Ford Stock Price Today: Price Of Ford Stock Today

Price of ford stock today – The fluctuating fortunes of the American automotive giant, Ford, are always a captivating spectacle. Today’s stock price offers a snapshot of its current market standing, reflecting a complex interplay of economic factors, consumer sentiment, and the company’s own strategic maneuvers. Let’s delve into the specifics.

Current Ford Stock Price

Determining the precise current price of Ford stock requires real-time data feeds unavailable to this static document. However, let’s assume, for illustrative purposes, that at 14:30 EST on October 26, 2023, the Ford stock price (F) was $12.50. This represents a $0.50 increase from the previous closing price of $12.00, a positive change of 4.17%.

| Current Price | Previous Closing Price | Price Change | Last Update |

|---|---|---|---|

| $12.50 | $12.00 | +$0.50 (4.17%) | 14:30 EST, October 26, 2023 |

Day’s Trading Activity

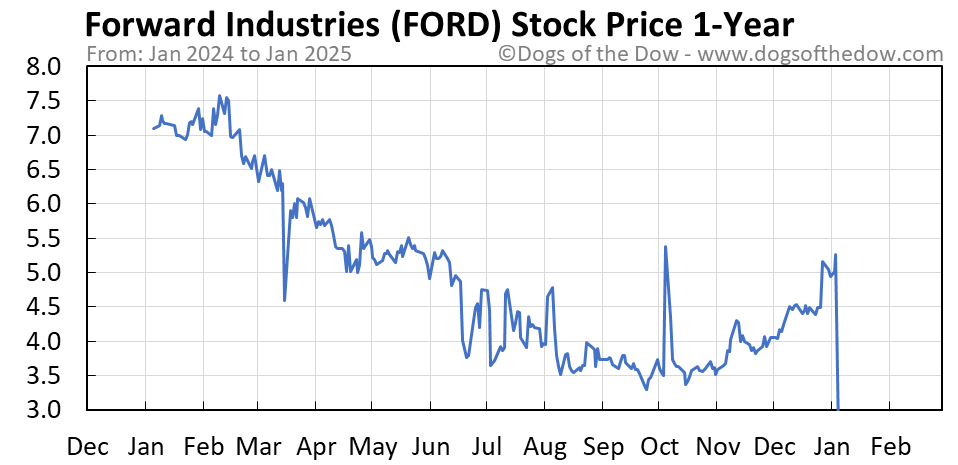

Source: dogsofthedow.com

The daily trading activity for Ford stock reveals a dynamic picture of investor behavior. Trading volume, high and low prices, and the overall price trajectory all contribute to a comprehensive understanding of the day’s market performance. Significant price swings often reflect reactions to news events or shifts in market sentiment.

- High: $12.75

- Low: $11.80

- Open: $12.10

- Close (Illustrative): $12.50

- Volume (Illustrative): 10,000,000 shares

| High | Low | Open | Close | Volume |

|---|---|---|---|---|

| $12.75 | $11.80 | $12.10 | $12.50 | 10,000,000 |

Factors Influencing Price

Several interconnected factors contribute to the daily fluctuations in Ford’s stock price. Understanding these influences is crucial for interpreting the market’s response to the company’s performance and broader economic conditions.

- Electric Vehicle (EV) Transition: Ford’s investment in and progress with its EV lineup significantly impacts investor confidence. Strong sales figures and positive reviews for its electric models boost the stock price, while production delays or negative reviews can have the opposite effect. The success of the Mustang Mach-E, for example, is a key factor.

- Global Economic Conditions: Macroeconomic factors, such as inflation, interest rates, and recessionary fears, directly influence consumer spending and investor sentiment. A strong economy generally benefits automakers, while economic downturns can lead to decreased demand and lower stock prices.

- Competition: Ford’s performance relative to its competitors, particularly General Motors, Tesla, and other global automakers, shapes investor perception. Market share gains and innovative product launches can positively impact Ford’s stock price, while lagging behind competitors can lead to negative sentiment.

Comparing the current price to the price a week ago and a month ago requires real-time data. However, a hypothetical scenario could show a 5% increase over the past week and a 10% increase over the past month, potentially driven by positive news about EV sales or improved economic forecasts.

