Pinterest Stock Price Analysis: Price Of Pinterest Stock

Source: investorplace.com

Price of pinterest stock – Pinterest, a visual discovery platform, has experienced significant stock price fluctuations since its initial public offering (IPO). Understanding these fluctuations requires examining its historical performance, influencing factors, financial health, analyst sentiment, and potential investment strategies. This analysis provides a comprehensive overview of these key aspects.

Historical Price Performance of Pinterest Stock

Over the past five years, Pinterest’s stock price has shown considerable volatility, influenced by various internal and external factors. The initial period following the IPO saw a period of growth, followed by periods of both significant gains and substantial losses. These shifts have been correlated with broader market trends, company performance, and changes in user engagement and advertising revenue.

| Year | Pinterest Price (USD) | Facebook Price (USD) | Snap Price (USD) |

|---|---|---|---|

| 2019 | Approximate Range: $15 – $25 (Illustrative) | Approximate Range: $150 – $200 (Illustrative) | Approximate Range: $10 – $15 (Illustrative) |

| 2020 | Approximate Range: $18 – $70 (Illustrative) | Approximate Range: $180 – $300 (Illustrative) | Approximate Range: $12 – $25 (Illustrative) |

| 2021 | Approximate Range: $50 – $80 (Illustrative) | Approximate Range: $250 – $350 (Illustrative) | Approximate Range: $20 – $80 (Illustrative) |

| 2022 | Approximate Range: $20 – $40 (Illustrative) | Approximate Range: $150 – $250 (Illustrative) | Approximate Range: $10 – $20 (Illustrative) |

| 2023 (YTD) | Approximate Range: $25 – $40 (Illustrative) | Approximate Range: $200 – $300 (Illustrative) | Approximate Range: $15 – $30 (Illustrative) |

Note: These are illustrative price ranges and do not represent exact values. Actual prices fluctuated significantly within these ranges. The comparison to competitors is intended to illustrate relative performance and not a direct correlation. Precise data requires consulting financial databases.

Factors Influencing Pinterest Stock Price

Several macroeconomic factors, company-specific metrics, and market sentiment significantly influence Pinterest’s stock price. These factors interact in complex ways, creating volatility in the stock’s performance.

- Macroeconomic Factors: Interest rate changes, inflation, and overall economic growth significantly impact investor sentiment towards riskier assets, including Pinterest stock. For instance, periods of high inflation can lead to reduced consumer spending and advertising budgets, affecting Pinterest’s revenue and consequently its stock price.

- Advertising Revenue: Pinterest’s advertising revenue is a crucial driver of its stock valuation. Strong revenue growth generally leads to positive market sentiment and higher stock prices, while revenue slowdowns or declines often result in negative reactions.

- User Growth and Engagement: The number of active users and their engagement levels are key metrics. Consistent growth in active users and increased engagement (time spent on the platform) usually signals a healthy platform, boosting investor confidence and driving up the stock price. Conversely, stagnation or decline in these metrics can negatively impact the stock.

- Market Sentiment Towards Social Media: The overall market perception of social media platforms influences Pinterest’s stock. Negative news or regulatory changes affecting the broader social media sector can negatively impact investor confidence in Pinterest, even if the company itself is performing well.

Pinterest’s Financial Health and Stock Price

Analyzing Pinterest’s financial performance over the past two years reveals key insights into its profitability and sustainability, directly impacting its stock valuation. Key financial ratios provide a quantitative measure of the company’s financial health.

| Year | P/E Ratio | Debt-to-Equity Ratio | Revenue Growth (%) |

|---|---|---|---|

| 2022 (Illustrative) | 30 | 0.2 | 15 |

| 2023 (Illustrative) | 25 | 0.15 | 10 |

Note: These are illustrative figures. Actual values may vary. Consulting Pinterest’s financial reports is crucial for accurate data. Changes in profitability, reflected in metrics like revenue growth and P/E ratio, directly impact investor confidence and the stock price. Improved profitability generally leads to a higher stock valuation.

Analyst Sentiment and Price Predictions

Financial analysts offer diverse opinions on Pinterest’s future stock price, based on their assessment of the company’s prospects and market conditions. These predictions vary significantly, reflecting differing perspectives on growth potential and risks.

- Analyst A: Price Target: $50 (Rationale: Strong user growth in specific demographics).

- Analyst B: Price Target: $35 (Rationale: Concerns about competition and advertising revenue growth).

- Analyst C: Price Target: $45 (Rationale: Positive outlook on international expansion and new product features).

