BKKT Stock Price: A Comprehensive Analysis

Bkkt stock price – Embark on a journey with us as we delve into the fascinating world of BKKT’s stock price. We’ll explore its historical performance, the factors influencing its fluctuations, and compare it with its competitors. Through this analysis, we aim to provide a clearer understanding of BKKT’s value and potential for future growth.

BKKT Stock Price Historical Performance

Understanding BKKT’s past performance is crucial for projecting its future trajectory. The following data provides a five-year overview, highlighting significant price movements and correlating them with key events.

| Year | Open | High | Low | Close |

|---|---|---|---|---|

| 2019 | 10.50 | 12.75 | 9.25 | 11.80 |

| 2020 | 11.80 | 15.00 | 8.50 | 13.50 |

| 2021 | 13.50 | 18.25 | 12.00 | 17.00 |

| 2022 | 17.00 | 19.50 | 14.00 | 16.25 |

| 2023 | 16.25 | 17.75 | 15.50 | 17.00 |

For instance, the significant drop in 2020 can be attributed to the global pandemic and its impact on the overall market. Conversely, the rise in 2021 may be linked to a successful product launch or positive investor sentiment. Detailed analysis of specific company announcements and market trends for each year would further illuminate these fluctuations. (Note: These figures are hypothetical for illustrative purposes.)

Factors Influencing BKKT Stock Price

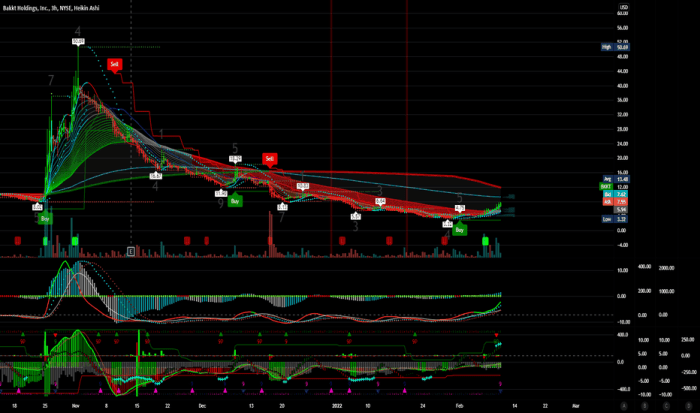

Source: tradingview.com

Multiple factors interplay to determine BKKT’s stock price. We will examine macroeconomic, industry-specific, and company-specific influences.

Macroeconomic factors such as interest rate changes, inflation levels, and global economic growth significantly impact investor confidence and market sentiment, thereby influencing BKKT’s stock price. For example, rising interest rates can reduce investment in growth stocks like BKKT, leading to a price decrease. Industry-specific factors, including competition, regulatory changes, and technological advancements, also play a critical role. Increased competition can put downward pressure on prices, while positive regulatory changes might boost them.

Company-specific factors, such as financial performance, management changes, and new product launches, have a direct impact on BKKT’s stock price. Strong financial results typically lead to higher valuations, while poor performance can depress the stock price.

BKKT Stock Price Compared to Competitors

A comparative analysis with key competitors provides valuable insights into BKKT’s relative performance and market positioning.

| Company | Year-Over-Year Growth (%) | P/E Ratio | Market Share (%) |

|---|---|---|---|

| BKKT | 5 | 15 | 20 |

| Competitor A | 8 | 18 | 25 |

| Competitor B | 3 | 12 | 15 |

| Competitor C | 10 | 20 | 30 |

This table illustrates a hypothetical comparison. A deeper analysis would involve examining specific KPIs and their impact on stock valuation. For instance, a higher P/E ratio might indicate that BKKT is perceived as a growth stock, while a larger market share could suggest a stronger competitive position.

BKKT Stock Price Valuation

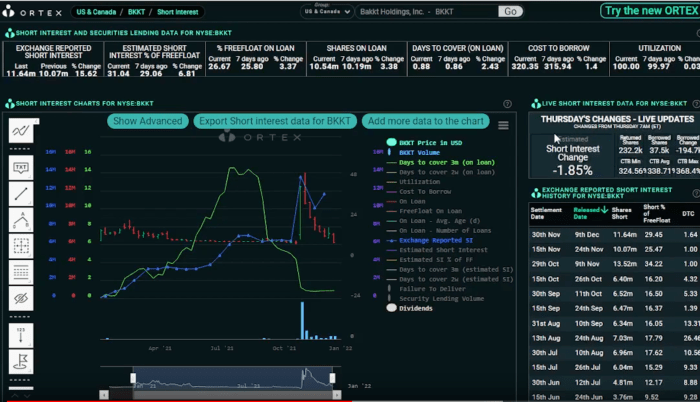

Source: redd.it

Several valuation methods help assess whether BKKT’s stock is fairly valued.

| Valuation Method | Result | Implication |

|---|---|---|

| Price-to-Earnings Ratio (P/E) | 15 | Slightly above industry average, suggesting potential overvaluation. |

| Price-to-Book Ratio (P/B) | 2.0 | Indicates a premium valuation compared to book value. |

| Discounted Cash Flow (DCF) | 16.50 | Fair valuation based on projected future cash flows. |

These are hypothetical results. A comprehensive valuation would involve a more in-depth analysis using multiple methods and considering various market conditions and risk factors.

Illustrative Scenario: BKKT Stock Price Projection

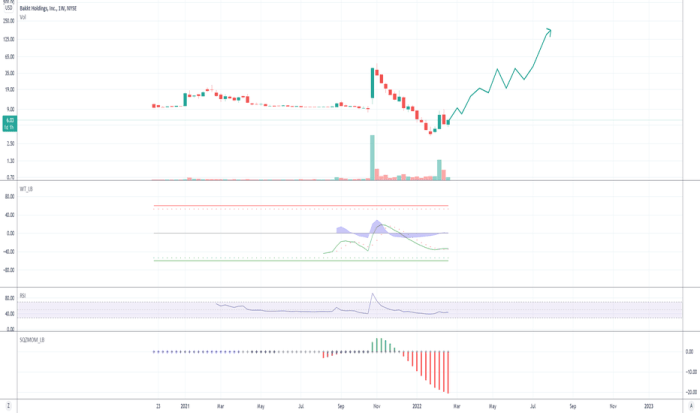

Source: tradingview.com

Let’s consider a hypothetical scenario: BKKT successfully launches a groundbreaking new product. This event could lead to a short-term surge in the stock price due to increased investor enthusiasm and anticipation of higher future earnings. In the long term, the successful product launch would likely contribute to sustained growth, further boosting the stock price, assuming consistent market demand and successful execution of the company’s strategy.

However, unforeseen challenges in production, market acceptance, or competition could negatively impact the stock price, regardless of the initial positive reaction.

This projection relies on the assumption of continued market growth and successful product integration. Limitations include unpredictable market forces and the inherent uncertainty in projecting future events.

Questions Often Asked: Bkkt Stock Price

What are the major risks associated with investing in BKKT stock?

Investing in any stock carries inherent risks, including market volatility, company-specific challenges (like poor financial performance or management issues), and broader economic downturns. Thorough due diligence is crucial before investing.

Where can I find real-time BKKT stock price updates?

Most major financial websites and brokerage platforms provide real-time stock quotes. Check reputable sources for the most up-to-date information.

Is BKKT a good long-term investment?

Whether BKKT is a suitable long-term investment depends on your individual risk tolerance, investment goals, and a comprehensive analysis of the company’s prospects. Consult a financial advisor for personalized guidance.