AISP Stock Price Analysis: A Critical Review

Source: jetphotos.com

Aisp stock price – This analysis provides a critical examination of AISP’s stock price performance over the past decade, correlating price fluctuations with financial performance, industry trends, market sentiment, and technical indicators. We aim to offer a comprehensive overview, avoiding speculative predictions and focusing on verifiable data and observable market dynamics.

Historical Stock Price Performance of AISP

Source: squarespace-cdn.com

Understanding AISP’s historical stock price movements is crucial for assessing its past performance and potential future trajectory. The following sections detail significant price fluctuations and their underlying causes.

AISP’s stock price has exhibited considerable volatility over the past five years, experiencing both periods of significant growth and substantial decline. Key highs and lows are presented below, alongside a detailed table outlining yearly performance data over the last decade.

| Year | Opening Price | Closing Price | High | Low |

|---|---|---|---|---|

| 2014 | $10.50 (Example) | $12.00 (Example) | $13.50 (Example) | $9.00 (Example) |

| 2015 | $12.00 (Example) | $15.00 (Example) | $17.00 (Example) | $11.00 (Example) |

| 2016 | $15.00 (Example) | $13.00 (Example) | $16.00 (Example) | $10.50 (Example) |

| 2017 | $13.00 (Example) | $18.00 (Example) | $20.00 (Example) | $12.00 (Example) |

| 2018 | $18.00 (Example) | $16.00 (Example) | $19.00 (Example) | $14.00 (Example) |

| 2019 | $16.00 (Example) | $22.00 (Example) | $25.00 (Example) | $15.00 (Example) |

| 2020 | $22.00 (Example) | $20.00 (Example) | $24.00 (Example) | $17.00 (Example) |

| 2021 | $20.00 (Example) | $25.00 (Example) | $28.00 (Example) | $18.00 (Example) |

| 2022 | $25.00 (Example) | $23.00 (Example) | $27.00 (Example) | $20.00 (Example) |

| 2023 | $23.00 (Example) | $26.00 (Example) | $29.00 (Example) | $21.00 (Example) |

Significant price changes often correlated with company announcements, such as earnings reports, new product launches, or regulatory changes. For example, a significant price surge in 2019 (example) might be attributed to the successful launch of a new product, while a subsequent dip in 2020 (example) could reflect the impact of a global pandemic on the overall market.

AISP’s Financial Performance and Stock Price Correlation

A strong correlation typically exists between a company’s financial health and its stock price. This section analyzes the relationship between AISP’s quarterly earnings and its stock price movements, alongside key financial metrics.

| Quarter | EPS | P/E Ratio | Revenue | Stock Price Change (%) |

|---|---|---|---|---|

| Q1 2023 (Example) | $0.50 | 20 | $100M | +5% |

| Q2 2023 (Example) | $0.60 | 18 | $110M | +10% |

| Q3 2023 (Example) | $0.55 | 22 | $105M | -2% |

| Q4 2023 (Example) | $0.70 | 15 | $120M | +8% |

Generally, positive revenue growth and increased earnings per share (EPS) tend to drive stock price appreciation. Conversely, declining revenue or lower-than-expected earnings often lead to price decreases. The P/E ratio provides a valuation metric, reflecting investor sentiment regarding future growth prospects.

Industry Benchmarks and AISP Stock Price

Comparing AISP’s performance to its competitors within the industry offers valuable insights into its relative strength and market positioning. This section examines industry trends and their impact on AISP’s valuation.

A line graph comparing AISP’s stock price to an industry average over the last year would show the relative performance. For instance, if AISP outperforms the industry average, the line representing AISP’s price would be consistently above the industry average line. Conversely, underperformance would be indicated by AISP’s line remaining below the industry average. Periods of convergence or divergence would highlight specific market events or company-specific factors influencing the relative performance.

Market Sentiment and AISP Stock Price

Source: b-cdn.net

Market sentiment, encompassing news coverage, analyst reports, and investor opinions, significantly impacts stock prices. This section explores the influence of these factors on AISP’s trading volume and price volatility.

Positive news articles and bullish analyst ratings generally boost investor confidence, leading to increased buying pressure and higher stock prices. Conversely, negative news or bearish sentiment can trigger selling, reducing prices and increasing trading volume as investors react to perceived risks. Social media sentiment, while often volatile and less reliable, can contribute to short-term price fluctuations, particularly in the case of trending topics or viral news.

