Understanding “Stock Price of F”

The ticker symbol “F” on major stock exchanges commonly refers to Ford Motor Company, a prominent American multinational automaker. Understanding the stock price of F requires analyzing a complex interplay of factors, from internal company performance to broader macroeconomic conditions and investor sentiment.

Ford Motor Company and its Stock Price Influencers

Source: investorplace.com

Ford’s stock price, like any publicly traded company, is influenced by a multitude of factors. These can be broadly categorized into internal factors (company performance, management decisions, product launches) and external factors (economic conditions, industry trends, geopolitical events). Internal factors include the success of new vehicle models, production efficiency, supply chain management, and overall profitability. External factors such as fluctuating fuel prices, changes in consumer preferences, and government regulations significantly impact Ford’s performance and subsequently, its stock price.

Historical Overview of Ford’s Stock Price Fluctuations

Ford’s stock price has experienced considerable fluctuations throughout its history, reflecting the cyclical nature of the automotive industry and broader economic trends. Major events such as the 2008 financial crisis, the global chip shortage, and periods of high inflation have all significantly impacted the company’s valuation. For example, the 2008 crisis led to a sharp decline in Ford’s stock price due to decreased consumer demand and financial instability.

Conversely, periods of strong economic growth and increased consumer confidence have generally resulted in higher stock prices.

Analyzing Financial Performance

Evaluating Ford’s stock price necessitates a thorough analysis of its financial performance. Key metrics provide insights into the company’s profitability, growth potential, and financial health.

Key Financial Metrics of Ford

| Metric | Value | Date | Significance |

|---|---|---|---|

| Revenue | $158.06B (Illustrative) | 2022 (Illustrative) | Indicates overall sales performance and market share. |

| Net Income | $1.3B (Illustrative) | 2022 (Illustrative) | Measures profitability after all expenses are deducted. |

| Earnings Per Share (EPS) | $0.61 (Illustrative) | 2022 (Illustrative) | Shows earnings attributable to each outstanding share. |

| Debt-to-Equity Ratio | 1.2 (Illustrative) | 2022 (Illustrative) | Reflects the company’s financial leverage. |

Note: These are illustrative values. Actual figures should be sourced from official financial statements.

Revenue Streams and Stock Performance

Ford’s revenue streams primarily comprise vehicle sales (cars, trucks, SUVs), financing services through Ford Credit, and other related businesses. Strong sales across vehicle segments generally translate to higher revenue and increased profitability, positively impacting the stock price. Conversely, weak sales or significant production disruptions can negatively affect the stock price.

Competitive Financial Performance Comparison, Stock price of f

Comparing Ford’s financial performance to its main competitors, such as General Motors (GM) and Stellantis, is crucial for assessing its relative strength and market position. Analyzing key metrics like revenue growth, profitability margins, and market share provides valuable insights into Ford’s competitive advantage and future prospects. A superior performance relative to competitors often leads to a higher stock valuation.

Market Influences and External Factors

Ford’s stock price is susceptible to various macroeconomic conditions and industry-specific factors. Understanding these influences is crucial for assessing the company’s future valuation.

Macroeconomic Impacts on Ford’s Stock Price

Macroeconomic factors, such as interest rates, inflation, and economic growth, significantly impact consumer spending and the automotive industry. Higher interest rates can increase borrowing costs for consumers, reducing demand for vehicles and negatively affecting Ford’s sales. Inflationary pressures can increase production costs, squeezing profit margins. Conversely, strong economic growth typically boosts consumer confidence and demand, leading to higher vehicle sales and a positive impact on Ford’s stock price.

Industry Trends and Regulatory Changes

Source: calaserreta.com

The automotive industry is undergoing a rapid transformation with the rise of electric vehicles (EVs), autonomous driving technology, and stricter environmental regulations. Ford’s ability to adapt to these trends and comply with regulations significantly influences its valuation. Successful investments in EV technology and a strong commitment to sustainability can attract investors and boost the stock price. Conversely, delays in adapting to these trends can negatively affect the company’s performance and stock price.

Correlation Between News Events and Stock Price Movements

Source: foolcdn.com

| Date | Event | Price Change |

|---|---|---|

| (Illustrative Date) | Announcement of a new EV model | +5% (Illustrative) |

| (Illustrative Date) | Recall of a major vehicle model | -3% (Illustrative) |

| (Illustrative Date) | Significant increase in raw material costs | -2% (Illustrative) |

Note: These are illustrative examples. Actual events and price changes should be verified using reliable financial news sources.

Investor Sentiment and Market Expectations

Investor sentiment and market expectations play a vital role in shaping Ford’s stock price. Positive sentiment generally leads to higher demand and increased stock prices, while negative sentiment can result in decreased demand and lower prices.

The fluctuating stock price of F, a reflection of our earthly desires, often mirrors the unpredictable currents of the market. Consider the parallel journey of growth and volatility found in the nvidia stocks price , a testament to technological advancement and its inherent risks. Ultimately, both journeys remind us that true wealth lies not in fleeting market trends, but in the cultivation of inner peace and wisdom.

