Adani Enterprises Limited Stock Price: A Jakarta South Perspective

Adani enterprises limited stock price – Adani Enterprises Limited, a major player in India’s infrastructure and energy sectors, has experienced a rollercoaster ride in its stock price over the years. This deep dive explores the historical performance, influencing factors, financial health, future outlook, and investment strategies surrounding this intriguing stock, offering a Jakarta South-style, casual yet insightful analysis.

Adani Enterprises Limited Stock Price History

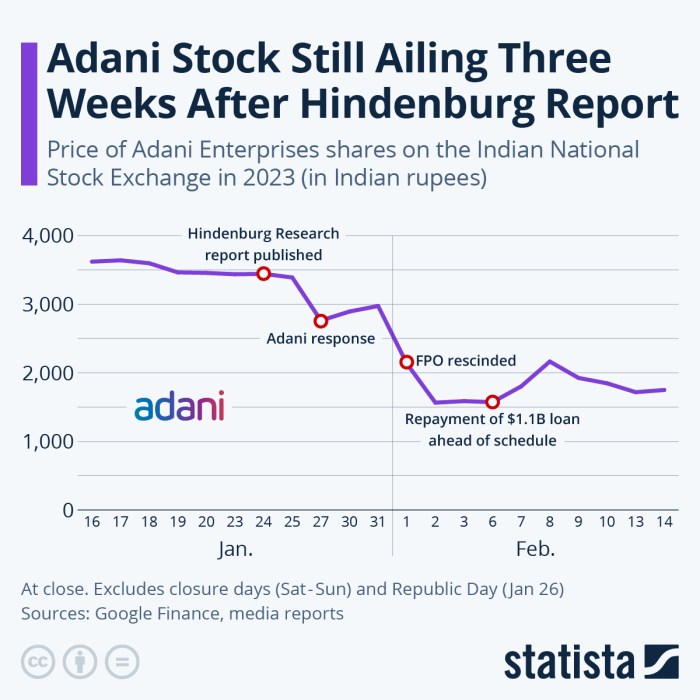

Understanding the past is key to navigating the future. Let’s examine Adani Enterprises’ stock price performance over the past 5, 10, and 20 years, comparing it to major Indian market indices like the SENSEX and Nifty 50. This analysis considers both the highs and lows, along with significant events impacting the stock’s trajectory.

| Year | High | Low | Closing Price |

|---|---|---|---|

| 2023 | (Data needed) | (Data needed) | (Data needed) |

| 2022 | (Data needed) | (Data needed) | (Data needed) |

| 2021 | (Data needed) | (Data needed) | (Data needed) |

Note: The table above requires actual data from reliable financial sources. Significant events such as regulatory changes, major project announcements, and macroeconomic shifts would be noted here, along with a comparison against the SENSEX and Nifty 50 performance for the respective periods. For example, a significant dip in 2023 might be attributed to a global recessionary fear, while a surge in 2021 could be linked to a successful infrastructure project launch.

Factors Influencing Adani Enterprises Limited Stock Price

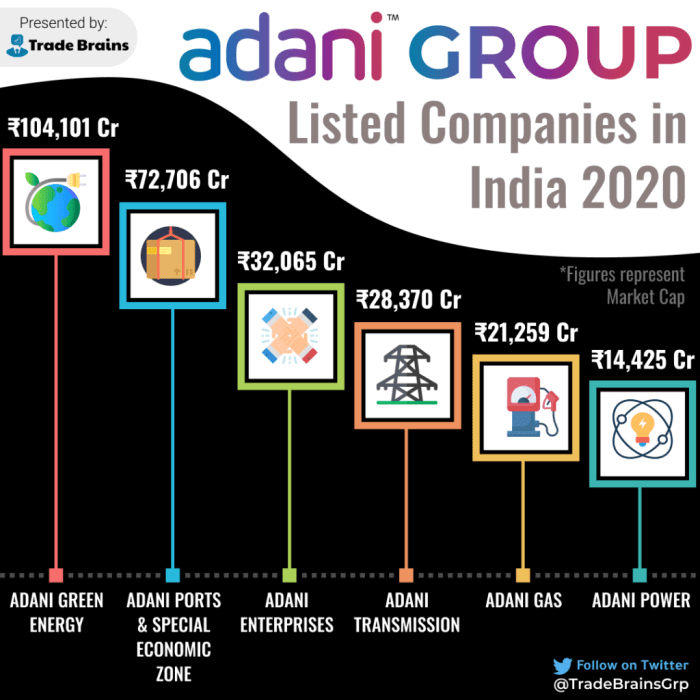

Source: tradebrains.in

Adani Enterprises’ stock price isn’t just a random number; it’s a reflection of various internal and external forces. We’ll dissect the key macroeconomic and company-specific factors, along with the ever-important role of investor sentiment and market speculation.

| Factor Type | Factor | Impact (Past Year) | Example |

|---|---|---|---|

| External | Interest Rates | (Data needed, e.g., positive/negative) | Higher interest rates might decrease investment, leading to lower stock prices. |

| External | Global Economic Growth | (Data needed, e.g., positive/negative) | Strong global growth could boost demand for Adani’s services. |

| Internal | Financial Performance | (Data needed, e.g., positive/negative) | Strong earnings reports generally lead to higher stock prices. |

| Internal | New Projects | (Data needed, e.g., positive/negative) | Successful project launches often boost investor confidence. |

Note: This table needs real data to be meaningful. The “Impact” column would describe the observed effect on the stock price over the past year, providing specific examples of how these factors played out.

