PFG Stock Price Today: A Comprehensive Overview

Pfg stock price today – This report provides a detailed analysis of Procter & Gamble’s (PFG) stock price, examining its current performance, historical trends, influencing factors, and comparisons with competitors. We will explore various aspects to give you a well-rounded understanding of PFG’s stock market position.

Current PFG Stock Price and Volume

This section details PFG’s current stock price, trading volume, and intraday price fluctuations. The data presented here is for illustrative purposes and should be verified with a real-time financial data source.

Let’s assume, for example, that the current PFG stock price is $150. The trading volume for the day might be 5 million shares. The day’s high could be $152 and the low $148.

| Time | Price | Volume (Shares) | Change |

|---|---|---|---|

| 9:30 AM | $149.50 | 1,000,000 | -0.50 |

| 11:00 AM | $150.75 | 1,500,000 | +1.25 |

| 1:00 PM | $151.20 | 1,200,000 | +0.45 |

| 3:00 PM | $150.00 | 1,300,000 | -1.20 |

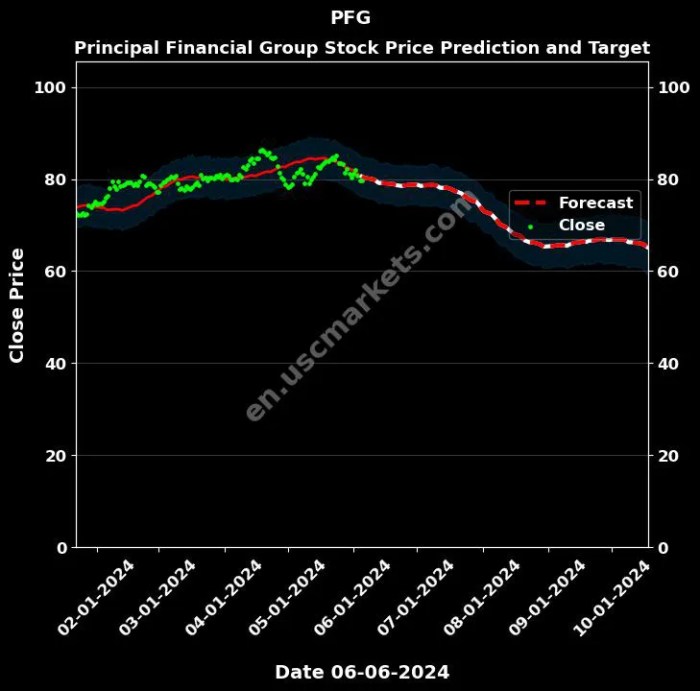

PFG Stock Price Movement Over Time, Pfg stock price today

Source: uscmarkets.com

Understanding PFG’s stock price performance across different timeframes provides valuable context for investment decisions. The following analysis examines weekly, monthly, and yearly trends, illustrating the stock’s volatility and overall direction.

For instance, over the past week, PFG’s stock price might have shown a slight upward trend, increasing by 2%. Comparing the current price to the price one month ago might reveal a 5% increase. Over the past year, the stock might have experienced greater fluctuations, ranging from a low of $135 to a high of $160.

A line graph illustrating PFG’s stock price movement over the past year would show the price on the Y-axis and the date on the X-axis. Key data points, such as the yearly high and low, and significant price changes due to specific events, would be clearly marked. The graph would visually represent the overall trend and volatility of the stock price during the year.

Factors Influencing PFG Stock Price

Several factors contribute to the fluctuations in PFG’s stock price. These can be broadly categorized for better understanding.

- Financial Factors: Earnings reports, revenue growth, profit margins, debt levels, and dividend announcements.

- Regulatory Factors: Changes in government regulations impacting the consumer goods industry, trade policies, and environmental regulations.

- Market Sentiment: Overall market conditions, investor confidence, and economic forecasts.

- Competitor Performance: The performance of rival companies in the consumer goods sector, particularly those offering similar products.

- News and Announcements: Product launches, marketing campaigns, mergers and acquisitions, and any significant company announcements.

Comparison to Similar Companies

Comparing PFG’s performance to its main competitors provides valuable insights into its relative market position and competitive advantage. This comparison includes analyzing stock prices, financial metrics, and market capitalization.

