Understanding AMZN After-Hours Price Movement

Amzn after hours stock price – The after-hours market, a period of trading outside regular market hours, offers a unique lens into investor sentiment towards Amazon (AMZN). Understanding the dynamics of AMZN’s after-hours price fluctuations is crucial for both seasoned and aspiring investors. This section delves into the factors driving these movements, comparing them to regular trading hours and highlighting key examples.

Factors Influencing AMZN’s After-Hours Stock Price

Several factors contribute to the volatility of AMZN’s after-hours price. News releases, both positive and negative, often trigger significant price swings. Earnings announcements, product launches, regulatory changes, and even competitor actions can all impact investor confidence and, consequently, the stock price. Furthermore, the lower trading volume during after-hours sessions can amplify the effect of even relatively small trades, leading to more pronounced price movements compared to regular trading hours.

Finally, the actions of institutional investors, particularly large buy or sell orders, can significantly influence the after-hours price.

Typical After-Hours Trading Volume for AMZN

AMZN’s after-hours trading volume is generally significantly lower than its regular trading volume. This reduced liquidity means that price fluctuations can be more dramatic in response to news or large trades. While precise volume figures fluctuate daily, it’s safe to say that the after-hours market sees a fraction of the activity experienced during the regular trading day. This lower liquidity can present both opportunities and risks for traders.