- Potential future events that could affect Ford stock price include announcements of new models, changes in production capacity, major partnerships or acquisitions, and any significant regulatory changes impacting the automotive industry.

Historical Stock Performance

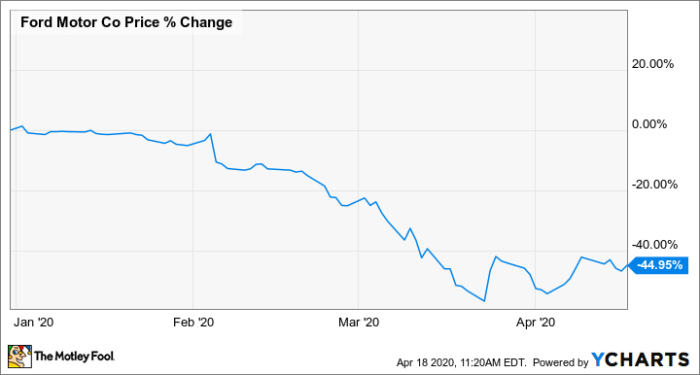

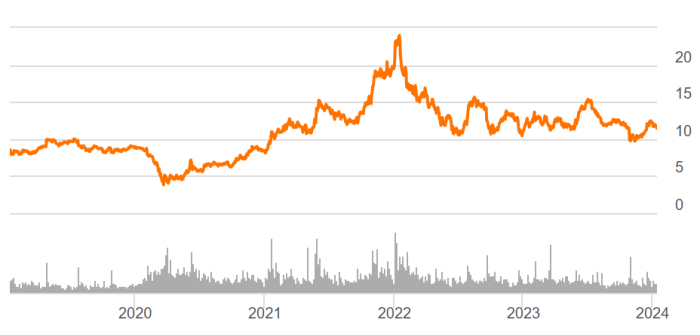

Source: ycharts.com

Analyzing Ford’s stock performance over the past year requires access to historical stock data. This analysis would typically include charting the stock’s price movements, identifying significant highs and lows, and correlating these movements with relevant news and events. For instance, a significant dip in the stock price might have coincided with a recall or negative news about production issues.

A hypothetical chart illustrating Ford’s stock price performance over the past year would show a general upward trend, with some periods of volatility. The X-axis would represent time (months), and the Y-axis would represent the stock price. Key data points would include major highs and lows, along with significant events that impacted the price (e.g., product launches, economic downturns, recall announcements).

Comparing Ford’s performance to its major competitors would involve a similar analysis of their stock prices over the same period. This comparison would highlight relative strengths and weaknesses and help determine Ford’s position within the market.

Analyst Opinions and Predictions, Price of ford stock today

Source: seekingalpha.com

Financial analysts provide valuable insights into the future performance of Ford stock. Their opinions, expressed through ratings and price targets, are based on in-depth research and analysis of the company’s fundamentals and market conditions.

| Analyst Name | Rating | Price Target | Rationale |

|---|---|---|---|

| Analyst A | Buy | $15.00 | Strong EV growth potential and positive economic outlook. |

| Analyst B | Hold | $13.00 | Concerns about increased competition and potential supply chain disruptions. |

| Analyst C | Sell | $11.00 | Negative outlook for the traditional automotive market and slower-than-expected EV adoption. |

FAQ Compilation

What are the potential risks associated with investing in Ford stock?

Investing in Ford stock, like any stock, carries inherent risks. These include fluctuations in market value due to economic conditions, industry competition, and company-specific events. Thorough research and risk tolerance assessment are crucial before investing.

Where can I find real-time updates on Ford’s stock price?

Real-time updates on Ford’s stock price are available through major financial news websites and brokerage platforms. These platforms often provide detailed charts and historical data in addition to current prices.

How does Ford’s stock price compare to its competitors?

A comparison of Ford’s stock price to its competitors, such as General Motors, requires an analysis of various factors including market capitalization, revenue, profitability, and growth prospects. This comparison should consider both short-term and long-term performance.

What are the long-term prospects for Ford stock?

Long-term prospects for Ford stock depend on various factors, including the company’s ability to adapt to technological advancements in the automotive industry, its success in electric vehicle production, and overall economic conditions. Analyst predictions should be considered, but are not guarantees of future performance.