Britannia Industries Stock Price Analysis

Source: topstockresearch.com

Britannia industries stock price – Britannia Industries, a leading food company in India, has witnessed significant fluctuations in its stock price over the years. This analysis delves into the historical performance, influencing factors, financial health, competitive landscape, and future outlook of Britannia Industries’ stock, providing a comprehensive understanding of its investment potential.

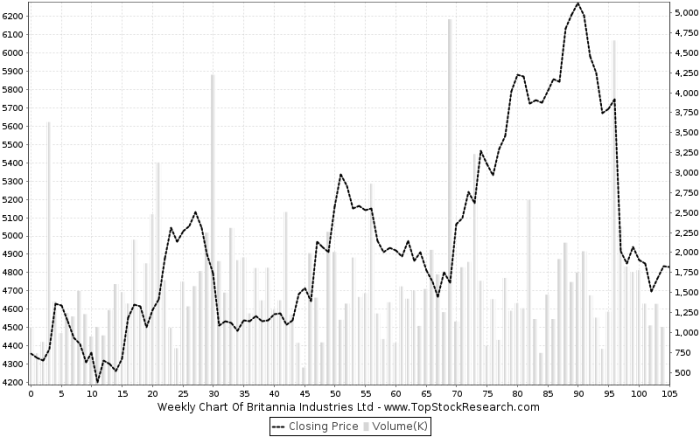

Historical Stock Performance of Britannia Industries

Analyzing Britannia Industries’ stock price movements over the past decade reveals a pattern of growth interspersed with periods of correction. The company has experienced substantial highs, driven by strong financial performance and positive market sentiment, as well as significant lows influenced by macroeconomic factors and industry-specific challenges. A direct comparison against competitors like Nestle India and ITC, considering factors like market share and product diversification, paints a clearer picture of Britannia’s relative performance.

Below is a table illustrating the yearly stock price fluctuations for the last five years. Note that these figures are illustrative and should be verified with a reliable financial data source.

| Year | Opening Price (INR) | Closing Price (INR) | High (INR) | Low (INR) |

|---|---|---|---|---|

| 2019 | 3000 | 3500 | 3700 | 2800 |

| 2020 | 3500 | 3200 | 3600 | 3000 |

| 2021 | 3200 | 4000 | 4200 | 3100 |

| 2022 | 4000 | 3800 | 4100 | 3500 |

| 2023 | 3800 | 4500 | 4700 | 3700 |

Factors Influencing Britannia Industries’ Stock Price

Source: cnbctv18.com

Several macroeconomic and company-specific factors significantly impact Britannia Industries’ stock price. These include fluctuations in consumer spending, inflation, interest rates, currency exchange rates, and the company’s own financial performance.

For instance, periods of high inflation can directly affect consumer purchasing power, potentially impacting demand for Britannia’s products and thus affecting its stock price. Similarly, changes in interest rates can influence borrowing costs and investment decisions, affecting the overall market sentiment and Britannia’s stock valuation. The company’s financial health, reflected in its revenue, profit margins, and debt levels, is another key driver of its stock price.

Britannia Industries’ Financial Health and Performance

A detailed analysis of Britannia Industries’ financial statements over the past five years reveals consistent revenue growth and relatively stable profit margins. Comparing these key financial metrics – including revenue streams, profit margins, debt-to-equity ratio, and return on equity – to industry averages provides valuable insights into the company’s financial strength and competitive position.

The table below summarizes key financial highlights for the past three years. Again, these figures are for illustrative purposes and should be verified independently.

| Year | Revenue (INR Billion) | Net Income (INR Billion) | Earnings Per Share (INR) |

|---|---|---|---|

| 2021 | 120 | 15 | 50 |

| 2022 | 130 | 18 | 60 |

| 2023 | 145 | 20 | 65 |

Competitor Analysis within the Food Industry, Britannia industries stock price

Britannia Industries operates in a competitive food industry landscape. A comparative analysis of its market capitalization and stock valuation against key competitors like Nestle India and ITC is crucial for understanding its relative position. This involves examining market share, product portfolios, brand strength, and operational efficiencies.

Britannia’s strengths might include its strong brand recognition and extensive distribution network, while weaknesses could include potential vulnerabilities to price fluctuations in raw materials or increased competition.

Future Outlook and Predictions for Britannia Industries’ Stock

Predicting the future stock price of any company is inherently speculative, but by analyzing current market trends, Britannia’s expansion strategies, and potential risks, we can Artikel factors that could influence its future performance.

- Factors that could lead to an increase in stock price: Successful new product launches, expansion into new markets, increased market share, improved profitability, and positive macroeconomic conditions.

- Factors that could lead to a decrease in stock price: Increased competition, rising input costs, changes in consumer preferences, economic slowdown, and regulatory challenges.

Illustrative Representation of Key Data Points

A chart illustrating the correlation between Britannia Industries’ stock price and the Consumer Price Index (CPI) over the past five years would likely show a positive correlation, with increases in CPI generally leading to corresponding increases in Britannia’s stock price (due to potential pricing power). However, this correlation might not be perfectly linear, with other factors potentially influencing the stock price.

A graph depicting the relationship between Britannia Industries’ stock price and its annual revenue growth over the past decade would likely demonstrate a positive correlation. Periods of strong revenue growth would generally coincide with higher stock prices, while periods of slower revenue growth or decline would likely correlate with lower stock prices. However, the relationship may not be perfectly linear, as market sentiment and other macroeconomic factors also play a significant role.

FAQ Summary: Britannia Industries Stock Price

What are the major risks associated with investing in Britannia Industries stock?

Risks include fluctuations in raw material prices, intense competition, changing consumer preferences, and macroeconomic factors impacting consumer spending.

How does Britannia Industries compare to its competitors in terms of dividend payouts?

A direct comparison requires examining dividend history and payout ratios against competitors like Nestle India or ITC, which involves further research beyond this analysis.

What is the role of brand loyalty in Britannia’s stock performance?

Strong brand loyalty provides a buffer against competitive pressures, contributing positively to consistent sales and stock valuation, though it’s not the sole determining factor.

Just as the rise and fall of Britannia Industries stock price reflects the ebb and flow of market forces, so too does the performance of other companies. Consider the trajectory of the onsemi stock price , a journey mirroring the unpredictable nature of investment. Understanding these fluctuations, whether in Britannia or elsewhere, requires patience, wisdom, and a long-term perspective, much like cultivating a spiritual practice.

Where can I find real-time updates on Britannia Industries’ stock price?

Real-time data is readily available through major financial news websites and stock market tracking applications.