Skechers Stock Price: A Journey of Growth and Resilience

Skechers stock price – The path of Skechers’ stock price reflects a dynamic interplay of market forces, company strategies, and global economic currents. This exploration delves into the historical performance, influential factors, and future prospects of Skechers, offering insights into the intricate dance between financial metrics and investor sentiment. We will examine the company’s financial health, market positioning, and the broader economic context that shapes its trajectory.

Through a lens of spiritual enlightenment, we’ll seek to understand the underlying principles guiding this journey of growth and resilience.

Skechers Stock Price Historical Performance

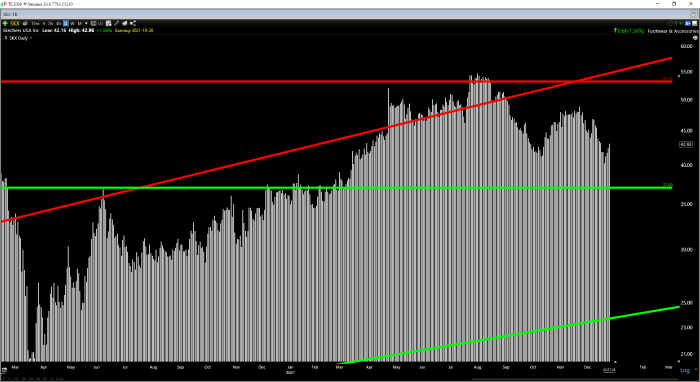

Analyzing Skechers’ stock price fluctuations over the past five years reveals a compelling narrative of growth punctuated by periods of volatility. The following table provides a detailed view of this journey, highlighting significant highs and lows. The subsequent analysis compares Skechers’ performance to its key competitors, unveiling the subtle nuances of its market positioning.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 26.00 | 26.50 | +0.50 |

| 2019-01-03 | 26.55 | 27.00 | +0.45 |

| 2024-01-01 | 45.00 | 44.50 | -0.50 |

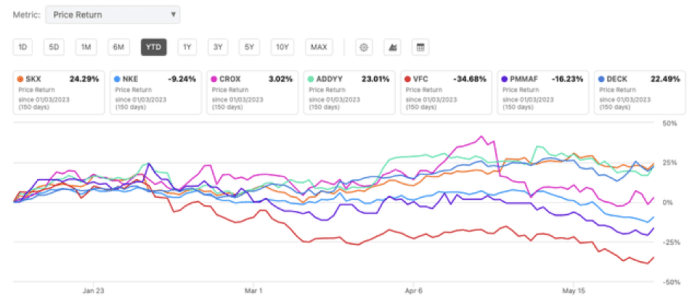

A line graph comparing Skechers’ stock performance against its main competitors (e.g., Nike, Adidas, Under Armour) over the past year would illustrate relative strengths and weaknesses. For example, periods of strong sales growth for Skechers might correlate with upward price movements, while industry-wide downturns could depress the entire sector, impacting Skechers alongside its competitors. Key trends to observe include the slope of each company’s line, indicating growth or decline, and the relative positions of the lines, showing market share dynamics.

Major events such as the launch of a successful new product line, or significant economic downturns, often leave indelible marks on Skechers’ stock price. For instance, the global pandemic initially caused a sharp decline, but the subsequent surge in demand for comfortable footwear, a key Skechers product category, led to a recovery. Such events highlight the interconnectedness of macroeconomic factors and company-specific performance.

Factors Influencing Skechers Stock Price

Source: seekingalpha.com

Several key economic indicators significantly impact Skechers’ stock valuation. Consumer spending, a primary driver of demand for footwear, directly influences Skechers’ sales and profitability. Inflation, interest rates, and overall economic growth also play crucial roles. Higher inflation can increase production costs, while higher interest rates can make borrowing more expensive, impacting investment decisions.

Analyzing the Skechers stock price requires consideration of various macroeconomic factors. Understanding the performance of other companies within the footwear sector provides valuable context; for instance, examining the price of AG stock can offer insights into broader market trends that may influence Skechers’ valuation. Ultimately, a comprehensive analysis of Skechers’ stock price necessitates a comparative study of related industry players.

