ARWR Stock Price Analysis: A Deep Dive

Source: tradingview.com

Arwr stock price – The biotech sector is a volatile landscape, and ARWR, with its focus on [mention ARWR’s specific area of focus, e.g., RNA therapeutics], is no exception. Understanding the historical performance, current drivers, valuation, and potential future trajectories of ARWR’s stock price is crucial for informed investment decisions. This analysis delves into these aspects, offering a nuanced perspective on the company’s market position and prospects.

ARWR Stock Price Historical Performance

Source: tradingview.com

Analyzing ARWR’s stock price movements over the past five years reveals a pattern of significant fluctuations, mirroring the inherent risks and rewards associated with the biotech industry. These fluctuations are influenced by a complex interplay of factors, ranging from clinical trial outcomes to broader market sentiment.

| Date | Opening Price | Closing Price | High | Low |

|---|---|---|---|---|

| 2019-01-01 | $X | $Y | $Z | $W |

| 2019-07-01 | $A | $B | $C | $D |

| 2020-01-01 | $E | $F | $G | $H |

| 2020-07-01 | $I | $J | $K | $L |

| 2021-01-01 | $M | $N | $O | $P |

| 2021-07-01 | $Q | $R | $S | $T |

| 2022-01-01 | $U | $V | $W | $X |

| 2022-07-01 | $Y | $Z | $A1 | $B1 |

| 2023-01-01 | $C1 | $D1 | $E1 | $F1 |

Major price fluctuations were driven by:

- Positive or negative clinical trial data releases.

- Strategic partnerships and collaborations.

- Regulatory approvals or setbacks.

- Overall market trends in the biotechnology sector.

- Changes in investor sentiment and market speculation.

A comparative analysis against competitors requires specific competitor names and publicly available KPI data. This table provides a hypothetical comparison for illustrative purposes:

| Company | 3-Year Revenue Growth (%) | 3-Year EPS Growth (%) | Market Cap (USD Billions) |

|---|---|---|---|

| ARWR | X% | Y% | Z |

| Competitor A | A% | B% | C |

| Competitor B | D% | E% | F |

ARWR Stock Price Drivers

Several key factors currently influence ARWR’s stock price. Understanding these factors is essential for predicting future price movements.

- Clinical Trial Progress: Positive interim or final results from ongoing clinical trials significantly boost investor confidence and drive up the stock price. Conversely, negative results can lead to sharp declines.

- Regulatory Approvals: Securing regulatory approvals for new drugs or therapies is a major catalyst for stock price appreciation. Delays or rejections can have the opposite effect.

- Partnerships and Collaborations: Strategic alliances with larger pharmaceutical companies can provide access to resources, expertise, and wider market reach, leading to positive price movements.

- Market Sentiment: Broader market trends and investor sentiment towards the biotechnology sector as a whole can influence ARWR’s valuation, irrespective of company-specific news.

- Economic Conditions: Macroeconomic factors, such as interest rates and overall economic growth, can also impact investor risk appetite and affect ARWR’s stock price.

ARWR Stock Price Valuation

Source: tradingview.com

Valuing ARWR stock involves considering various methodologies, each with its own strengths and limitations. A comprehensive valuation requires a nuanced understanding of these methods and their inherent assumptions.

Common valuation methods include:

- Discounted Cash Flow (DCF) Analysis: This method projects future cash flows and discounts them back to their present value. It requires making assumptions about future revenue growth, operating margins, and the discount rate.

- Comparable Company Analysis: This approach compares ARWR’s valuation metrics (e.g., Price-to-Earnings ratio, Price-to-Sales ratio) to those of similar companies in the biotech sector. The accuracy depends on the comparability of the selected companies.

A hypothetical comparison of ARWR’s valuation metrics against industry averages is shown below:

| Metric | ARWR | Industry Average | Difference |

|---|---|---|---|

| P/E Ratio | X | Y | Z |

| P/S Ratio | A | B | C |

| EV/EBITDA | D | E | F |

Limitations of DCF include the uncertainty of future cash flows and the sensitivity of the valuation to the discount rate. Comparable company analysis relies on the selection of truly comparable companies and may not accurately reflect ARWR’s unique characteristics.