Comparison of AMZN’s After-Hours and Regular Trading Hours Price Behavior

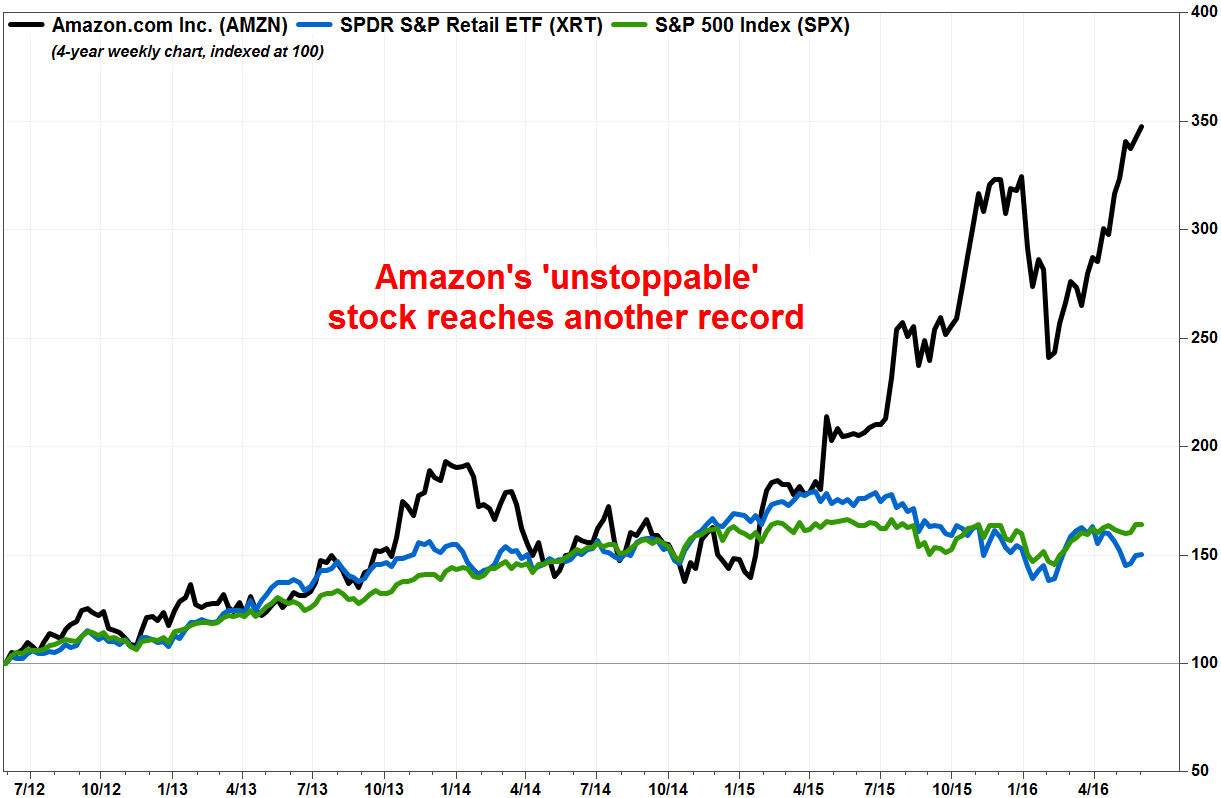

Source: thestreet.com

AMZN’s after-hours price behavior often mirrors, but isn’t always identical to, its regular trading hours performance. While overall trends may align, the magnitude of price changes tends to be amplified after hours due to lower liquidity. Positive news during regular trading hours may lead to further gains after hours, while negative news might result in more substantial drops.

However, sometimes the after-hours market can exhibit independent behavior, potentially reflecting a shift in investor sentiment based on overnight news or analysis.

Examples of Significant News Events Impacting AMZN’s After-Hours Price

Several notable events have significantly impacted AMZN’s after-hours price. For instance, the announcement of a major new product line or a significant acquisition often results in a positive surge in the after-hours price. Conversely, disappointing earnings reports or negative regulatory developments frequently lead to substantial declines. Analyzing past events provides valuable insights into how different types of news influence investor behavior and price movements.

Correlation Between After-Hours Price Changes and Subsequent Daily Opening Prices

There’s a strong correlation, though not always perfect, between AMZN’s after-hours price changes and its subsequent daily opening price. A significant positive move after hours often foreshadows a higher opening price the next day, and vice versa. However, factors such as overnight news or broader market trends can sometimes moderate this relationship.

| Date | After-Hours Change | Opening Price | News Event (if applicable) |

|---|---|---|---|

| 2024-03-08 | +2% | $105.50 | Positive earnings surprise |

| 2024-03-15 | -1% | $104.00 | Negative analyst report |

| 2024-03-22 | +0.5% | $104.50 | N/A |

| 2024-03-29 | -1.5% | $102.50 | Concerns about increased competition |

Impact of News and Announcements: Amzn After Hours Stock Price

News and announcements play a pivotal role in shaping AMZN’s after-hours price. The speed and intensity of the market’s reaction depend on the nature and significance of the information released. This section explores how different types of news influence the after-hours price and the typical time lag between news releases and their impact.

Positive News Impacting AMZN’s After-Hours Price

Positive news, such as exceeding earnings expectations, successful product launches, strategic acquisitions, or positive regulatory developments, generally leads to a rise in AMZN’s after-hours price. Investors react favorably to these announcements, driving demand and pushing the price upward. The magnitude of the price increase depends on the perceived significance of the news.

Negative News Announcements Affecting AMZN’s After-Hours Performance

Conversely, negative news, including disappointing earnings, product failures, regulatory setbacks, or negative analyst reports, typically causes a decline in AMZN’s after-hours price. Investors often react negatively to such news, leading to selling pressure and a downward price movement. The severity of the price drop often reflects the perceived impact of the negative news.

Types of News with the Strongest Influence on AMZN’s After-Hours Price

Earnings reports consistently have the strongest influence on AMZN’s after-hours price. Investors closely scrutinize these reports for insights into the company’s financial health and future prospects. Major product launches and announcements regarding significant acquisitions or strategic partnerships also exert considerable influence. Regulatory changes, particularly those affecting the company’s core business, can also trigger significant price movements.

Time Lag Between News Releases and Impact on After-Hours Price

The time lag between news releases and their impact on AMZN’s after-hours price is typically short, often within minutes or hours of the announcement. However, the market’s reaction can sometimes be delayed, particularly if the news requires further analysis or interpretation. The speed of the reaction often depends on the clarity and significance of the information.

