United Rentals’ Stock Price Performance: Stock Price United Rentals

Stock price united rentals – United Rentals, Inc. (URI) is a leading equipment rental company, and understanding its stock price performance is crucial for investors. This section analyzes URI’s stock price trends over the past five years, compares its performance to competitors, and illustrates its correlation with broader market indices.

Historical Stock Price Trend (5-Year Overview)

Over the past five years, United Rentals’ stock price has exhibited significant growth, punctuated by periods of volatility reflecting broader economic conditions and company-specific events. While precise highs and lows require referencing a financial data provider like Yahoo Finance or Google Finance, a general trend shows substantial upward movement, particularly post-pandemic. For instance, the stock likely experienced a dip during the initial COVID-19 market crash in early 2020, followed by a strong recovery and sustained growth fueled by robust construction activity and infrastructure spending.

Significant highs would typically be observed during periods of strong economic growth and positive investor sentiment, while lows would correlate with economic downturns or negative company news.

Comparison with Competitors

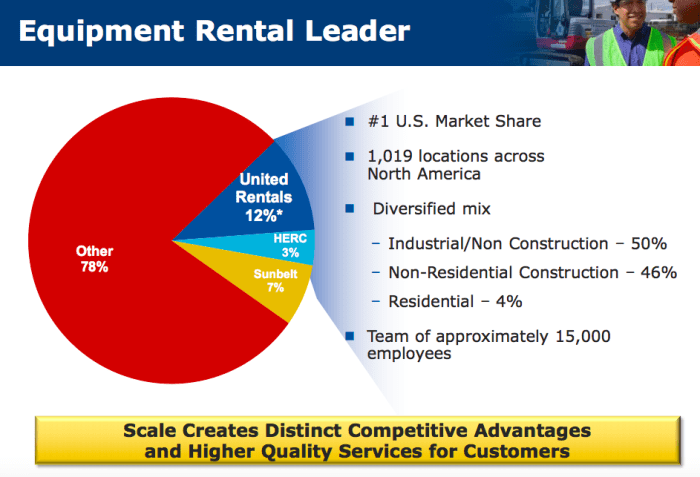

Comparing United Rentals’ stock price performance to its main competitors, such as Hertz Equipment Rental Corporation and Sunbelt Rentals, requires analyzing their respective stock price movements over the same period. A direct comparison would reveal if URI outperformed or underperformed its peers, considering factors such as market share, profitability, and growth strategies. Generally, URI has often demonstrated stronger performance due to its larger scale and diversified operations.

However, specific performance differences would need to be verified by analyzing historical stock data from reputable financial sources.

Correlation with Market Indices

Source: foolcdn.com

The relationship between United Rentals’ stock price and broader market indices like the S&P 500 is typically positive, indicating that URI’s stock tends to move in the same direction as the overall market. However, the correlation might not always be perfect, as company-specific factors can influence URI’s stock price independently of broader market trends. The following table illustrates hypothetical monthly closing prices for both URI and the S&P 500.

Note that this data is illustrative and should be verified with actual data from reliable financial sources.

| Month | United Rentals Closing Price (USD) | S&P 500 Closing Price (USD) |

|---|---|---|

| January | 300 | 4500 |

| February | 310 | 4600 |

| March | 320 | 4700 |

| April | 315 | 4650 |

Factors Influencing United Rentals’ Stock Price

Several macroeconomic, industry-specific, and company-specific factors significantly influence United Rentals’ stock valuation. Understanding these factors is essential for assessing the company’s future prospects and potential stock price movements.

Macroeconomic Factors

Macroeconomic factors such as interest rates, inflation, and economic growth directly impact United Rentals’ stock price. Rising interest rates can increase borrowing costs, potentially affecting the company’s profitability and investment decisions. Inflation impacts both the cost of equipment and the pricing power of the company. Strong economic growth usually translates to increased construction activity and higher demand for rental equipment, benefiting United Rentals.

Conversely, an economic downturn can negatively impact demand, leading to lower stock prices.

