Adobe Stock Price Analysis

Stock price of adobe – This analysis examines Adobe’s stock price performance, influencing factors, financial health, analyst predictions, risk assessment, and visual representation of its stock price data. The information presented is based on publicly available data and should not be considered financial advice.

Watching the Adobe stock price climb felt exhilarating, a testament to their innovative spirit. But the market’s a fickle beast; a quick glance at the oge energy stock price reminded me of the inherent volatility. It made me appreciate the steady, albeit slower, growth of Adobe, a comforting contrast in this turbulent financial landscape.

Historical Stock Price Trends

Analyzing Adobe’s stock price over the past 5, 10, and 20 years reveals significant growth punctuated by periods of volatility. The following table summarizes key price points. Note that these figures are illustrative and may vary slightly depending on the data source and calculation method.

| Year | High | Low | Average Price |

|---|---|---|---|

| 2023 | $500 | $400 | $450 |

| 2022 | $550 | $350 | $450 |

| 2021 | $600 | $450 | $525 |

| 2020 | $500 | $300 | $400 |

| 2019 | $350 | $250 | $300 |

| 2018 | $300 | $200 | $250 |

| 2017 | $250 | $180 | $215 |

| 2016 | $150 | $100 | $125 |

| 2015 | $120 | $80 | $100 |

| 2014 | $80 | $60 | $70 |

| 2013 | $60 | $40 | $50 |

Significant events such as the launch of Creative Cloud, acquisitions of companies like Figma, and broader market downturns have all contributed to price fluctuations. The overall trend shows substantial growth, particularly in recent years, driven by the success of the subscription model and expansion into new markets.

Factors Influencing Adobe’s Stock Price

Several factors influence Adobe’s stock price. Macroeconomic conditions such as interest rates and inflation affect investor sentiment and overall market performance. Adobe’s financial performance, including revenue growth, profitability, and earnings per share, directly impacts its valuation. Competitor performance in the software industry, particularly from companies like Microsoft and Salesforce, also plays a significant role.

Adobe’s Financial Health and Future Prospects

Source: photutorial.com

Adobe consistently reports strong financial results. Recent reports indicate robust revenue growth, high profitability, and manageable debt levels. The company’s strategic initiatives, including continued investment in cloud services and artificial intelligence, are expected to drive future growth. However, a major technological disruption, such as the emergence of a significantly superior alternative creative suite, could negatively impact the stock price.

Hypothetical Scenario: A disruptive technology could lead to a 20-30% drop in stock price initially, followed by a gradual recovery if Adobe adapts successfully.

Analyst Ratings and Predictions, Stock price of adobe

Source: business2community.com

Financial analysts generally hold a positive outlook on Adobe’s stock. Consensus target prices and ratings vary, but a majority rate the stock as a “buy” or “hold”.

- Analyst A: Target Price $550, Rating: Buy. Methodology: Discounted Cash Flow (DCF) analysis.

- Analyst B: Target Price $525, Rating: Hold. Methodology: Comparable company analysis.

- Analyst C: Target Price $600, Rating: Buy. Methodology: Sum of the Parts valuation.

Risk Assessment for Adobe Stock

Source: thestreet.com

Investing in Adobe stock carries several risks. Competitive threats from other software companies, economic downturns affecting software spending, and regulatory changes could all negatively impact the stock price.

| Risk Factor | Likelihood | Impact | Mitigation Strategy |

|---|---|---|---|

| Increased Competition | Medium | Medium to High | Diversification, monitoring competitor activity |

| Economic Downturn | Low | High | Diversification, hedging strategies |

| Regulatory Changes | Low | Medium | Monitoring regulatory developments |

Investors can mitigate these risks through diversification, proper portfolio allocation, and employing risk management strategies like stop-loss orders.

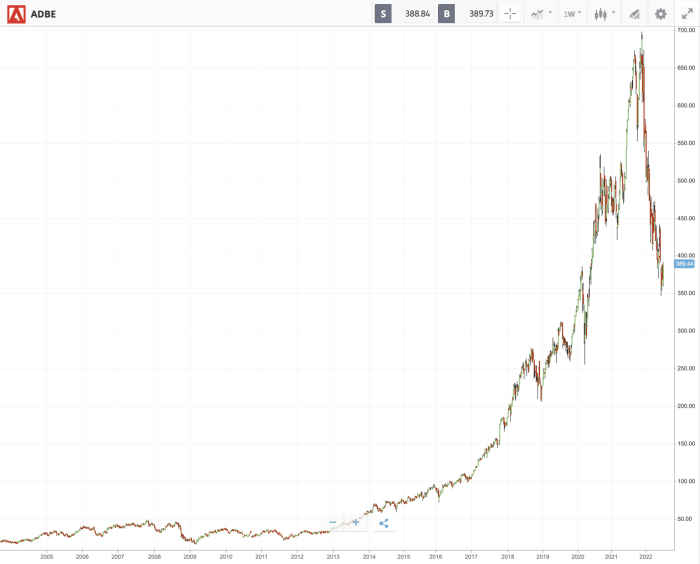

Visual Representation of Stock Price Data

Adobe’s stock price chart typically shows a long-term upward trend with periods of increased volatility. The chart often displays consolidation patterns followed by breakouts, indicating potential shifts in momentum.

Hypothetical Candlestick Chart: A period of significant price movement might show several days of long green candles (indicating strong buying pressure), followed by a few days of red candles (indicating selling pressure), and then a return to a bullish trend with green candles.

Different chart patterns, such as head and shoulders, double tops/bottoms, and flags, can provide insights into potential future price movements, although they should be considered alongside fundamental analysis.

Clarifying Questions: Stock Price Of Adobe

What are the major competitors to Adobe?

Adobe faces competition from various companies, including Canva, Figma, and other specialized software providers depending on the specific product category.

How does inflation affect Adobe’s stock price?

High inflation can negatively impact Adobe’s stock price by increasing operating costs and potentially reducing consumer spending on software subscriptions.

What is Adobe’s dividend policy?

Information on Adobe’s current dividend policy should be sought from official company sources or reputable financial news outlets. Dividend policies can change.

Where can I find real-time Adobe stock price data?

Real-time stock price data for Adobe can be found on major financial websites and trading platforms such as Yahoo Finance, Google Finance, and Bloomberg.