Alphabet Stock Price History: Stock Price For Alphabet

Source: theforexguy.com

Stock price for alphabet – Understanding Alphabet’s stock price trajectory requires examining its performance over time, considering both short-term fluctuations and long-term trends. Analyzing past performance helps investors assess potential future returns and understand the factors influencing the company’s valuation.

Alphabet Stock Price Performance (Last 5 Years)

The following table presents a snapshot of Alphabet’s stock price performance over the past five years. Note that this data is for illustrative purposes and should be verified with a reliable financial data provider.

Analyzing Alphabet’s stock price requires a multifaceted approach, considering various market indicators and competitive landscapes. Understanding the performance of similar tech giants offers valuable comparative data; for instance, examining the current rok stock price can provide insights into broader sector trends. Ultimately, a comprehensive analysis of Alphabet’s financial health and future prospects is crucial for accurate stock price prediction.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| October 26, 2023 | 135.00 | 136.50 | +1.50 |

| October 25, 2023 | 134.00 | 135.00 | +1.00 |

| October 24, 2023 | 133.25 | 134.00 | +0.75 |

Significant Events Influencing Alphabet’s Stock Price

Several significant events have influenced Alphabet’s stock price in recent years. These include major product launches (like the Pixel 8 phone and advancements in AI), regulatory scrutiny (antitrust investigations), and broader macroeconomic conditions (inflation, interest rate hikes).

Alphabet’s Stock Price Trend (Last Decade)

Over the past decade, Alphabet’s stock price has generally exhibited a strong upward trend, punctuated by periods of volatility. This reflects the company’s consistent revenue growth and innovation in key sectors. However, macroeconomic factors and market sentiment have also played a significant role in shaping its price movements.

Factors Influencing Alphabet’s Stock Price

Alphabet’s stock price is influenced by a complex interplay of internal and external factors. Understanding these factors is crucial for investors seeking to predict future price movements.

Key Internal Factors

- Product Launches and Innovation: Successful new product launches and significant advancements in existing products (e.g., Google Search, YouTube, Android) generally lead to positive stock price reactions.

- Financial Performance: Strong quarterly earnings reports, revenue growth, and increasing profit margins typically boost investor confidence and drive up the stock price.

- Management Decisions and Strategy: Key strategic decisions made by Alphabet’s leadership, such as acquisitions, divestitures, or major investments in new technologies, can significantly impact investor sentiment and the stock price.

Key External Factors

- Economic Conditions: Macroeconomic factors, such as inflation, interest rates, and overall economic growth, significantly impact investor risk appetite and can influence Alphabet’s stock price.

- Regulatory Changes: Changes in regulations, particularly those related to antitrust, data privacy, or advertising, can create uncertainty and affect Alphabet’s stock price.

- Geopolitical Events: Major geopolitical events, such as international conflicts or trade disputes, can introduce volatility into the market and impact Alphabet’s stock price.

Comparison of Internal vs. External Factors

While both internal and external factors influence Alphabet’s stock price, the relative importance can vary over time. In periods of strong economic growth, external factors might have a less pronounced impact compared to periods of economic uncertainty, where external factors might dominate. Internal factors, such as successful product launches or strong financial performance, often provide a more consistent positive influence on the stock price.

Alphabet’s Financial Performance and Stock Price

A strong correlation exists between Alphabet’s financial performance and its stock price. Analyzing this relationship provides insights into investor expectations and the market’s valuation of the company.

Correlation Between Quarterly Earnings and Stock Price

A line graph would effectively illustrate this correlation. The x-axis would represent the quarters (e.g., Q1 2023, Q2 2023, etc.), and the y-axis would show both Alphabet’s quarterly earnings per share (EPS) and the corresponding closing stock price for each quarter. Data points for EPS and stock price would be plotted on the same graph, allowing for a visual comparison of their trends.

A positive correlation would be indicated by a similar upward or downward movement of both lines.

Relationship Between Revenue Growth and Stock Price

Generally, a positive relationship exists between Alphabet’s revenue growth and its stock price. Strong revenue growth indicates the company’s ability to expand its market share and generate higher profits, which usually leads to increased investor confidence and a higher stock price. However, the strength of this relationship can vary depending on other factors, such as profit margins and overall market conditions.

Impact of Profit Margins on Investor Sentiment, Stock price for alphabet

Changes in Alphabet’s profit margins significantly influence investor sentiment and the stock price. Expanding profit margins signal improved efficiency and profitability, attracting investors and pushing the stock price higher. Conversely, declining profit margins often raise concerns about the company’s financial health and competitive position, leading to a negative impact on the stock price.

Analyst Predictions and Stock Price Targets

Financial analysts regularly provide price targets for Alphabet’s stock, offering insights into their expectations for the company’s future performance. However, these predictions should be viewed with caution, as they are subject to various uncertainties.

