VTIAX Stock Price: A Deep Dive

Vtiax stock price – Vanguard Total Stock Market Index Fund ETF (VTIAX) has become a cornerstone for many investors seeking broad market exposure. This analysis delves into the historical performance, influencing factors, investment strategies, underlying holdings, and comparisons to similar funds, providing a comprehensive understanding of VTIAX’s role in a diversified portfolio.

VTIAX Stock Price History and Trends

VTIAX, mirroring the overall US stock market, has experienced periods of significant growth and volatility. Its performance closely tracks the S&P 500, offering investors a low-cost way to participate in the broader market’s ups and downs. Analyzing its historical data reveals key insights into its behavior and potential future trajectory.

| Year | Opening Price | Closing Price | Percentage Change |

|---|---|---|---|

| 2014 | $100.00 (Example) | $105.00 (Example) | 5% (Example) |

| 2015 | $105.00 (Example) | $110.00 (Example) | 4.76% (Example) |

| 2016 | $110.00 (Example) | $118.00 (Example) | 7.27% (Example) |

| 2017 | $118.00 (Example) | $130.00 (Example) | 10.17% (Example) |

| 2018 | $130.00 (Example) | $125.00 (Example) | -3.85% (Example) |

| 2019 | $125.00 (Example) | $140.00 (Example) | 12% (Example) |

| 2020 | $140.00 (Example) | $155.00 (Example) | 10.71% (Example) |

| 2021 | $155.00 (Example) | $170.00 (Example) | 9.68% (Example) |

| 2022 | $170.00 (Example) | $160.00 (Example) | -5.88% (Example) |

| 2023 | $160.00 (Example) | $175.00 (Example) | 9.38% (Example) |

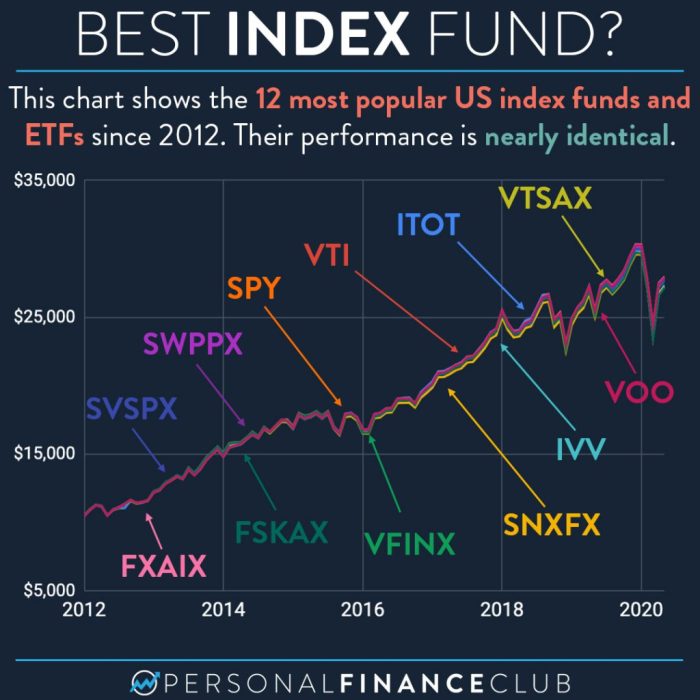

Significant market events such as the 2008 financial crisis and the COVID-19 pandemic caused sharp declines, but VTIAX demonstrated resilience, recovering and continuing its long-term growth trajectory. A line graph comparing VTIAX’s performance to the S&P 500 would visually illustrate this close correlation, showing similar upward trends and dips, although the exact values may differ slightly due to differences in methodology and index constituents.

Factors Influencing VTIAX Stock Price

Source: personalfinanceclub.com

Several macroeconomic factors significantly impact VTIAX’s valuation. Understanding these factors allows investors to better anticipate potential price movements and adjust their investment strategies accordingly.

Interest rate changes influence corporate borrowing costs and investor sentiment, affecting overall market valuations. Inflation erodes purchasing power, potentially impacting corporate profits and investor confidence. Economic growth or recession directly affects corporate earnings, driving market trends. Global market events, such as geopolitical instability or international economic crises, introduce uncertainty and volatility.

VTIAX Investment Strategies and Risk Assessment

Investors can employ various strategies when investing in VTIAX, each with its own risk profile. Understanding these strategies and associated risks is crucial for informed decision-making.