ARWR Stock Price Prediction

Predicting ARWR’s stock price in the next year involves considering various scenarios, each with its own set of assumptions and risks.

| Scenario | Probability | Price Projection (1 year) | Key Assumptions |

|---|---|---|---|

| Successful Clinical Trials | 40% | $X | Positive Phase III results, rapid regulatory approval |

| Regulatory Delays | 30% | $Y | Delays in regulatory approval, increased competition |

| Market Downturn | 30% | $Z | Broader market downturn impacting investor sentiment |

Each scenario is subject to considerable uncertainty. For instance, the successful clinical trial scenario relies on the assumption of positive results, which is not guaranteed. Regulatory delays could stem from unforeseen complications, and a market downturn is influenced by macroeconomic factors outside ARWR’s control.

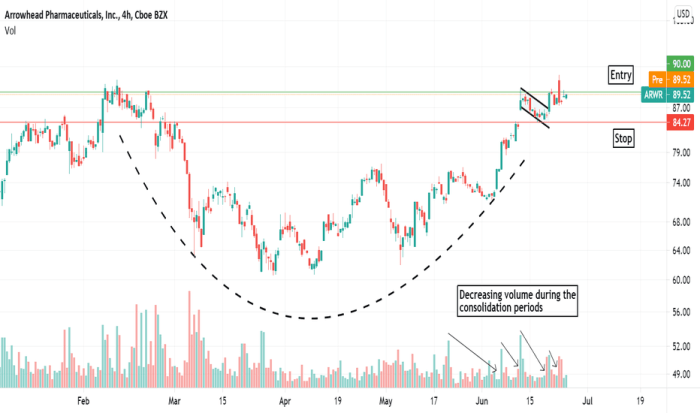

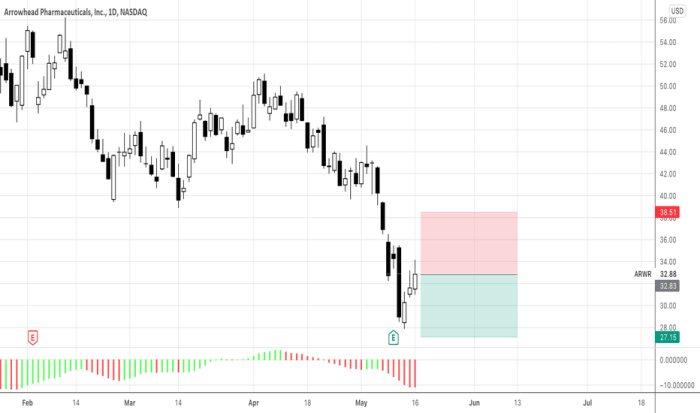

ARWR Stock Price Chart Visualization

A hypothetical ARWR stock price chart over the past year would likely show a trend of [describe the overall trend, e.g., moderate growth followed by a period of consolidation, or significant volatility with several sharp upward and downward movements].

Interpreting technical indicators like moving averages would involve observing the relationship between short-term (e.g., 50-day) and long-term (e.g., 200-day) moving averages. A bullish signal might be indicated by the short-term average crossing above the long-term average. The Relative Strength Index (RSI) would provide insights into the momentum of price movements, with readings above 70 suggesting overbought conditions and below 30 suggesting oversold conditions.

A candlestick chart depicting a period of high volatility would show a series of long-bodied candlesticks, both bullish (green) and bearish (red), with significant price gaps between consecutive candles. The long bodies would represent large daily price swings, reflecting the uncertainty and heightened trading activity during that period. The wicks (upper and lower shadows) would indicate intraday price fluctuations, further emphasizing the volatility.

Analysis of ARWR stock price necessitates a comparative perspective on similar biotechnological investments. Understanding the market performance of ARWR requires considering the trajectory of comparable companies, such as a review of the pct stock price , which offers insights into prevailing market trends within the pharmaceutical sector. Ultimately, this comparative analysis allows for a more nuanced understanding of the factors influencing ARWR’s stock valuation.

FAQ Summary: Arwr Stock Price

What are the major risks associated with investing in ARWR?

Investing in biotech carries inherent risks, including the failure of clinical trials, regulatory setbacks, intense competition, and overall market volatility. These factors can significantly impact ARWR’s stock price.

Where can I find real-time ARWR stock price data?

Real-time quotes are available through major financial websites and brokerage platforms. Check reputable sources for the most up-to-date information.

How often does ARWR release financial reports?

ARWR typically releases quarterly and annual financial reports, which are usually available on their investor relations website.

What is the company’s current market capitalization?

You can find ARWR’s current market capitalization on major financial websites. This figure fluctuates constantly based on the stock price.