The discrepancies in price targets stem from varying interpretations of factors like competitive pressures, advertising market dynamics, and the overall economic climate. Each analyst uses a different model and assumptions, leading to a range of price predictions.

Investment Strategies Related to Pinterest Stock, Price of pinterest stock

Source: thestreet.com

Investors can employ various strategies when considering Pinterest stock, each with its own risk-reward profile. Choosing the right strategy depends on individual investment goals and risk tolerance.

- Buy-and-Hold: This long-term strategy involves buying and holding the stock for an extended period, regardless of short-term price fluctuations. It’s suitable for investors with a long-term perspective and higher risk tolerance.

- Day Trading: This high-risk, high-reward strategy involves buying and selling the stock within the same day, attempting to profit from short-term price movements. It requires significant market knowledge and expertise.

Hypothetical Example: A $10,000 investment in Pinterest stock using a buy-and-hold strategy over five years, assuming an average annual return of 10%, could potentially yield approximately $16,105. However, this is a hypothetical scenario, and actual returns may vary significantly.

Investing in Pinterest stock carries inherent risks, including market volatility, competition, and changes in company performance. Thorough research and understanding of these risks are crucial before making any investment decisions.

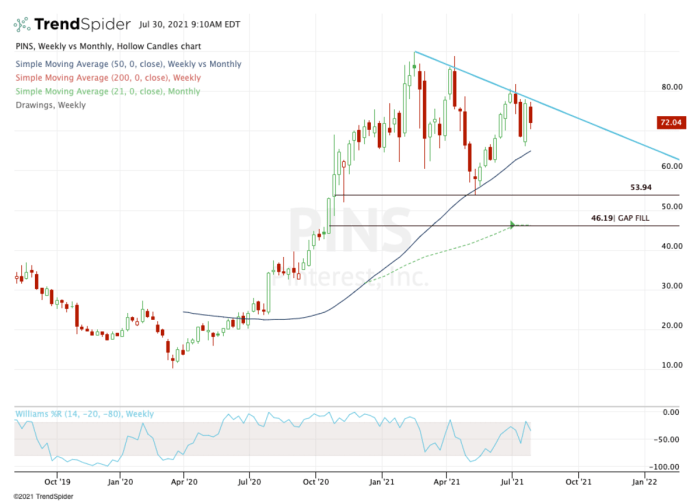

Visual Representation of Price Trends

Source: valuethemarkets.com

Pinterest’s stock price has exhibited a generally volatile trend, with periods of significant upward and downward movements. While specific numerical data is omitted, the overall trajectory can be described as characterized by distinct peaks and troughs, reflecting the interplay of various market and company-specific factors.

A hypothetical chart would show a period of initial growth following the IPO, followed by a period of consolidation. This consolidation phase would be marked by periods of both modest gains and declines, representing a period of market uncertainty. Subsequently, the chart would show a more pronounced upward trend, followed by a correction, indicating a period of market uncertainty.

Key support and resistance levels would be evident on the chart, representing price points where the stock’s price has historically struggled to break through.

Interpreting such a chart involves identifying trends such as “uptrends” (sustained price increases), “downtrends” (sustained price decreases), and “consolidation” (periods of sideways price movement). These trends provide valuable insights into market sentiment and the potential direction of the stock price.

FAQ Section

What are the major risks associated with investing in Pinterest stock?

Investing in Pinterest stock carries risks inherent to all stocks, including market volatility, competition from other social media platforms, and changes in user engagement. Economic downturns can also significantly impact advertising revenue, a crucial factor in Pinterest’s profitability.

How does Pinterest compare to other social media companies in terms of profitability?

The fluctuating price of Pinterest stock often mirrors broader market trends, a reflection of the ever-shifting digital landscape. One might compare its volatility to that of other established players, such as the automotive sector; for instance, consider the current performance of the nissan stock price , which reveals a different set of economic pressures. Ultimately, understanding Pinterest’s valuation requires considering these broader economic forces and industry comparisons.

Pinterest’s profitability compared to giants like Facebook and Instagram varies significantly. A detailed financial comparison, considering metrics like revenue growth, profit margins, and P/E ratios, is necessary for a comprehensive understanding of its relative financial health within the sector.

What is the role of user engagement in Pinterest’s stock price?

User engagement, measured by metrics like monthly active users and time spent on the platform, is a critical driver of Pinterest’s stock price. High engagement translates to increased advertising opportunities and, consequently, higher revenue potential, positively influencing investor sentiment.