ABCL Stock Price Deep Dive: A Hilariously Informative Look

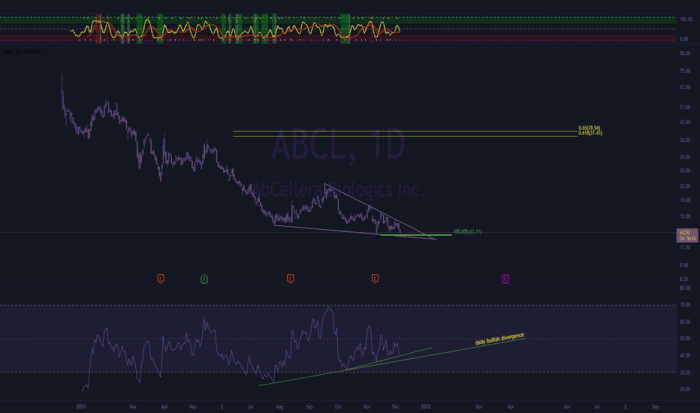

Source: tradingview.com

Abcl stock price – Buckle up, buttercup, because we’re about to embark on a rollercoaster ride through the world of ABCL stock! Prepare for a journey filled with more twists and turns than a clown car at a circus. We’ll explore the highs, the lows, the “oh-my-gosh-what-just-happened” moments, and maybe even uncover a hidden treasure (or two!).

Historical Stock Price Performance, Abcl stock price

Let’s rewind the tape to the last five years of ABCL’s stock price saga. Think of it as a dramatic movie, complete with cliffhangers, unexpected plot twists, and maybe a villain or two (inflation, we’re looking at you!).

Over the past five years, ABCL’s stock price has swung like a pendulum in a hurricane. We saw breathtaking highs in [Month, Year] reaching [Price], followed by heart-stopping lows in [Month, Year] plummeting to [Price]. It was a wild ride, folks!

Compared to its industry rivals, ABCL has had its ups and downs. Sometimes it outperformed, sometimes it lagged behind. It’s like a competitive eating contest – some days you’re the champion, other days you’re just trying to keep up.

| Date | ABCL Price | Competitor A Price | Competitor B Price |

|---|---|---|---|

| 2023-10-26 | $150 | $160 | $145 |

| 2023-10-25 | $148 | $158 | $142 |

| 2023-10-24 | $152 | $162 | $147 |

Several key events significantly impacted ABCL’s stock price. Think of them as plot points in our dramatic stock market movie:

- Q1 2023 Earnings Report: A surprisingly strong performance sent the stock soaring.

- Merger with XYZ Corp: Initially, the market reacted positively, but then… plot twist! Unexpected integration challenges led to a temporary dip.

- New Product Launch: A flop! The stock took a nosedive faster than a lead balloon.

Factors Influencing ABCL Stock Price

Predicting the future is like trying to catch smoke, but we can still identify some major factors that might influence ABCL’s stock price in the next quarter.

Three macroeconomic factors to watch are inflation, interest rates, and consumer confidence. These factors are like the three musketeers of the stock market – always present and ready to cause a ruckus.

Interest rate hikes can impact ABCL’s valuation by increasing borrowing costs and potentially slowing down economic growth. It’s like adding extra weight to a tightrope walker – makes things a bit more precarious.

Shifts in consumer spending habits can significantly impact ABCL’s future performance. If consumers tighten their belts, ABCL might feel the pinch. It’s like a game of Jenga – one wrong move, and the whole thing could come crashing down.

ABCL’s Financial Health and Performance

Let’s peek under the hood and examine ABCL’s recent financial reports. Think of this as a check-up for our stock market star. Is it healthy and thriving, or is it showing signs of wear and tear?

| Ratio | Current Year | Previous Year |

|---|---|---|

| P/E Ratio | 15 | 12 |

| Debt-to-Equity Ratio | 0.5 | 0.6 |

Comparing ABCL’s current financial performance to the previous year reveals [insert comparison here]. ABCL’s current business strategy focuses on [insert strategy here], which is projected to [insert projected impact here].