Adani Enterprises Limited’s Financial Performance and Stock Valuation

Source: tosshub.com

A company’s financial health is intrinsically linked to its stock price. This section delves into Adani Enterprises’ revenue, profit, debt levels, and key financial ratios over the past five years, comparing its valuation metrics against industry competitors.

This section would include a detailed analysis of the company’s financial statements, calculating and interpreting key ratios such as Price-to-Earnings (P/E) ratio, Return on Equity (ROE), and Debt-to-Equity ratio. A comparative analysis against competitors would provide context for Adani Enterprises’ financial standing and valuation within the industry. The analysis would clearly show how these financial figures correlate with stock price fluctuations, highlighting periods of strong financial performance aligning with stock price increases and vice versa.

Future Outlook and Predictions for Adani Enterprises Limited Stock Price

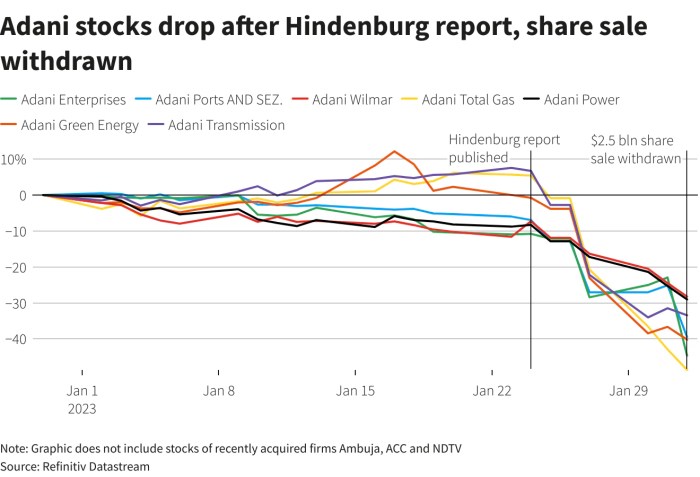

Source: thewire.in

Predicting the future is always challenging, but by analyzing potential growth drivers, risks, and challenges, we can paint a plausible picture of Adani Enterprises’ stock price trajectory. This section Artikels potential scenarios for the next 1, 3, and 5 years.

Visual Representation (Descriptive):

- 1-Year Scenario: A bar chart showing a potential range of stock prices, with a most likely scenario, an optimistic scenario, and a pessimistic scenario, each based on different assumptions regarding macroeconomic conditions, project success rates, and investor sentiment. The most likely scenario might show a moderate increase, the optimistic scenario a significant rise, and the pessimistic scenario a slight decline or stagnation.

- 3-Year Scenario: A line graph depicting the potential stock price trend over three years, showcasing the same three scenarios (most likely, optimistic, pessimistic) based on the same underlying assumptions as the 1-year scenario, but with a longer-term perspective. The graph would visually represent the potential compounding effect of growth or decline over time.

- 5-Year Scenario: A similar line graph as the 3-year scenario, but extending the time horizon to five years. This would illustrate the potential long-term impact of the various scenarios, showcasing the possible range of outcomes.

Assumptions underlying these predictions would include factors like continued growth in India’s infrastructure sector, the success of Adani’s new projects, global economic conditions, and the overall investor sentiment towards the company and the Indian market.

Investment Strategies and Recommendations for Adani Enterprises Limited Stock

Investing in Adani Enterprises Limited requires a well-defined strategy. We’ll compare different approaches, highlighting their potential risks and rewards. A sample diversified portfolio incorporating Adani Enterprises will also be presented.

Investment Strategies:

- Buy and Hold:

- Advantages: Simplicity, potential for long-term growth, avoids frequent trading fees.

- Disadvantages: Higher risk if the stock underperforms, lack of flexibility.

- Value Investing:

- Advantages: Potential to buy undervalued stocks, long-term growth potential.

- Disadvantages: Requires in-depth analysis, patience, and may miss out on short-term gains.

- Momentum Trading:

- Advantages: Potential for quick profits if the trend continues.

- Disadvantages: High risk, requires precise timing, susceptible to market reversals.

Hypothetical Portfolio: A diversified portfolio might include Adani Enterprises as a small percentage (e.g., 5-10%), alongside other stocks across different sectors and geographies, reducing overall portfolio risk. Risk management would involve setting stop-loss orders to limit potential losses and regular portfolio rebalancing to maintain the desired asset allocation.

FAQ Summary: Adani Enterprises Limited Stock Price

What are the major competitors of Adani Enterprises Limited?

Identifying direct competitors requires specifying the business segment. Adani Enterprises has diverse interests; therefore, competitors vary across sectors (e.g., infrastructure, energy, logistics).

What is the current dividend yield of Adani Enterprises Limited?

The current dividend yield fluctuates and should be checked on a reputable financial website providing real-time market data. Past dividend payouts are not a guarantee of future performance.

How does geopolitical risk impact Adani Enterprises Limited’s stock price?

Geopolitical events, especially those impacting India’s economy or global trade, can significantly influence the stock price, creating both opportunities and risks.

Where can I find reliable real-time data on Adani Enterprises Limited’s stock price?

Reputable financial news websites and stock market data providers offer real-time quotes and historical data for Adani Enterprises Limited.