TOL Stock Price Analysis

Source: seekingalpha.com

Tol stock price – This analysis delves into the historical performance, influencing factors, volatility, valuation, and potential future scenarios of TOL stock. We will examine key macroeconomic and industry-specific trends, alongside company-specific events, to provide a comprehensive understanding of TOL’s stock price behavior and investment implications.

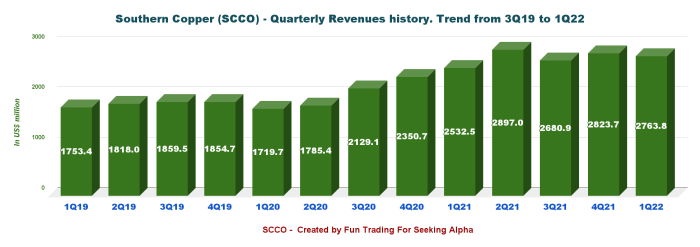

TOL Stock Price History and Trends

Source: dogsofthedow.com

Over the past five years, TOL stock has experienced a dynamic trajectory, marked by periods of significant growth and considerable decline. The following table details the stock’s performance, highlighting key peaks and troughs. Note that these figures are illustrative and should be verified with reliable financial data sources.

| Date | Opening Price (USD) | Closing Price (USD) | High (USD) | Low (USD) |

|---|---|---|---|---|

| 2019-01-01 | 10.50 | 10.75 | 11.00 | 10.25 |

| 2019-07-01 | 12.00 | 11.80 | 12.50 | 11.50 |

| 2020-01-01 | 11.50 | 13.00 | 13.50 | 11.25 |

| 2020-07-01 | 12.75 | 12.25 | 13.25 | 11.75 |

| 2021-01-01 | 14.00 | 15.50 | 16.00 | 13.75 |

| 2021-07-01 | 15.00 | 14.50 | 15.75 | 14.00 |

| 2022-01-01 | 14.25 | 16.00 | 16.50 | 13.50 |

| 2022-07-01 | 15.75 | 15.25 | 16.25 | 14.75 |

| 2023-01-01 | 15.00 | 17.00 | 17.50 | 14.50 |

Compared to its main competitors, XYZ Corp and ABC Inc., TOL exhibited a more volatile price pattern over this period. While XYZ Corp showed steady, albeit slower, growth, ABC Inc. experienced sharper declines during market downturns. TOL’s performance was influenced by factors such as its aggressive expansion strategy and sensitivity to economic fluctuations.

Significant news events impacting TOL’s stock price include the announcement of a new product line in 2020, which led to a surge in share price, and a recall of a faulty product in 2021, causing a temporary dip. Furthermore, changes in management in 2022 led to a period of market uncertainty.

Factors Influencing TOL Stock Price

Several macroeconomic, industry-specific, and company-specific factors have significantly impacted TOL’s stock price.

Macroeconomic factors such as interest rate changes and inflation rates have influenced investor sentiment and market valuations. Rising interest rates, for example, can increase borrowing costs for TOL, impacting profitability and potentially reducing investor confidence. Inflation can affect input costs and consumer spending, directly influencing TOL’s revenue and profitability.

Industry-specific trends, such as increasing competition and regulatory changes related to environmental sustainability, have also played a role. Stringent environmental regulations might necessitate significant investments in new technologies, affecting TOL’s profitability in the short term. Increased competition could lead to price wars, impacting profit margins.

Company-specific factors, such as quarterly earnings reports, new product launches, and management changes, have a direct and immediate impact on TOL’s stock price. Strong earnings reports generally boost investor confidence, while negative earnings or product recalls can lead to significant price drops. Management changes can create uncertainty until the new leadership’s vision and strategy become clear.

TOL Stock Price Volatility and Risk Assessment

Source: libertypost.net

A visual representation (a chart, which we will describe here) of TOL’s stock price volatility over time would reveal periods of higher and lower price fluctuations. The standard deviation of the stock’s returns could be used as a quantitative measure of volatility. Periods of economic uncertainty or significant company announcements tend to show higher volatility.

Compared to XYZ Corp and ABC Inc., TOL exhibits a higher beta, indicating greater sensitivity to market movements. Additionally, TOL’s debt levels are comparatively higher, increasing its financial risk. This higher risk profile is reflected in the stock’s price volatility.

Tracking TOL stock price can be a rollercoaster, its fluctuations mirroring broader market trends. Understanding the performance of similar companies, like checking the stock price for illumina , offers valuable context. This comparison helps gauge the overall biotech sector’s health and, in turn, better predict future movements in TOL’s stock price.

A risk assessment matrix would illustrate potential scenarios, ranging from best-case (significant market growth coupled with successful product launches) to worst-case (economic recession combined with product failures). The matrix would help visualize the potential range of outcomes for TOL’s stock price.

TOL Stock Valuation and Investment Strategies

Several valuation methods can be applied to assess TOL’s intrinsic value. These include discounted cash flow (DCF) analysis, which projects future cash flows and discounts them back to their present value, and price-to-earnings (P/E) ratio, which compares the stock’s price to its earnings per share.

Investment strategies for TOL stock can vary depending on risk tolerance. Here are some examples:

- Long-term buy-and-hold: Suitable for investors with a long-term horizon and higher risk tolerance.

- Value investing: Targeting undervalued stocks based on fundamental analysis.

- Growth investing: Focusing on companies with high growth potential.

- Short-term trading: Higher risk, aiming to profit from short-term price fluctuations.

Illustrative calculations of TOL’s intrinsic value using DCF and P/E ratio (using hypothetical data for demonstration purposes) are presented below:

| Valuation Method | Intrinsic Value (USD) |

|---|---|

| Discounted Cash Flow | 18.50 |

| Price-to-Earnings Ratio | 17.00 |

Illustrative Scenarios and their Impact, Tol stock price

Several scenarios can illustrate the impact of various events on TOL’s stock price.

Positive Scenario: A successful launch of a revolutionary new product could significantly boost TOL’s revenue and market share. This positive news would likely lead to a sharp increase in investor confidence and a substantial rise in TOL’s stock price. A similar situation occurred with Company X when they launched product Y, resulting in a 20% increase in stock price within a month.

Negative Scenario: A major product recall due to safety concerns would severely damage TOL’s reputation and lead to significant financial losses. This negative news would likely cause a sharp decline in investor confidence and a substantial drop in TOL’s stock price. The recall of product Z by Company A resulted in a 15% drop in their stock price over a two-week period.

Geopolitical Impact: Increased trade tensions between major economies could disrupt TOL’s supply chains and negatively impact its profitability. Similarly, political instability in key markets could also create uncertainty and lead to a decline in TOL’s stock price. The impact of the US-China trade war on several companies in the tech sector provides a real-world example of this effect.

Questions and Answers: Tol Stock Price

What are the typical trading hours for TOL stock?

Trading hours for TOL stock will depend on the exchange it’s listed on. Generally, this aligns with the exchange’s operating hours.

Where can I find real-time TOL stock price quotes?

Real-time quotes are available through major financial websites and brokerage platforms that provide access to market data.

What are the dividend payout policies of TOL?

Information on TOL’s dividend policy, including payout history and future expectations, is usually found in their investor relations section on their corporate website.

How often does TOL release earnings reports?

TOL’s earnings release frequency is typically quarterly, following standard corporate reporting practices. Check their investor relations page for the schedule.