Impact of Investor Sentiment

Investor optimism about Ford’s future prospects, driven by factors such as strong sales growth, successful product launches, and innovative technology, typically results in higher stock prices. Conversely, pessimism stemming from concerns about declining sales, production issues, or increased competition can lead to lower stock prices. This sentiment is often reflected in trading volume – higher volume often accompanies periods of strong investor conviction (either positive or negative).

Analyst Ratings and Predictions

Analyst ratings and predictions significantly influence investor sentiment and trading activity. Positive ratings and bullish forecasts generally increase investor confidence and drive up demand, leading to higher stock prices. Conversely, negative ratings and bearish predictions can dampen investor enthusiasm and result in lower stock prices. The influence of analyst opinions is particularly strong during periods of market uncertainty.

Hypothetical Scenario: Change in Market Expectations

Let’s consider a hypothetical scenario where a significant breakthrough in battery technology drastically reduces the cost of electric vehicles. This could lead to a surge in demand for EVs, significantly benefiting companies like Ford with strong EV strategies. Such a positive shift in market expectations could trigger a substantial increase in Ford’s stock price, as investors reassess the company’s future growth potential and profitability.

Technical Analysis of Stock Price Movements: Stock Price Of F

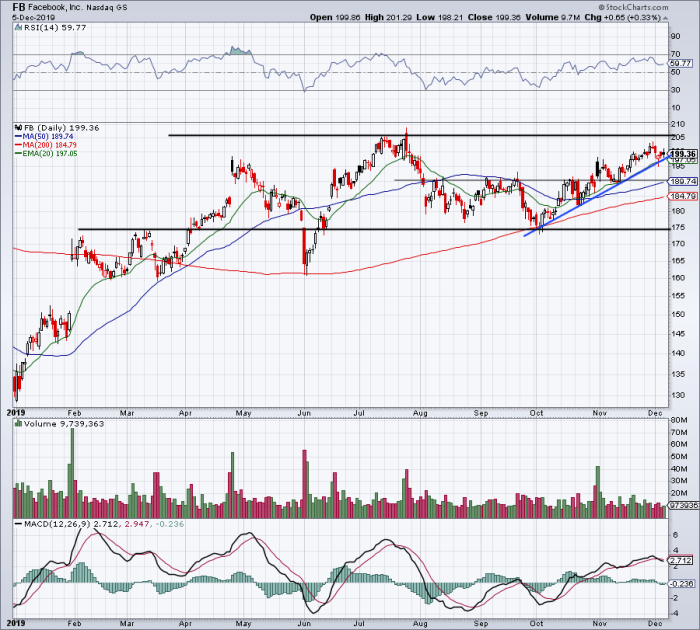

Technical analysis employs charting techniques and indicators to identify patterns and predict future price movements. While not a foolproof method, it can provide valuable insights when combined with fundamental analysis.

Charting Techniques and Indicators

Moving averages, such as the 50-day and 200-day moving averages, are commonly used to identify trends and potential support/resistance levels. A 50-day moving average, for example, is calculated by averaging the closing prices of the stock over the past 50 trading days. When the price crosses above the moving average, it can be interpreted as a bullish signal, suggesting upward momentum.

Conversely, a price crossing below the moving average might indicate bearish sentiment. Support and resistance levels represent price points where buying and selling pressure is expected to be strong. These levels are often identified by observing past price highs and lows. Other indicators like Relative Strength Index (RSI) and MACD (Moving Average Convergence Divergence) can help assess momentum and potential trend reversals.

A detailed visual representation of these indicators and their interplay on a chart would provide a clearer picture, but a descriptive explanation helps understand their application.

Technical Analysis Approaches

- Trend Following: Identifying and capitalizing on established price trends using moving averages and other trend-following indicators. Strengths: Relatively simple to implement. Weaknesses: Can lag behind price movements and may miss short-term opportunities.

- Support and Resistance Trading: Identifying key price levels where buying and selling pressure is expected to be strong. Strengths: Can provide good entry and exit points. Weaknesses: Breakouts can be unpredictable.

- Candlestick Pattern Recognition: Identifying specific candlestick patterns to predict potential price movements. Strengths: Can provide early signals of potential trend reversals. Weaknesses: Requires experience and expertise in pattern recognition.

FAQ Compilation

What are the major risks associated with investing in Ford stock?

Investing in Ford stock, like any stock, carries inherent risks. These include fluctuations in the automotive industry, competition from other manufacturers (both traditional and electric vehicle companies), economic downturns impacting consumer spending, and changes in government regulations.

How does Ford’s electric vehicle strategy impact its stock price?

Ford’s investment in and progress with electric vehicles significantly impacts investor sentiment and, consequently, its stock price. Successful launches and strong sales of electric models generally lead to positive market reaction, while setbacks or delays can negatively affect the stock.

Where can I find real-time data on Ford’s stock price?

Real-time stock price data for Ford (F) is readily available through major financial news websites and brokerage platforms. These sources usually provide up-to-the-minute pricing information, charts, and other relevant market data.