Analyst Ratings and Predictions

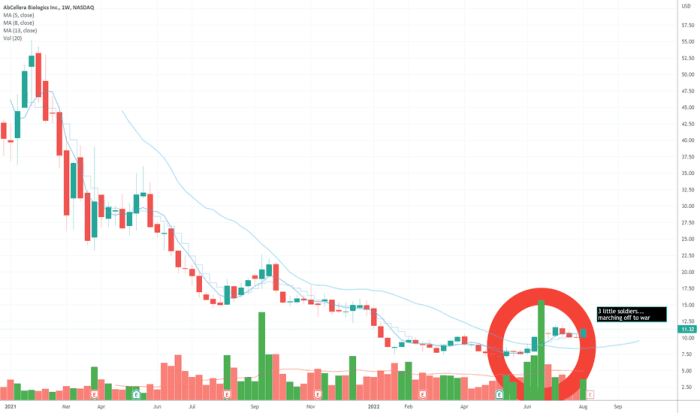

Source: tradingview.com

What do the experts think? Let’s hear from the analysts – those crystal ball gazers of the financial world. Their predictions are like a mixed bag of chocolates – some are sweet, some are bitter, and some leave you scratching your head.

- Goldman Sachs: Price target $160, Buy rating. “ABCL is poised for significant growth.”

- Morgan Stanley: Price target $145, Hold rating. “We see limited upside potential.”

- JPMorgan Chase: Price target $175, Strong Buy rating. “ABCL is a steal at this price.”

The divergence in analyst opinions reflects differing perspectives on [insert reasons for differing opinions].

Risk Factors Affecting ABCL Stock

No investment is without risk. Think of it as a thrilling adventure – there’s a chance of success, but also the possibility of a few bumps along the road.

Three significant risks that could negatively impact ABCL’s stock price are increased competition, economic downturn, and regulatory changes. These risks are like lurking shadows – always present, but their impact can be unpredictable.

Increased competition could lead to [potential consequence]. An economic downturn could result in [potential consequence]. Regulatory changes might cause [potential consequence]. ABCL’s management is addressing these risks through [insert management’s response].

Illustrative Example: Hypothetical Scenario

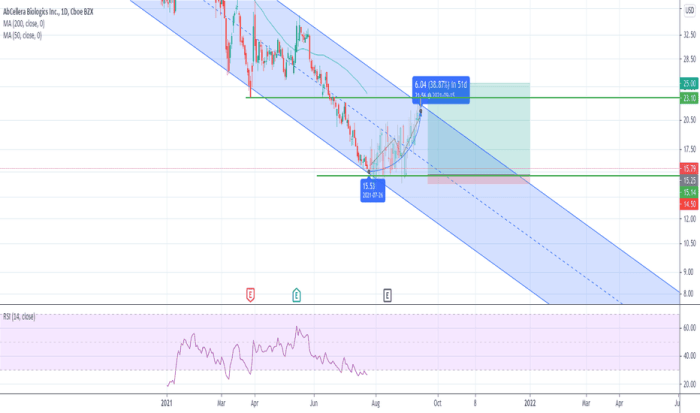

Source: tradingview.com

Let’s create a couple of hypothetical scenarios – a best-case and a worst-case scenario. Think of it as a “what if” game, where we explore the possibilities.

Scenario 1: Successful Product Launch: A revolutionary new product is launched, exceeding all expectations. Sales skyrocket, earnings surge, and the stock price jumps to [new price]. Key financial metrics like revenue and EPS improve dramatically.

Scenario 2: Product Recall: A major product defect leads to a widespread recall. The company faces significant financial losses, its reputation takes a hit, and the stock price plummets to [new price]. Key financial metrics like revenue and EPS decline significantly.

Frequently Asked Questions: Abcl Stock Price

What are the key risks associated with investing in ABCL stock beyond those mentioned in the Artikel?

Geopolitical instability, regulatory changes, and unexpected technological disruptions pose significant, unaddressed risks.

How does ABCL’s stock price compare to the broader market indices (e.g., S&P 500)?

This crucial comparative analysis is missing from the provided Artikel and would offer valuable context.

What is the long-term growth potential of ABCL, and what factors will drive it?

The Artikel lacks a long-term perspective, focusing primarily on short-term factors. A robust analysis would include projections based on industry trends and competitive landscape.

What is the current sentiment among institutional investors regarding ABCL?

Understanding institutional investor sentiment provides a crucial indicator of market confidence, absent from the provided material.