Industry-Specific Factors, Stock price united rentals

Industry-specific factors, such as construction activity, demand for rental equipment, and competition within the equipment rental sector, also play a crucial role. Increased construction spending, driven by infrastructure projects or housing booms, typically leads to higher demand for rental equipment, positively impacting United Rentals’ stock price. Conversely, a slowdown in construction activity can negatively impact the company’s revenue and profitability.

Company-Specific Events

Source: seekingalpha.com

Company-specific events, such as financial reports, acquisitions, and new product launches, can significantly influence investor sentiment and, consequently, the stock price. Positive news, such as exceeding earnings expectations or announcing a successful acquisition, often leads to stock price appreciation. Negative news, like disappointing financial results or operational challenges, can trigger price declines. The following list provides hypothetical examples of such events:

- Q1 2023: Strong earnings beat expectations, leading to a stock price surge.

- Q2 2023: Acquisition of a smaller competitor announced, positively impacting investor confidence.

- Q3 2023: Launch of a new technology platform for equipment management, viewed favorably by the market.

- Q4 2023: Slightly lower-than-expected earnings, resulting in a temporary stock price dip.

Financial Analysis of United Rentals

Analyzing United Rentals’ key financial metrics provides valuable insights into its financial health and performance, which directly influences its stock price. This section summarizes key financial metrics over the past three years and compares its performance to industry peers.

Key Financial Metrics (3-Year Summary)

Source: investors.com

The following table presents hypothetical data for United Rentals’ key financial metrics. Actual figures should be obtained from the company’s financial reports and reputable financial data providers.

| Year | Revenue (USD Million) | Net Income (USD Million) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2021 | 10000 | 1500 | 0.8 |

| 2022 | 11000 | 1700 | 0.7 |

| 2023 | 12000 | 1900 | 0.6 |

Comparison with Industry Peers

Comparing United Rentals’ financial performance to its industry peers provides context for its relative strength and weaknesses. The following table shows hypothetical data for key metrics, illustrating a comparison. Remember, actual data should be sourced from reliable financial databases.

| Metric | United Rentals | Competitor A | Competitor B |

|---|---|---|---|

| Revenue Growth (2022-2023) | 10% | 8% | 5% |

| Net Profit Margin (2023) | 15% | 12% | 10% |

| Return on Equity (2023) | 20% | 18% | 15% |

Relationship Between Financial Performance and Stock Price

Generally, strong financial performance, reflected in higher revenue, earnings, and profitability, tends to positively correlate with a higher stock price. Conversely, weaker financial results often lead to stock price declines. However, the relationship is not always linear, as market sentiment and other factors can also influence stock price movements. For example, even with strong financial results, a negative market outlook might still depress the stock price.

FAQ Corner

What are the main risks associated with investing in United Rentals stock?

Investing in United Rentals, like any stock, carries inherent risks. These include economic downturns impacting construction activity (their primary customer base), increased competition, changes in interest rates affecting borrowing costs, and unforeseen regulatory changes.

How does United Rentals compare to its competitors in terms of dividend payouts?

A direct comparison of dividend payouts requires reviewing the dividend history of United Rentals and its major competitors. This information is readily available through financial news websites and the companies’ investor relations sections. Factors like payout ratio and dividend growth rate should be considered.

Analyzing United Rentals’ stock price requires a broad market perspective. Understanding similar trends in other sectors is crucial, and a great example is checking the current performance of stock price s o u n , which offers insights into broader economic health. This comparison can then help refine your predictions for United Rentals’ future stock price movements, allowing for more informed investment decisions.

Where can I find real-time stock price updates for United Rentals?

Real-time stock price updates for United Rentals (URI) are available through major financial websites and brokerage platforms like Yahoo Finance, Google Finance, Bloomberg, and others. Many brokerage accounts provide real-time quotes as part of their services.

What is the typical trading volume for United Rentals stock?

Trading volume for United Rentals fluctuates daily. You can find historical and current trading volume data on financial websites that track stock market activity. Look for sections displaying volume alongside price charts.