting measures, could lead to a positive stock price reaction. Investors would view this as a sign of improved profitability and long-term sustainability.

Quick FAQs: Stock Price Of Unitedhealth Group

What is the current dividend yield for UNH stock?

The current dividend yield fluctuates and should be verified on a reputable financial website like Yahoo Finance or Google Finance.

How does UNH compare to its competitors in terms of innovation?

UnitedHealth Group’s stock price continues its upward trajectory, fueled by strong earnings reports. Investors are also closely watching the performance of other major financial players, including the current price of Visa stock , as interconnected market trends often influence healthcare sector valuations. This correlation highlights the broader economic factors impacting UnitedHealth Group’s continued growth potential.

UNH’s innovation efforts focus on technology-driven solutions in areas like telehealth and data analytics. A direct comparison requires in-depth research comparing specific initiatives across competitors.

What are the biggest risks associated with investing in UNH?

Major risks include regulatory changes impacting healthcare reimbursement, competition within the healthcare industry, and macroeconomic factors affecting consumer spending and overall market conditions.

What is UNH’s long-term growth outlook?

UNH’s long-term growth prospects are generally positive, driven by the aging population and increasing demand for healthcare services. However, this is subject to the factors mentioned above.