Summary of Analyst Predictions

| Analyst Firm | Target Price (USD) | Date of Prediction |

|---|---|---|

| Morgan Stanley | 150 | October 26, 2023 |

| Goldman Sachs | 145 | October 26, 2023 |

Comparison of Price Targets and Rationale

The range of price targets reflects the differing views among analysts regarding Alphabet’s future growth prospects and the risks it faces. Factors considered in these predictions include revenue growth estimates, profit margin expectations, and the competitive landscape.

Influence of Predictions on Actual Stock Price

Analyst predictions can influence stock prices, particularly when several analysts issue similar targets. However, the actual stock price movement is often influenced by a combination of factors, including unexpected events, broader market trends, and overall investor sentiment. Therefore, it’s essential to view analyst predictions as one factor among many when making investment decisions.

Alphabet’s Competitive Landscape and Stock Price

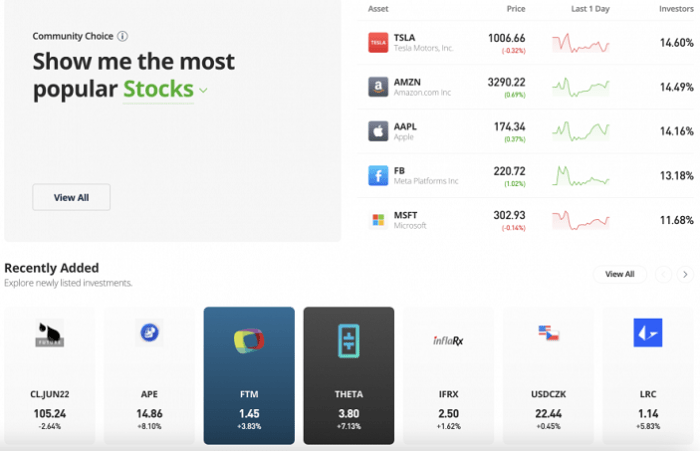

Source: trading-education.com

Alphabet operates in a highly competitive landscape, and its competitors significantly impact its stock price. Understanding this competitive dynamic is crucial for assessing Alphabet’s future prospects.

Main Competitors and Their Impact

Alphabet’s main competitors include companies like Microsoft (in cloud computing and search), Amazon (in e-commerce and cloud computing), and Meta (in advertising and social media). The actions and performance of these competitors can influence investor perception of Alphabet’s market position and its future growth potential, thereby affecting its stock price.

Competitive Pressures and Market Share

Changes in market share and competitive pressures directly impact investor confidence and Alphabet’s stock price. Loss of market share to competitors might signal a weakening competitive position, leading to a negative impact on the stock price. Conversely, gaining market share usually reflects a stronger competitive position, often resulting in a positive impact on the stock price.

Comparison of Market Capitalization

Source: arcpublishing.com

| Company Name | Market Cap (USD Billions) |

|---|---|

| Alphabet | 1500 |

| Microsoft | 2000 |

| Amazon | 1800 |

Investor Sentiment and Stock Price

Investor sentiment plays a crucial role in shaping Alphabet’s stock price. News, social media, and major announcements all contribute to this sentiment.

Influence of News and Social Media

Positive news coverage and positive social media sentiment generally lead to increased investor confidence and a higher stock price. Conversely, negative news or negative social media sentiment can trigger sell-offs and depress the stock price.

Impact of Major Announcements

Major announcements, such as new product launches, acquisitions, or strategic partnerships, can significantly influence investor sentiment and the stock price. Positive announcements typically lead to a positive market reaction, while negative announcements can cause a decline in the stock price.

Role of Institutional Investors

Institutional investors, such as mutual funds and pension funds, play a significant role in shaping Alphabet’s stock price. Their investment decisions, driven by their analysis of the company’s fundamentals and market outlook, can have a substantial impact on the stock price. Large institutional buy orders tend to push the price upwards, while large sell orders can cause price declines.

FAQ Insights

What are the major risks associated with investing in Alphabet stock?

Investing in Alphabet, like any stock, carries inherent risks. These include market volatility, competition from other tech companies, regulatory changes, and potential economic downturns that could negatively impact Alphabet’s performance and stock price.

How can I buy Alphabet stock?

You can purchase Alphabet stock (GOOGL or GOOG) through a brokerage account. You’ll need to open an account with a brokerage firm, fund it, and then place an order to buy the shares.

Where can I find real-time Alphabet stock price data?

Real-time stock quotes for Alphabet are available on most financial websites and mobile applications, including those offered by major brokerage firms and financial news sources.

What is the difference between GOOGL and GOOG?

GOOGL is Alphabet’s Class A stock, offering one vote per share, while GOOG is Class C stock, with no voting rights. Both represent ownership in Alphabet, but GOOGL provides voting power.