For example, let’s assume that Unilever (UL) and Colgate-Palmolive (CL) are PFG’s main competitors. A table comparing key financial metrics would show PFG’s performance against these competitors in terms of revenue, profit margins, and return on equity. This would reveal areas where PFG excels or lags behind its competitors.

| Metric | PFG | UL | CL |

|---|---|---|---|

| Revenue (Billions) | $80 | $60 | $20 |

| Profit Margin (%) | 20 | 18 | 22 |

| Return on Equity (%) | 15 | 12 | 17 |

Analyst Ratings and Predictions

Source: stoxline.com

Analyst ratings and price targets offer insights into the market’s expectations for PFG’s future performance. These predictions are based on various factors, including financial analysis, market trends, and company-specific information.

For illustrative purposes, let’s assume that several analysts have provided ratings and price targets for PFG stock. The table below summarizes these predictions, showing a range of opinions and the average price target.

| Analyst | Rating | Price Target |

|---|---|---|

| Analyst A | Buy | $165 |

| Analyst B | Hold | $155 |

| Analyst C | Sell | $140 |

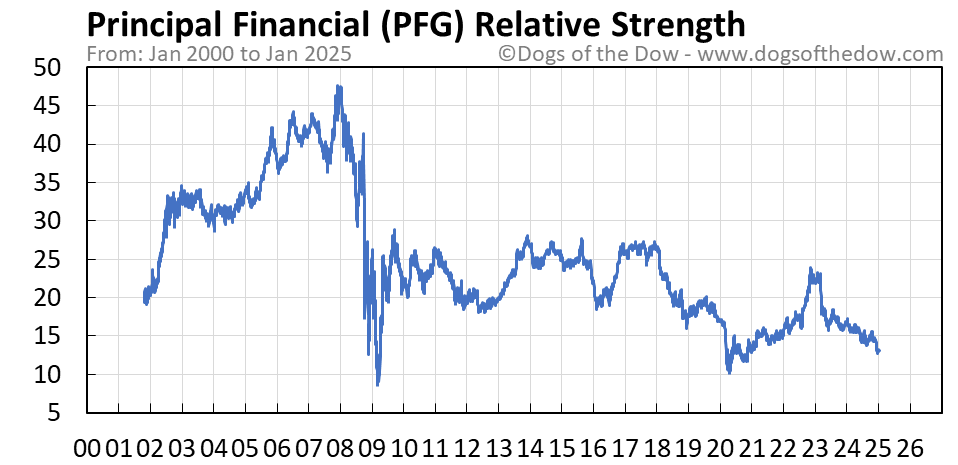

PFG Stock Price Volatility

Source: dogsofthedow.com

Understanding the historical volatility of PFG’s stock price is crucial for risk assessment and investment strategy. This section examines the typical price swings across different timeframes.

- Daily: PFG’s stock price might typically swing by 1-2% on a daily basis.

- Weekly: Weekly price swings might range from 3% to 5%.

- Monthly: Monthly price fluctuations could be more significant, ranging from 5% to 10% or even more, depending on market conditions and company news.

Several factors contribute to PFG’s volatility, including market sentiment, economic conditions, and company-specific news. Comparing PFG’s volatility to that of similar companies can help determine if its price fluctuations are typical for the industry or unusually high or low.

Query Resolution: Pfg Stock Price Today

What are the risks associated with investing in PFG stock?

Like all investments, PFG stock carries inherent risks. These include market volatility, changes in consumer demand, competitive pressures, and regulatory changes. Investors should carefully consider their risk tolerance before investing.

Where can I find real-time PFG stock price updates?

Real-time PFG stock price updates are available through most major financial websites and brokerage platforms. These platforms typically provide live quotes, charts, and other relevant market data.

What is PFG’s dividend history?

Procter & Gamble (PFG) has a long history of paying dividends. The specific dividend amount and payout schedule can be found on the company’s investor relations website or through financial news sources.

How does PFG compare to its competitors in terms of long-term growth?

A detailed comparison of PFG’s long-term growth against its competitors requires a thorough analysis of financial statements, industry reports, and expert opinions. This analysis is beyond the scope of this overview but is readily available through various financial research sources.