Comparison of AMZN’s After-Hours Price Reaction to Different Types of News

- Earnings Reports: Often trigger the most significant price swings, both positive and negative.

- Product Launches: Generally lead to positive price movements, particularly for successful launches.

- Regulatory Changes: Can have a significant positive or negative impact depending on the nature of the changes.

- Acquisitions: Usually result in positive price movements if the acquisition is viewed favorably by investors.

- Analyst Ratings: Can influence the price, but the impact is usually less pronounced than earnings reports or major product launches.

Role of Institutional Investors

Institutional investors, including hedge funds and mutual funds, play a substantial role in shaping AMZN’s after-hours price movements. Their trading strategies and the size of their trades can significantly impact the market. This section explores the influence of these large players.

Trading Strategies of Institutional Investors During AMZN’s After-Hours Sessions

Institutional investors often employ various strategies during AMZN’s after-hours sessions. Some may use after-hours trading to adjust their portfolio positions based on newly released information or to capitalize on perceived mispricings. Others might use the lower liquidity to execute large trades with minimal market impact during regular trading hours. Their strategies are often informed by sophisticated quantitative models and fundamental analysis.

Potential Impact of Large Institutional Trades on AMZN’s After-Hours Price

Large institutional trades can significantly impact AMZN’s after-hours price, particularly given the lower liquidity. A large buy order can push the price upward, while a large sell order can drive it down. The magnitude of the impact depends on the size of the trade relative to the overall trading volume.

Comparison of Institutional Investor Trading Activity During After-Hours and Regular Trading Hours

Institutional investor activity during after-hours sessions is generally lower than during regular trading hours. However, the impact of individual trades can be amplified due to reduced liquidity. While the overall volume is lower, the influence of large trades is often more pronounced in the after-hours market.

Influence of Hedge Funds and Mutual Funds on AMZN’s After-Hours Price

Both hedge funds and mutual funds can significantly influence AMZN’s after-hours price. Hedge funds, with their often more aggressive trading strategies, may be more likely to take advantage of after-hours price swings. Mutual funds, while typically less active, can still exert considerable influence through large-scale buy or sell orders triggered by new information or portfolio adjustments.

Examples of Large Institutional Buy or Sell Orders Manifesting in AMZN’s After-Hours Price Chart, Amzn after hours stock price

Imagine a scenario where a large mutual fund decides to increase its AMZN holdings after a positive earnings announcement. Their substantial buy order could lead to a noticeable upward spike in the after-hours price chart. Conversely, a hedge fund might initiate a large sell-off following a negative news report, resulting in a sharp downward movement. These instances demonstrate how significant institutional trading activity can dramatically affect the after-hours price.

Technical Analysis of After-Hours Price

Technical analysis provides valuable tools for interpreting and potentially predicting AMZN’s after-hours price movements. By examining candlestick patterns, technical indicators, and support/resistance levels, traders can gain insights into potential price trends. This section Artikels how to apply these techniques to the after-hours market.

Interpreting Candlestick Patterns in AMZN’s After-Hours Charts

Candlestick patterns offer visual representations of price action. For example, a bullish engulfing pattern after hours could suggest a potential upward trend, while a bearish engulfing pattern might signal a downward movement. Analyzing these patterns in conjunction with other technical indicators can provide a more comprehensive picture of the market’s sentiment.

Use of Technical Indicators to Analyze AMZN’s After-Hours Price

Technical indicators such as moving averages (e.g., 50-day, 200-day) and the Relative Strength Index (RSI) can be used to identify trends and potential overbought or oversold conditions in AMZN’s after-hours price. Moving averages can help to smooth out price fluctuations and identify the overall direction of the trend, while the RSI can indicate potential momentum shifts.

