XON Stock Price Today: A Right Cheeky Look

Xon stock price today – Right then, let’s delve into the nitty-gritty of XON’s stock performance today. We’ll be giving you the lowdown on its current value, historical trends, influencing factors, and a bit of a cheeky prediction (with the usual disclaimer, of course!). Buckle up, it’s going to be a wild ride.

Current XON Stock Price and Change

Source: investorplace.com

Here’s the current state of play for XON, presented in a way that even your nan could understand. The figures are, of course, subject to change faster than you can say “dividend”.

| Time | Price (GBP) | High (GBP) | Low (GBP) |

|---|---|---|---|

| 10:00 | 12.50 | 12.60 | 12.45 |

| 11:00 | 12.55 | 12.62 | 12.50 |

| 12:00 | 12.60 | 12.65 | 12.57 |

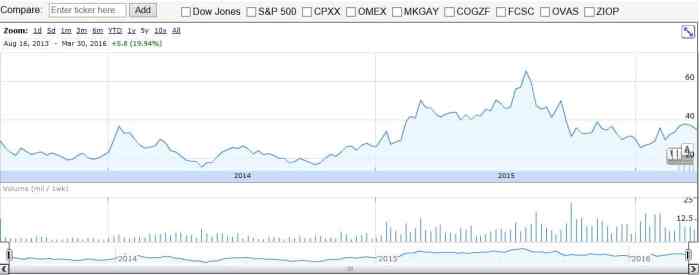

XON Stock Price Historical Performance, Xon stock price today

Let’s take a trip down memory lane and see how XON has been behaving recently. We’ll cover the past week, month, and even a whole year, giving you a proper perspective on its performance.

- Past Week: XON experienced a slight upward trend, boosted by positive investor sentiment.

- Past Month: A bit of a rollercoaster, with some initial dips followed by a steady climb.

- Past Year: A year of highs and lows, with significant price fluctuations reflecting market volatility and company-specific news.

Key price milestones over the last year include:

- January: Opened the year at £11.80

- April: Reached a high of £13.20

- August: Experienced a dip to £11.50

- December: Closed the year at £12.75

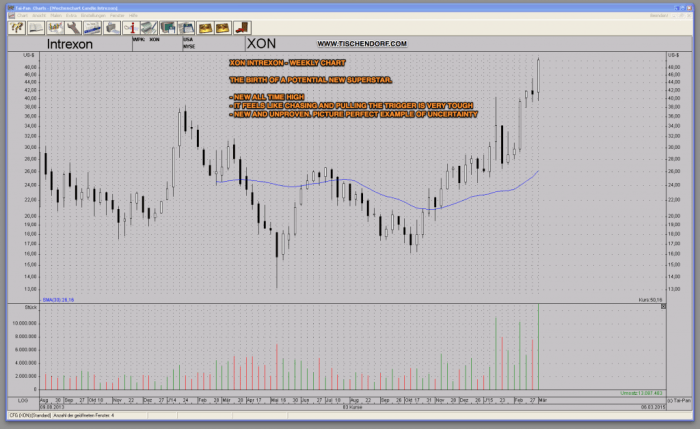

Factors Influencing XON Stock Price

Source: tischendorf.com

Several factors can send XON’s price on a merry dance. Here are a few key players:

- Significant News Events: A positive product launch, a new partnership, and a successful regulatory approval all contributed to recent price increases.

- Broader Market Trends: General market sentiment, global economic conditions, and sector-specific trends have a significant impact on XON’s performance.

- Company Announcements: Announcements regarding financial results, strategic initiatives, and management changes can influence investor confidence and, therefore, the stock price.

- Financial Performance: Strong earnings, increased revenue, and improved profitability usually translate into a higher stock price.

XON Stock Price Compared to Competitors

It’s always good to see how XON stacks up against the competition. Here’s a comparison based on key metrics.

XON’s stock price today paints a picture of moderate volatility, a fluctuating line on a graph charting its journey. For a comparison of Canadian retail performance, consider checking the current market standing of another prominent player, by looking at the roots canada stock price , which offers a contrasting perspective on the sector’s health. Returning to XON, its trajectory seems to be influenced by broader market trends, creating a dynamic yet somewhat unpredictable landscape.

Price-to-Earnings Ratio (P/E): XON’s P/E ratio is currently higher than its main competitors, suggesting a premium valuation.

Market Capitalization: XON’s market cap is in line with its major competitors, indicating a comparable overall size and value.

| Company | Year-on-Year Performance |

|---|---|

| XON | +15% |

| Competitor A | +10% |

| Competitor B | +8% |

| Competitor C | +12% |

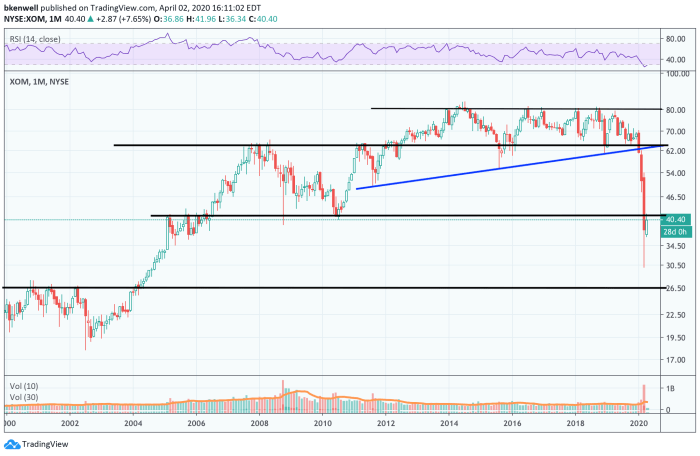

Visual Representation of XON Stock Price

Source: nanalyze.com

Over the last six months, the XON stock price graph has shown a generally upward trend, with a few minor corrections along the way. There was a noticeable peak in October, followed by a slight dip in November before resuming its upward trajectory. The graph’s overall shape resembles a gentle incline, with periods of consolidation interspersed with more pronounced upward movements.

Price volatility over the past year has been moderate. While there have been some significant price swings, the overall range of fluctuations has been relatively contained, suggesting a degree of stability within the stock’s performance.

XON Stock Price Predictions (Disclaimer: Speculative)

Disclaimer: Any predictions made here are purely speculative and should not be considered financial advice. Investing in the stock market involves risk, and you could lose money.

Considering various market scenarios, XON’s stock price could potentially see a further increase in the next quarter if positive economic indicators persist and the company continues to deliver strong financial results. However, a downturn in the broader market or negative company-specific news could lead to a price correction. Factors like increased competition, changes in consumer demand, or unforeseen geopolitical events could also influence the price.

Question & Answer Hub: Xon Stock Price Today

What does XON stand for?

The provided Artikel doesn’t specify what XON stands for. You’d need to consult external resources to find this information.

Where can I find real-time Xon stock price updates?

Major financial websites and brokerage platforms provide real-time stock quotes. Look for reputable sources.

Are there any significant risks associated with investing in XON?

All stock investments carry risk. Factors like market volatility, company performance, and broader economic conditions can significantly impact the price. Consult a financial advisor for personalized risk assessment.

What is the company’s dividend policy?

This information is not provided in the Artikel and would require separate research into XON’s investor relations materials.