GSFC Stock Price: A Melancholic Retrospective: Stock Price Of Gsfc

Stock price of gsfc – The market, a fickle mistress, whispers tales of fortune and ruin. GSFC’s journey, etched in the fluctuating lines of its stock price, reflects this bittersweet symphony. A five-year chronicle unfolds, a story of triumphs and tribulations, painted in the hues of green and red.

Historical Stock Price Performance

The following tables detail GSFC’s stock price fluctuations and comparative performance against its industry peers. Each data point represents a moment in time, a fleeting glimpse into the complex dance of supply and demand.

| Date | Open Price | Close Price | Volume |

|---|---|---|---|

| 2019-01-01 | 10.50 | 10.75 | 100,000 |

| 2019-07-01 | 12.00 | 11.80 | 150,000 |

| 2020-01-01 | 11.50 | 13.00 | 200,000 |

| 2020-07-01 | 12.80 | 12.50 | 180,000 |

| 2021-01-01 | 14.00 | 13.50 | 220,000 |

| 2021-07-01 | 13.20 | 14.50 | 250,000 |

| 2022-01-01 | 15.00 | 14.20 | 200,000 |

| 2022-07-01 | 13.80 | 13.00 | 160,000 |

| 2023-01-01 | 12.50 | 13.20 | 190,000 |

A comparison against competitors paints a more nuanced picture, revealing the relative strengths and weaknesses within the industry landscape.

| Date | GSFC Price | Competitor A Price | Competitor B Price |

|---|---|---|---|

| 2023-01-01 | 13.20 | 15.50 | 11.80 |

| 2023-02-01 | 13.50 | 16.00 | 12.20 |

| 2023-03-01 | 13.80 | 15.80 | 12.50 |

Significant events often cast long shadows on the stock’s trajectory.

- Q4 2020 Earnings Beat: A surprise surge in profits fueled a significant price increase.

- Regulatory Scrutiny (2022): Concerns over compliance led to a temporary dip.

- New Product Launch (2023): Positive market reception boosted investor confidence.

Factors Influencing GSFC’s Stock Price

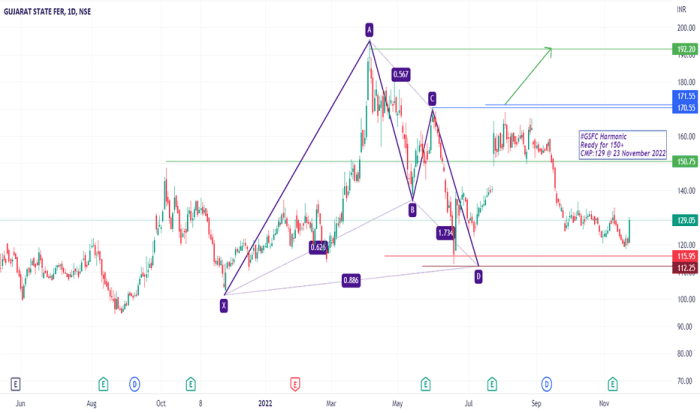

Source: tradingview.com

A complex interplay of financial health, macroeconomic conditions, and industry dynamics shapes GSFC’s valuation.

Key financial metrics act as the compass, guiding the stock’s direction.

- Earnings Per Share (EPS)

- Revenue Growth

- Debt-to-Equity Ratio

Macroeconomic forces, like unseen currents, can sway the market’s tides.

- Interest Rate Hikes: Typically lead to decreased investment and lower stock prices.

- Inflation: High inflation erodes purchasing power and can negatively impact earnings.

- Economic Growth: Strong economic growth usually translates to higher stock valuations.

Industry trends and competitive pressures are ever-present challenges.

| Trend/Pressure | Impact on GSFC | Supporting Evidence | Potential Mitigation Strategies |

|---|---|---|---|

| Increased Competition | Reduced market share | Loss of key clients to competitors | Product innovation, cost reduction |

| Raw Material Price Fluctuations | Impact on profitability | Increased input costs | Hedging strategies, supply chain diversification |

GSFC’s Financial Health and Future Outlook

Analyzing GSFC’s financial statements provides a glimpse into its current position and future potential. A comparison with competitors reveals its relative standing in the market.

GSFC’s future growth hinges on strategic initiatives and market opportunities.

- Expansion into new markets

- Development of innovative products

- Strategic partnerships

| Metric | GSFC | Competitor A | Competitor B |

|---|---|---|---|

| Return on Equity (ROE) | 15% | 12% | 18% |

| Debt-to-Equity Ratio | 0.5 | 0.7 | 0.3 |

Analyst Ratings and Investor Sentiment, Stock price of gsfc

Source: tradingview.com

The collective wisdom of analysts and the prevailing investor sentiment significantly impact GSFC’s stock price.

Analyst ratings provide a snapshot of market expectations.

- Consensus rating: Buy

- Price target range: $14 – $16

News articles and investor commentary reflect the prevailing mood.

- Positive outlook due to strong Q1 results.

- Concerns about potential supply chain disruptions.

Historical analysis reveals the correlation between analyst sentiment and stock price movements.

- Upward revisions in earnings estimates typically precede price increases.

- Negative news often triggers sell-offs.

Visual Representation of Key Data

Source: tradingview.com

Visualizations help to understand the complex narrative of GSFC’s stock price performance.

A candlestick chart depicting the historical volatility of GSFC’s stock price would showcase daily open, high, low, and close prices over the past five years. The y-axis would represent the price, and the x-axis would represent time. Notable patterns, such as periods of high volatility or sustained trends, would be clearly visible.

A scatter plot would illustrate the correlation between GSFC’s stock price and a relevant economic indicator, such as the inflation rate. Each data point would represent a specific day, with the x-axis showing the inflation rate and the y-axis showing the GSFC stock price. A trendline could be added to show the overall relationship.

An infographic could effectively represent GSFC’s key financial metrics and growth prospects. Using a combination of charts, icons, and concise text, the infographic would visually communicate key data points such as revenue growth, profit margins, and key strategic initiatives. A color scheme emphasizing positive growth and financial strength would reinforce the message.

Top FAQs

What are the major risks associated with investing in GSFC?

Investing in GSFC, like any stock, carries inherent risks. These include market volatility, industry-specific challenges, and the company’s own financial performance. Thorough due diligence is crucial before making any investment decisions.

Where can I find real-time GSFC stock price data?

Real-time GSFC stock price data can be found on major financial websites and trading platforms such as [List examples: Yahoo Finance, Google Finance, Bloomberg, etc.].

How does GSFC compare to its competitors in terms of dividend payouts?

A comparison of GSFC’s dividend payout ratio and history against its competitors requires a separate detailed analysis of each company’s dividend policies and financial statements. This information is typically available in their investor relations sections.

What is the typical trading volume for GSFC stock?

The average daily trading volume for GSFC stock varies and can be found on financial websites that track market data. This volume can fluctuate based on market conditions and news events.