American Tower Corporation: A Deep Dive into Stock Performance

Source: marketbeat.com

American tower stock price – American Tower Corporation (AMT) is a prominent player in the global telecommunications infrastructure sector. This analysis delves into the company’s business model, financial health, market position, and future prospects, providing insights into factors influencing its stock price.

American Tower Corporation Overview

American Tower Corporation operates as a real estate investment trust (REIT), owning, operating, and developing a portfolio of communications real estate, primarily wireless and broadcast towers. Its key revenue streams stem from lease payments from wireless carriers and other communications service providers for space on its towers. These tenants utilize the towers to deploy their antennas and other equipment for cellular, broadcast, and other wireless services.American Tower boasts a substantial global presence, with significant operations across the Americas, Europe, Africa, and the Middle East.

Major markets include the United States, Brazil, India, and numerous other countries experiencing rapid growth in wireless data consumption. Profitability is driven by long-term lease agreements, high occupancy rates, and the continuous demand for wireless infrastructure upgrades to accommodate increasing data traffic and the deployment of new technologies such as 5G. The company’s scale, geographic diversification, and long-term contracts contribute to its consistent revenue streams and profitability.

| Year | Revenue (USD Billions) | Net Income (USD Billions) | EPS (USD) |

|---|---|---|---|

| 2022 | 8.8 | 1.6 | 7.16 |

| 2021 | 8.3 | 1.5 | 6.55 |

| 2020 | 7.7 | 1.2 | 5.21 |

| 2019 | 7.3 | 1.1 | 4.72 |

| 2018 | 6.8 | 1.0 | 4.18 |

Factors Affecting American Tower Stock Price

Source: seekingalpha.com

Macroeconomic factors such as interest rate hikes and inflation significantly influence American Tower’s stock price. Higher interest rates increase borrowing costs, impacting the company’s capital expenditure plans and potentially reducing profitability. Inflation affects operating costs and can influence lease rates. Industry trends, particularly the 5G rollout and the ongoing development of wireless infrastructure, are major drivers. The increasing demand for 5G infrastructure presents a substantial growth opportunity for American Tower, while the broader wireless infrastructure development fuels consistent demand for tower space.

Competitive pressures from other tower companies like Crown Castle International and SBA Communications exist, but American Tower’s scale, global footprint, and strong tenant relationships provide a competitive advantage.

- American Tower: Strong global presence, large portfolio, long-term contracts.

- Crown Castle International: Primarily focused on the US market, significant US market share.

- SBA Communications: Global presence, but smaller than AMT and Crown Castle.

American Tower generally outperforms its competitors in terms of revenue and market capitalization, reflecting its scale and global reach.

American Tower’s Financial Health

American Tower maintains a significant level of debt to finance its expansion and acquisitions. However, the company’s credit rating remains investment grade, reflecting its strong cash flow generation and ability to service its debt obligations. American Tower has a consistent dividend policy, distributing a portion of its earnings to shareholders. The dividend payout ratio is generally moderate, allowing for reinvestment in growth initiatives.

American Tower’s stock price, a reflection of its extensive global infrastructure, often correlates with broader market trends. However, a contrasting analysis might involve comparing its performance against the technology sector, for instance, by examining the current paloalto stock price , a key player in cybersecurity. Understanding this comparison helps contextualize American Tower’s valuation within the larger economic landscape.

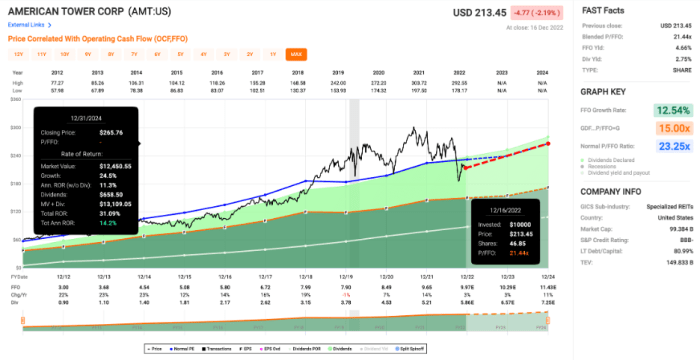

Capital expenditures are substantial, primarily focused on expanding its tower portfolio and upgrading existing infrastructure. These expenditures are crucial for maintaining its competitive advantage and supporting future growth, though they can influence short-term profitability.A chart illustrating American Tower’s key financial ratios (e.g., debt-to-equity ratio, return on equity, dividend payout ratio) over time would show a generally stable trend in debt levels, consistent profitability, and a moderate dividend payout ratio.

The x-axis would represent time (years), and the y-axis would represent the ratio values. Data points would be plotted for each year, and lines would connect the points to illustrate trends. The chart would visually represent the company’s financial stability and growth trajectory.

Investor Sentiment and Market Outlook

Source: evancarthey.com

Current market sentiment towards American Tower stock is generally positive, driven by the ongoing growth in wireless data consumption and the expansion of 5G networks. Key events that could significantly impact the stock price include changes in interest rates, major acquisitions or divestitures, and regulatory changes impacting the telecommunications industry. Potential risks include increased competition, economic downturns affecting tenant demand, and changes in technology that could render existing infrastructure obsolete.

Opportunities lie in the continued expansion of 5G and other wireless technologies, international market growth, and strategic acquisitions.

- Scenario 1 (Bullish): Continued strong demand for wireless infrastructure, successful 5G rollout, leading to a 15-20% stock price increase.

- Scenario 2 (Neutral): Moderate growth in the wireless industry, stable interest rates, resulting in a 5-10% stock price increase.

- Scenario 3 (Bearish): Economic downturn impacting tenant demand, increased competition, potentially leading to a 5-10% stock price decrease.

These scenarios are based on assumptions regarding economic growth, industry trends, and competitive dynamics.

Long-Term Growth Prospects, American tower stock price

Long-term growth drivers for American Tower include the continued expansion of 5G networks, the increasing demand for wireless data, and the growth of the global telecommunications industry. Strategic initiatives such as acquisitions, organic growth, and technology upgrades will be crucial for maintaining its competitive edge. The sustainability of American Tower’s business model rests on its ability to adapt to technological changes, maintain high occupancy rates, and secure long-term lease agreements.

In 5-10 years, American Tower could be a significantly larger company, with a more diversified global portfolio and a leading position in the 5G infrastructure market. However, challenges such as increased competition, regulatory hurdles, and technological disruption could impact its growth trajectory. The company’s success will depend on its ability to innovate, adapt, and manage risks effectively in a dynamic and competitive environment.

Question & Answer Hub: American Tower Stock Price

What is American Tower Corporation’s primary competitor?

American Tower faces competition from several companies, including Crown Castle International and SBA Communications. The competitive landscape is complex and varies by geographic region.

How does inflation affect American Tower’s stock price?

High inflation can increase the cost of building and maintaining towers, impacting profitability. It can also affect interest rates, influencing borrowing costs and potentially impacting investment decisions.

What are the risks associated with investing in American Tower?

Risks include changes in government regulations, competition, economic downturns, and currency fluctuations (due to its international operations).

Does American Tower offer a dividend?

Yes, American Tower typically pays a dividend; however, the specific payout ratio can vary.