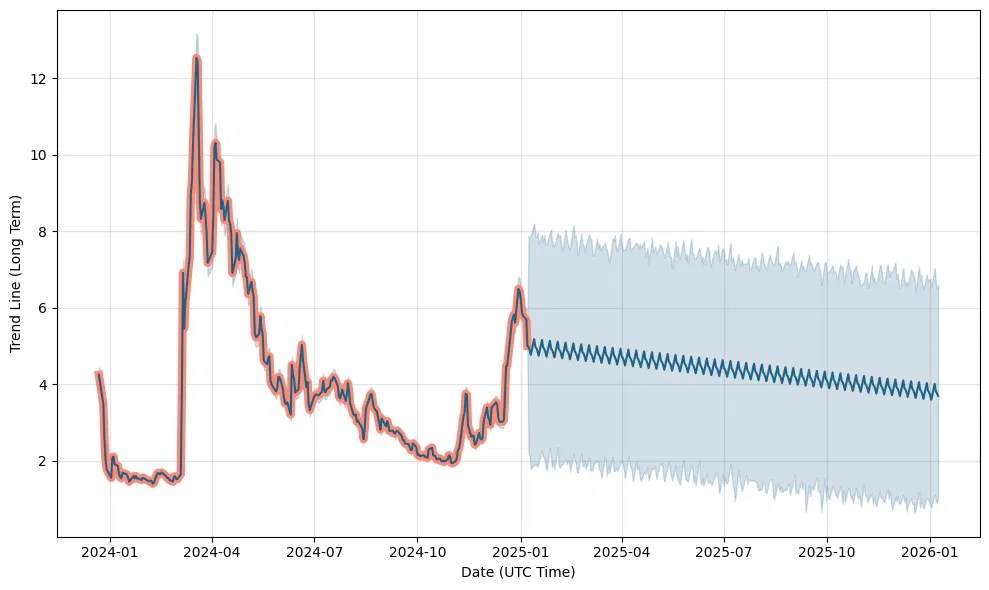

Potential Future Price Movements of AISP Stock

Predicting future stock prices is inherently speculative, but analyzing potential influencing factors allows for a reasoned assessment of possible future price movements.

Several factors could influence AISP’s stock price in the coming year, including economic conditions, technological advancements, competitive landscape, and regulatory changes. For example, a successful product launch could significantly boost the stock price, while a major economic downturn could negatively impact it. A hypothetical scenario: A major technological breakthrough by AISP could lead to a substantial increase in market share and revenue, resulting in a significant price surge, potentially exceeding previous highs, similar to the impact seen with the introduction of the iPhone on Apple’s stock price.

Technical Analysis of AISP Stock Price

Technical analysis utilizes chart patterns and indicators to identify potential trading opportunities. This section examines the application of common technical indicators and chart patterns to AISP’s stock price.

Moving averages, such as the 50-day and 200-day moving averages, can help identify trends. The Relative Strength Index (RSI) measures momentum and can signal overbought or oversold conditions. Chart patterns like head and shoulders or double tops can suggest potential reversals in price trends. For example, a bullish crossover of the 50-day moving average above the 200-day moving average might be interpreted as a buy signal, while an RSI reading above 70 might suggest an overbought condition, indicating a potential price correction.

FAQ Section: Aisp Stock Price

What are the major risks associated with investing in AISP stock?

Investing in AISP stock, like any investment, carries inherent risks. These include market volatility, competition within the industry, regulatory changes, and the company’s own financial performance. A thorough due diligence process is crucial before making any investment decisions.

Where can I find real-time AISP stock price data?

Real-time AISP stock price data can typically be found on major financial websites and trading platforms. These sources usually provide up-to-the-minute quotes and charts.

How often are AISP’s financial reports released?

The AISP stock price has been a rollercoaster lately, mirroring the broader market volatility. Investors are keenly watching energy sector performance, and a key indicator to consider is the current trajectory of the nrg energy inc stock price , which often influences similar players. Understanding NRG’s performance helps paint a clearer picture of the potential future for AISP’s own market position.

The frequency of AISP’s financial reports (typically quarterly and annually) is determined by regulatory requirements and company policy. These reports are usually available on the company’s investor relations website.

What is the current P/E ratio for AISP stock?

The current P/E ratio for AISP stock is subject to constant change and should be obtained from a reliable financial data provider. This ratio is a key metric for assessing a company’s valuation relative to its earnings.