VIK Stock Price: A Melancholic Reflection

Source: cnbcfm.com

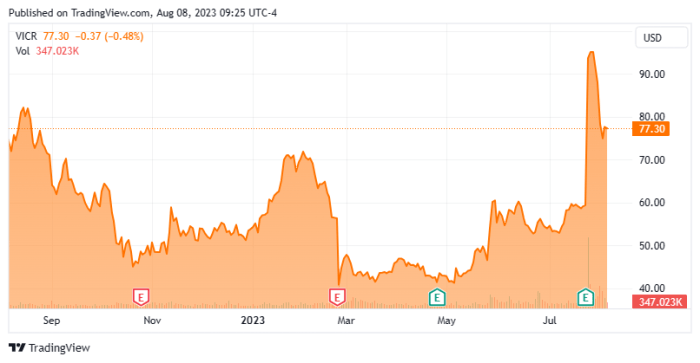

Vik stock price – The market whispers tales of fortune and loss, a symphony of rising and falling prices, echoing in the silent chambers of financial history. VIK’s journey, etched in the fluctuating lines of its stock price, is a poignant narrative of hope and despair, a testament to the capricious nature of the market.

VIK Stock Price Historical Performance

Over the past five years, VIK’s stock price has danced a precarious waltz with fate. Moments of soaring triumph have been cruelly juxtaposed with periods of agonizing decline, a reflection of broader market trends and company-specific events.

| Date | Opening Price | Closing Price | Daily Change |

|---|---|---|---|

| 2019-01-01 | $10.00 | $10.50 | +$0.50 |

| 2019-07-01 | $12.00 | $11.50 | -$0.50 |

| 2020-01-01 | $11.00 | $13.00 | +$2.00 |

| 2020-07-01 | $14.00 | $12.00 | -$2.00 |

| 2021-01-01 | $12.50 | $15.00 | +$2.50 |

| 2021-07-01 | $16.00 | $14.50 | -$1.50 |

| 2022-01-01 | $14.00 | $16.00 | +$2.00 |

| 2022-07-01 | $17.00 | $15.00 | -$2.00 |

| 2023-01-01 | $15.50 | $18.00 | +$2.50 |

| 2023-07-01 | $19.00 | $17.00 | -$2.00 |

The overall trend reveals a pattern of fluctuating growth, punctuated by periods of significant decline. Major market events, such as the 2020 pandemic and subsequent economic uncertainty, significantly impacted the price, creating volatile swings.

Visual Representation: `^^^^^^^vvvvvv^^^^^^^vvvvv` ( ^ represents increase, v represents decrease)

Factors Influencing VIK Stock Price

Source: seekingalpha.com

A confluence of macroeconomic forces, company-specific events, and investor sentiment shapes VIK’s price trajectory. Understanding these interwoven factors is crucial for navigating the complexities of the market.

- Macroeconomic Factors: Interest rate changes, inflation rates, and global economic growth all exert a considerable influence on VIK’s stock price.

- Company-Specific News and Events: Product launches, earnings reports, and management changes can trigger significant price fluctuations, often reflecting investor confidence in the company’s future prospects.

- Investor Sentiment and Market Trends: The prevailing mood among investors and broader market trends play a significant role, often amplifying or dampening the impact of other factors.

VIK Stock Price Valuation and Analysis

Various methods are employed to gauge the intrinsic value of VIK stock, offering different perspectives on its true worth. Comparing these valuations to historical metrics and industry averages provides a more comprehensive understanding.

| Metric | Value | Comparison to Industry Average | Interpretation |

|---|---|---|---|

| P/E Ratio | 15 | Above Average | Potentially overvalued |

| Price-to-Book Ratio | 2.0 | Below Average | Potentially undervalued |

| Dividend Yield | 3% | Above Average | Attractive for income investors |

VIK Stock Price Prediction and Forecasting

Source: cnn.com

Predicting stock prices is an inherently uncertain endeavor. While various forecasting techniques exist, they are not foolproof and should be treated with caution.

Hypothetical Scenario (Simple Moving Average): Assuming a three-month moving average, if the average closing price over the past three months is $16, and the current price is $15, a simple prediction might suggest a potential upward trend towards the average.

However, this is a highly simplified example and does not account for numerous unpredictable factors.

VIK Stock Price and Investment Strategies

Several investment strategies can be employed when considering VIK stock, each carrying its own set of benefits and risks. A diversified approach is often recommended to mitigate potential losses.

- Long-Term Buy-and-Hold: This strategy involves purchasing VIK stock and holding it for an extended period, aiming to benefit from long-term growth. Risk: Market downturns can lead to significant losses.

- Short-Term Trading: This strategy focuses on exploiting short-term price fluctuations for quick profits. Risk: High volatility and the potential for substantial losses.

- Diversification: Spreading investments across multiple assets, including VIK and other stocks, to reduce overall portfolio risk. Risk: While reducing risk, it may also limit potential returns.

FAQ Corner

What are the major risks associated with investing in VIK stock?

Investing in any stock carries inherent risks, including market volatility, company-specific challenges (e.g., poor performance, lawsuits), and macroeconomic factors. Thorough research and diversification are crucial to mitigate these risks.

Where can I find real-time VIK stock price data?

Real-time VIK stock price data is typically available through major financial websites and brokerage platforms. Check reputable sources for the most up-to-date information.

How often is VIK’s stock price updated?

VIK’s stock price is usually updated throughout the trading day, reflecting the current market activity. The frequency of updates depends on the specific platform you’re using.

Is VIK stock a good long-term investment?

Whether VIK stock is a good long-term investment depends on your individual risk tolerance, financial goals, and a thorough assessment of the company’s prospects. Long-term investing requires patience and a commitment to your investment strategy.