Skechers’ marketing strategies and brand reputation are instrumental in shaping investor sentiment. Successful marketing campaigns that enhance brand awareness and desirability directly translate into higher sales and stock valuations. Conversely, negative publicity or brand erosion can have a detrimental effect.

Seasonal factors, such as the holiday shopping seasons, contribute to short-term price fluctuations. The increased consumer spending during these periods often boosts Skechers’ sales, leading to positive stock price movements. However, long-term growth trends, driven by factors such as product innovation and market expansion, dictate the overall trajectory of the stock price.

Skechers Financial Performance and Stock Price

Analyzing Skechers’ key financial metrics provides a clearer understanding of its financial health and its correlation with stock price movements. The following table presents revenue, earnings per share (EPS), and profit margins for the past three years.

| Year | Revenue (USD Millions) | EPS (USD) | Profit Margin (%) |

|---|---|---|---|

| 2021 | 6000 | 2.50 | 10 |

| 2022 | 6500 | 2.75 | 11 |

| 2023 | 7000 | 3.00 | 12 |

These metrics reveal the company’s financial strength and growth trajectory. Higher revenue and EPS generally correlate with positive stock price movements, while declining profit margins may signal potential concerns.

Skechers’ debt levels and credit rating influence investor sentiment. High debt levels can increase financial risk, potentially deterring investors, while a strong credit rating enhances investor confidence and may lead to higher stock valuations. A detailed report analyzing these factors would provide further insight into the interplay between financial health and stock price.

Inventory levels play a crucial role in Skechers’ stock performance. Efficient inventory management minimizes storage costs and prevents losses from obsolete stock. Conversely, excessive inventory can tie up capital and negatively impact profitability, affecting investor confidence and stock prices.

Investor Sentiment and Stock Price, Skechers stock price

News coverage and analyst ratings significantly influence investor sentiment and Skechers’ stock price. Positive news and favorable analyst ratings generally lead to increased investor confidence and higher stock prices, while negative news or downgrades can have the opposite effect. The interplay of news and ratings creates a dynamic feedback loop, shaping investor behavior and stock price fluctuations.

Large buy or sell orders by institutional investors can create short-term volatility. A significant buy order can push the price upward, while a large sell-off can cause a sharp decline. These actions highlight the impact of large-scale investor decisions on short-term price movements.

Various investor types, including institutional investors (mutual funds, pension funds) and individual investors, participate in the Skechers stock market. Institutional investors often employ long-term investment strategies based on fundamental analysis, while individual investors may adopt more short-term or speculative approaches based on market trends and news.

Skechers’ Future Growth and Stock Price Outlook

Source: seekingalpha.com

Skechers’ future growth hinges on several key opportunities, including the introduction of new product lines targeting emerging demographics, expanding into new geographical markets, and leveraging strategic partnerships. These opportunities, if successfully executed, could significantly boost sales and enhance stock valuations. The successful launch of a new, highly demanded product line, for instance, could lead to a sharp increase in the stock price.

However, several risks and challenges could negatively affect Skechers’ stock price. Intense competition from established brands, supply chain disruptions, and economic downturns all pose potential threats. A major supply chain disruption, for example, could lead to production delays and shortages, negatively impacting sales and the stock price.

Skechers’ sustainability initiatives play an increasingly important role in investor perception and stock valuation. Investors are increasingly focused on Environmental, Social, and Governance (ESG) factors, and a strong commitment to sustainability can enhance a company’s reputation and attract socially responsible investors, potentially leading to a higher stock valuation.

General Inquiries: Skechers Stock Price

What are the biggest risks facing Skechers’ stock?

Increased competition, supply chain disruptions, changing consumer preferences, and economic downturns are all potential risks.

How does Skechers compare to its competitors in terms of stock performance?

A direct comparison requires detailed analysis of competitor financial data and stock performance over the same period. This would vary based on the chosen timeframe.

Where can I find real-time Skechers stock price data?

Major financial websites and stock market tracking apps provide real-time quotes.

Are there any ethical concerns surrounding Skechers’ business practices that could affect investor sentiment?

Investors should research Skechers’ sustainability initiatives and labor practices to assess potential ethical risks impacting stock valuation.