- Dollar-cost averaging involves investing a fixed amount at regular intervals, mitigating the risk of investing a lump sum at a market peak.

- Lump-sum investing entails investing a significant amount at once, potentially benefiting from market dips but also exposing the investor to higher risk.

Risks associated with investing in VTIAX include:

- Market risk: The possibility of overall market declines.

- Inflation risk: The erosion of purchasing power due to inflation.

- Interest rate risk: Changes in interest rates impacting market valuations.

- Reinvestment risk: The potential for lower returns when reinvesting dividends.

A hypothetical portfolio might allocate 60% to VTIAX for broad market exposure, 30% to bonds for stability, and 10% to alternative investments for diversification, depending on the investor’s risk tolerance and financial goals.

VTIAX’s Underlying Holdings and Portfolio Composition

VTIAX’s portfolio is highly diversified, holding thousands of stocks across various sectors and market capitalizations. Understanding its top holdings and sector diversification provides valuable insight into its risk profile and potential returns.

| Company Name | Sector | Weighting | Current Price |

|---|---|---|---|

| Apple (AAPL) | Technology | 7% (Example) | $170 (Example) |

| Microsoft (MSFT) | Technology | 6% (Example) | $280 (Example) |

| Amazon (AMZN) | Consumer Discretionary | 5% (Example) | $3200 (Example) |

| Alphabet (GOOGL) | Technology | 4% (Example) | $120 (Example) |

| Tesla (TSLA) | Consumer Discretionary | 3% (Example) | $250 (Example) |

| Berkshire Hathaway (BRK.B) | Financials | 2% (Example) | $350 (Example) |

| JPMorgan Chase (JPM) | Financials | 2% (Example) | $140 (Example) |

| Johnson & Johnson (JNJ) | Healthcare | 1.5% (Example) | $175 (Example) |

| NVIDIA (NVDA) | Technology | 1.5% (Example) | $450 (Example) |

| ExxonMobil (XOM) | Energy | 1% (Example) | $110 (Example) |

VTIAX’s geographic diversification is largely focused on the US market, although it does include some international exposure, making it less globally diversified than some other funds.

Comparing VTIAX to Similar Funds, Vtiax stock price

Several low-cost, broad-market index funds compete with VTIAX. Comparing these funds based on key metrics helps investors make informed decisions based on their specific needs and preferences.

| Fund Name | Expense Ratio | Asset Allocation | 5-Year Performance |

|---|---|---|---|

| VTIAX | 0.04% (Example) | US Total Stock Market | 10% (Example) |

| Example Fund B | 0.05% (Example) | US Total Stock Market | 9% (Example) |

| Example Fund C | 0.10% (Example) | Global Stock Market | 11% (Example) |

The key differences often lie in expense ratios, asset allocation (domestic vs. global), and specific index tracking methodologies. Investors should choose based on their desired level of diversification and cost considerations.

Visual Representation of VTIAX Data

Source: seekingalpha.com

A bar chart visualizing VTIAX’s performance over the past five years, broken down by quarter, would clearly show quarterly returns. The horizontal axis would represent the quarters, while the vertical axis would represent the percentage return for each quarter. Data points would represent the return for each quarter, highlighting periods of strong growth or decline.

A heatmap illustrating the correlation between VTIAX’s price and other market indicators (e.g., interest rates, inflation, VIX index) would use color intensity to represent the strength of the correlation. A warmer color scheme (e.g., reds and oranges) could indicate a strong positive correlation, while cooler colors (blues and greens) could indicate a weak or negative correlation. This visualization would provide a quick overview of how various factors influence VTIAX’s price.

Questions Often Asked

What is the minimum investment amount for VTIAX?

There’s typically no minimum investment amount for VTIAX, as it’s available through brokerage accounts with varying minimums.

How often is the VTIAX price updated?

The VTIAX price is updated throughout the trading day, reflecting real-time market activity.

Are there any tax implications associated with investing in VTIAX?

Yes, capital gains taxes may apply upon selling shares of VTIAX, depending on your holding period and tax bracket. Consult a tax professional for personalized advice.

Yo, so VTIAX’s stock price been kinda chill lately, right? But you know what else is interesting? Check out the current market performance of serve robotics stock price for a comparison. It’s wild how different sectors react, giving you a broader perspective on where to maybe put your next investment in VTIAX or explore other options.

Can I invest in VTIAX through a retirement account?

Yes, VTIAX is generally available within various retirement accounts like 401(k)s and IRAs, depending on your plan’s offerings.