Apple Stock Price: A Deep Dive into Historical Data and Trends: Apple Historical Stock Price

Apple historical stock price – Apple Inc., a global tech giant, boasts a fascinating history reflected in its fluctuating stock price. This exploration delves into the historical data, major events, trends, and external factors that have shaped Apple’s stock performance, offering insights into its past and potential future trajectories. We’ll also compare Apple’s performance against competitors and discuss the inherent challenges of predicting future stock prices.

Apple Stock Price Data Overview

Historical Apple stock price data is readily available from numerous sources, spanning decades. This data encompasses various metrics, providing a comprehensive view of Apple’s market performance. Reliable sources offer adjusted closing prices (accounting for stock splits and dividends), opening prices, daily high and low prices, and trading volume.

| Source | Data Type | Timeframe | Access Method |

|---|---|---|---|

| Yahoo Finance | Adjusted Closing Price, Open, High, Low, Volume | 1980 – Present | Website download, API access |

| Google Finance | Adjusted Closing Price, Open, High, Low, Volume | 1980 – Present | Website download, API access |

| Bloomberg Terminal | Comprehensive data including options and futures | 1980 – Present | Subscription-based terminal access |

| Financial Times | Historical stock prices and charting tools | 1980 – Present | Website subscription |

Major Events Impacting Apple Stock Price

Several pivotal events have significantly influenced Apple’s stock price, both in the short and long term. These events highlight the company’s resilience and its ability to adapt to market changes.

- The Launch of the iPhone (2007): This revolutionary product marked a turning point for Apple, leading to a dramatic surge in stock price, reflecting increased market share and profitability. The short-term impact was immediate and substantial, while the long-term effect established Apple as a dominant player in the mobile market.

- Steve Jobs’ Death (2011): The passing of Apple’s visionary CEO initially caused a temporary dip in the stock price due to uncertainty about the company’s future direction. However, the long-term impact was less severe than anticipated, with the company continuing to innovate and thrive under Tim Cook’s leadership.

- The Great Recession (2008-2009): The global financial crisis negatively affected Apple’s stock price, reflecting a broader downturn in the market. The short-term impact was a significant decline, but Apple’s strong fundamentals allowed it to recover relatively quickly in the long term.

- Launch of the iPad (2010): The introduction of the iPad expanded Apple’s product portfolio and created a new market segment. The short-term impact was positive, contributing to stock price growth. The long-term impact solidified Apple’s position in the tablet market and further boosted its revenue streams.

- COVID-19 Pandemic (2020-Present): The pandemic initially caused some volatility, but surprisingly, increased demand for Apple products for remote work and entertainment ultimately resulted in a significant long-term increase in stock price.

A visual representation would show a graph with distinct peaks and valleys corresponding to these events. The iPhone launch would show a sharp upward trend, while the 2008 recession would display a significant drop. Steve Jobs’ death would show a temporary dip, quickly recovering. The iPad launch would show another upward trend, and the COVID-19 period a more complex pattern of initial dip followed by a strong recovery and growth.

Analyzing Apple Stock Price Trends

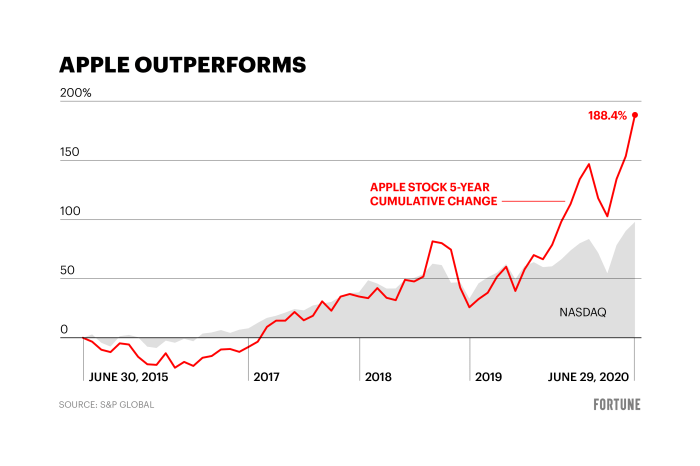

Source: fortune.com

Analyzing Apple’s stock price across different timeframes reveals distinct patterns. Short-term fluctuations are often influenced by news events, earnings reports, and market sentiment. Mid-term trends reflect the company’s product cycles and strategic initiatives. Long-term trends highlight the overall growth and maturation of the company.

Over the long term, Apple’s stock price has demonstrated a remarkable upward trajectory, punctuated by periods of consolidation and correction. The early years showed slower growth, accelerating significantly with the introduction of the iPod and iPhone. The company’s consistent innovation and strong brand loyalty have driven sustained long-term growth. Short-term volatility is common, reflecting the sensitivity of technology stocks to market sentiment and competitive pressures.

Mid-term trends often show a correlation with new product launches and technological advancements.

