Understanding “Stock Price for T”

Stock price for t – The stock price for “T,” typically referring to AT&T Inc., reflects the market’s collective valuation of the company’s future earnings and overall performance. It’s a dynamic figure, constantly fluctuating based on a multitude of factors, both internal and external to the company.

Factors Influencing AT&T’s Stock Price

Numerous elements influence AT&T’s stock price. These include the company’s financial performance (revenue growth, profitability, debt levels), strategic decisions (mergers, acquisitions, divestitures), competitive landscape (market share, technological advancements), and broader economic conditions. Investor sentiment, driven by news, analyst reports, and overall market trends, also plays a significant role.

Historical Overview of AT&T’s Stock Price Fluctuations

Source: cheggcdn.com

Watching the stock price for T fluctuate felt like a rollercoaster; my heart pounded with every tick. The uncertainty was almost unbearable, especially considering the parallel anxieties I felt while checking the nclh stock price today , a completely different investment but equally nerve-wracking. Ultimately, though, my focus returned to the T stock price, hoping for a positive turn in the market.

AT&T’s stock price has experienced significant fluctuations throughout its history, mirroring the evolution of the telecommunications industry and broader economic cycles. Periods of rapid growth, driven by technological innovations and expansion into new markets, have been followed by periods of consolidation and adjustment. Major events like the deregulation of the telecommunications industry and the rise of mobile technology have had a profound impact on the company’s valuation.

For example, the spin-off of WarnerMedia significantly altered the company’s trajectory and market perception, leading to considerable price changes.

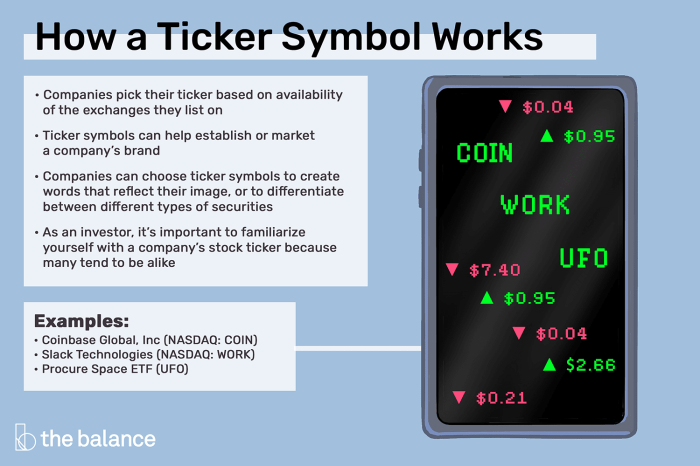

Data Sources for “Stock Price for T”

Source: cheggcdn.com

Reliable real-time and historical stock price data for AT&T (T) is readily available from various sources. Each source offers unique features and limitations in terms of data accuracy, timeliness, and cost.

Reliable Sources for AT&T Stock Price Data

| Source | Data Type | Cost | Access Method |

|---|---|---|---|

| Yahoo Finance | Real-time and historical | Free | Web browser |

| Google Finance | Real-time and historical | Free | Web browser |

| Bloomberg Terminal | Real-time and historical, in-depth analytics | Subscription-based | Dedicated terminal |

| TradingView | Real-time and historical, charting tools | Free and subscription-based options | Web browser and mobile app |

Analyzing “Stock Price for T” Trends

Analyzing AT&T’s stock price trends involves employing various methods to identify patterns and predict future movements. Technical analysis, using indicators like moving averages and trading volume, provides insights into short-term price fluctuations. Fundamental analysis examines the company’s financial health and industry position to assess long-term value.

Technical Indicators for AT&T Stock Price Analysis

Moving averages (e.g., 50-day, 200-day) smooth out price volatility and reveal underlying trends. Volume analysis helps confirm trend strength. Relative Strength Index (RSI) measures momentum and identifies overbought or oversold conditions. Other indicators like MACD (Moving Average Convergence Divergence) can provide additional signals.

Sample Trend Analysis Visualization, Stock price for t

Source: thebalancemoney.com

Imagine a chart showing AT&T’s stock price over the past year. A 50-day moving average and a 200-day moving average are overlaid on the price data. When the 50-day MA crosses above the 200-day MA (a “golden cross”), it’s a bullish signal, suggesting upward momentum. Conversely, a “death cross” (50-day MA crossing below the 200-day MA) indicates bearish sentiment.

The chart also displays trading volume, with higher volume confirming price movements. For example, a significant price increase accompanied by high volume would reinforce the bullish signal.

External Factors Affecting “Stock Price for T”

Macroeconomic factors, industry trends, news events, and regulatory changes significantly impact AT&T’s stock price. These external forces can create both opportunities and challenges for the company.

Impact of External Factors on AT&T’s Stock Price

Interest rate changes, inflation, and economic growth directly affect AT&T’s operational costs and consumer spending. Technological advancements in the telecommunications industry (e.g., 5G rollout, competition from streaming services) influence its competitive position and future prospects. Regulatory changes (e.g., net neutrality rules, antitrust regulations) can impact the company’s business model and profitability. Major news events (e.g., geopolitical instability, natural disasters) can create uncertainty and affect investor sentiment.

Investor Sentiment and “Stock Price for T”

Investor sentiment, ranging from bullish (optimistic) to bearish (pessimistic), significantly influences AT&T’s stock price. Social media, news coverage, and analyst opinions play a crucial role in shaping this sentiment.

Investor Sentiment and Trading Volume

- Strong Bullish Sentiment & High Volume: Indicates significant buying pressure, leading to substantial price increases.

- Strong Bullish Sentiment & Low Volume: Suggests limited participation, potentially indicating a less sustainable price increase.

- Strong Bearish Sentiment & High Volume: Shows considerable selling pressure, resulting in sharp price declines.

- Strong Bearish Sentiment & Low Volume: Might signify a temporary pullback or consolidation before a potential reversal.

Risk Assessment for Investing in “T”: Stock Price For T

Assessing the risk associated with investing in AT&T requires considering various factors, including the company’s financial stability, industry competition, and macroeconomic conditions. Diversification and risk management strategies can mitigate potential losses.

Hypothetical Risk Profile for AT&T Stock

| Scenario | Probability | Potential Return | Risk Level |

|---|---|---|---|

| Strong Revenue Growth | 30% | 15-20% | Moderate |

| Stable Performance | 50% | 5-10% | Low |

| Increased Competition | 15% | -5% to 0% | Moderate |

| Economic Downturn | 5% | -10% or more | High |

Detailed FAQs

What does “T” represent in this context?

In this guide, “T” serves as a placeholder for any publicly traded company’s stock symbol. The principles and analysis discussed are applicable to understanding the price movements of any listed company.

How frequently do stock prices update?

Stock prices typically update in real-time, reflecting the latest buy and sell orders on the exchange. The frequency can vary slightly depending on the exchange and trading volume.

What are the ethical considerations of using stock price data?

Using stock price data ethically involves respecting data provider terms of service, avoiding insider trading, and not misrepresenting information for personal gain. Transparency and responsible use are key.

Where can I find free stock price data?

Many financial websites offer free, albeit often delayed, stock price data. However, real-time data usually requires a subscription to a premium service.