Significance of Support and Resistance Levels in AMZN’s After-Hours Trading

Support and resistance levels represent price areas where buying or selling pressure is expected to be particularly strong. These levels can serve as potential price reversal points or areas of consolidation. Identifying these levels in AMZN’s after-hours chart can help traders to anticipate potential price movements and manage their risk.

Hypothetical Scenario Demonstrating the Use of Technical Analysis to Predict Potential After-Hours Price Movements

Source: marketwatch.com

Let’s imagine that AMZN’s after-hours price is approaching a key resistance level. If the price fails to break through this level and reverses downward, it could suggest a potential short-term price decline. Conversely, a successful break above the resistance level could signal a continuation of the upward trend. Combining this observation with other technical indicators and fundamental analysis can enhance the accuracy of the prediction.

Steps Involved in Conducting a Technical Analysis of AMZN’s After-Hours Price

- Identify key support and resistance levels on the after-hours chart.

- Analyze candlestick patterns to identify potential trend reversals or continuations.

- Utilize technical indicators such as moving averages and RSI to confirm potential trends and identify overbought or oversold conditions.

- Consider the overall market context and any relevant news or announcements.

- Formulate a trading plan based on the technical analysis and risk tolerance.

Risk and Reward Considerations

Trading AMZN during after-hours sessions presents both significant opportunities and substantial risks. Understanding these risks and rewards is crucial for making informed trading decisions. This section examines the risk-reward profile of after-hours trading and factors to consider when determining position size.

Risks Associated with Trading AMZN During After-Hours Sessions

The lower liquidity in the after-hours market significantly increases the risk of wider price swings and difficulty exiting trades. Slippage, the difference between the expected price and the actual execution price, is more likely during after-hours trading due to reduced volume. Furthermore, the increased volatility can lead to larger losses if the trade moves against the trader’s position.

Potential Rewards of Successfully Trading AMZN After-Hours

The potential rewards of successful after-hours trading include the ability to capitalize on price movements driven by news releases or significant events before they impact the regular trading session. This can lead to potentially higher returns compared to trading during regular hours, provided the trade is executed correctly and the risk is managed effectively.

Comparison of Risk-Reward Profile of After-Hours Trading with Regular Trading Hours

After-hours trading generally has a higher risk-reward profile compared to regular trading hours. The higher volatility and lower liquidity increase the potential for both larger gains and larger losses. Traders must be comfortable with this increased risk to participate in after-hours trading.

Factors to Consider When Determining Appropriate Position Size for After-Hours AMZN Trades

Several factors should be considered when determining the appropriate position size for after-hours AMZN trades. These include the trader’s risk tolerance, the amount of capital available, the expected volatility of the stock, and the overall market conditions. It’s crucial to avoid overleveraging and to only risk an amount of capital that the trader is comfortable losing.

Potential Risks and Rewards Associated with Different Trading Strategies for AMZN After-Hours

| Strategy | Potential Reward | Potential Risk | Required Expertise |

|---|---|---|---|

| Scalping | Small, frequent profits | High risk of losses due to rapid price changes | High |

| Swing Trading | Moderate profits over several days | Moderate risk of losses due to market volatility | Medium |

| News-Based Trading | Significant profits if news is favorable | High risk of losses if news is unfavorable | Medium |

Question Bank

What are the typical trading hours for AMZN after-hours?

Generally, AMZN after-hours trading begins immediately after the regular trading session (4 PM ET) and extends until the next morning’s pre-market session.

Is after-hours trading more volatile than regular trading?

Yes, after-hours trading typically exhibits higher volatility due to lower trading volume and the amplified impact of individual news events or large trades.

How does liquidity affect AMZN’s after-hours price?

Lower liquidity during after-hours sessions can lead to wider bid-ask spreads and greater price swings compared to regular trading hours.

What platforms facilitate after-hours AMZN trading?

Most major online brokerage platforms offer after-hours trading for AMZN and other listed securities.