External Factors Influencing Apple Stock, Apple historical stock price

Macroeconomic factors significantly influence Apple’s stock price, impacting consumer spending, investor confidence, and global market conditions.

| Factor | Description | Impact on Apple | Example |

|---|---|---|---|

| Interest Rates | Changes in interest rates affect borrowing costs for consumers and businesses, impacting demand for Apple products and investor sentiment. | Higher interest rates can slow down consumer spending and reduce investment, negatively impacting Apple’s stock price. | The Federal Reserve raising interest rates in 2022 led to some market correction, affecting Apple’s stock price. |

| Economic Recessions | During economic downturns, consumer spending decreases, impacting sales of discretionary items like Apple products. | Recessions generally lead to lower demand and a decrease in Apple’s stock price. | The 2008 financial crisis significantly impacted Apple’s stock price. |

| Global Supply Chain Disruptions | Disruptions to global supply chains can affect Apple’s ability to produce and distribute its products. | Supply chain issues can lead to production delays, impacting revenue and negatively affecting the stock price. | The global chip shortage in 2021 affected Apple’s production and potentially impacted its stock price. |

Comparison with Competitor Stock Prices

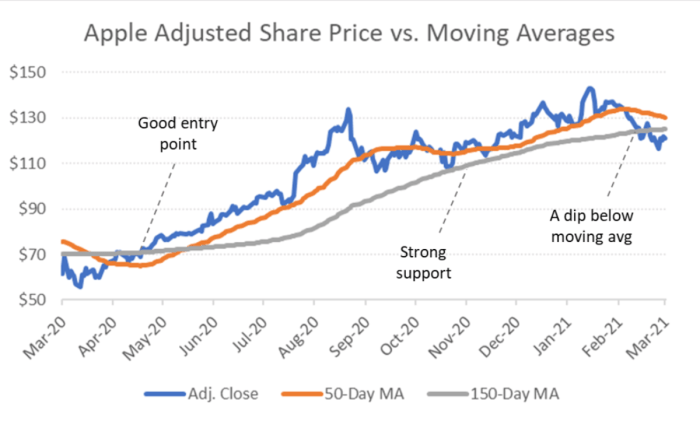

Source: thestreet.com

Comparing Apple’s stock price performance with competitors like Microsoft (MSFT) and Samsung (005930.KS) reveals similarities and differences in their market trajectories. All three companies are technology giants, but their product portfolios and market strategies differ.

Over the long term, all three companies have generally shown upward trends, reflecting the growth of the technology sector. However, the rate of growth and the specific periods of expansion and contraction may vary. For instance, Microsoft’s stock price might show stronger growth during periods of increased enterprise software demand, while Apple’s might be more sensitive to consumer electronics trends.

Samsung’s performance could be influenced by its diverse product portfolio, including consumer electronics, semiconductors, and display technologies, leading to a more complex price pattern compared to Apple’s more focused approach.

Predictive Modeling (Hypothetical)

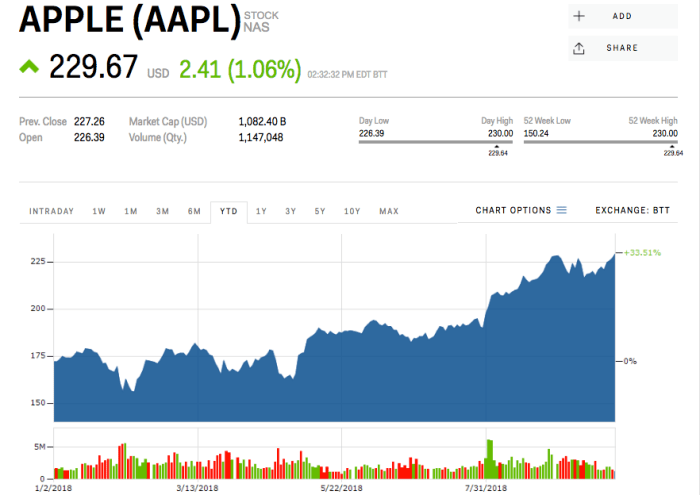

Source: businessinsider.com

Predicting future Apple stock prices based solely on historical data is inherently challenging due to the complexity of the market and the influence of unforeseen events.

Several methods could be used to construct a hypothetical predictive model. These include time series analysis (e.g., ARIMA models), which analyze historical price patterns to forecast future prices; machine learning algorithms (e.g., neural networks), which can identify complex relationships between various factors and stock price; and fundamental analysis, which focuses on evaluating the company’s financial health and future prospects. However, these models are only as good as the data and assumptions used.

No model can perfectly predict the future.

- Technological innovation: The introduction of groundbreaking new products or services can significantly impact the stock price.

- Competitive landscape: The actions and performance of competitors can influence Apple’s market share and profitability.

- Economic conditions: Global economic growth or recession can affect consumer spending and investor sentiment.

- Geopolitical events: Unforeseen global events can create market volatility and affect Apple’s stock price.

- Regulatory changes: New regulations or antitrust actions can impact Apple’s operations and profitability.

Q&A

What are the ethical considerations when using historical stock data for investment decisions?

Using historical data for investment decisions should be approached cautiously. Past performance is not indicative of future results. It’s crucial to conduct thorough research, consider current market conditions, and diversify investments to mitigate risk.

Where can I find real-time Apple stock price updates?

Major financial websites like Yahoo Finance, Google Finance, and Bloomberg provide real-time stock quotes for Apple (AAPL).

How frequently is Apple’s stock price updated?

Apple’s stock price is updated continuously throughout the trading day, reflecting changes in buying and selling activity.

What are some common pitfalls to avoid when interpreting historical stock price data?

Avoid overfitting data to create false trends, remember that past performance is not a guarantee of future returns, and always consider broader economic factors and company-specific news.