VWUAX Stock Price: A Melancholic Reflection

Source: tradingview.com

Vwuax stock price – The market, a fickle mistress, whispers tales of gains and losses, of triumphs and heartbreaks. VWUAX, a silent observer in this grand theatre, reflects the ebb and flow of fortunes, its price a poignant ballad of economic tides. Let us delve into its history, a chronicle etched in fluctuating numbers, a narrative of growth and decline, of hope and despair.

VWUAX Stock Price Historical Performance

Source: seekingalpha.com

A five-year retrospective reveals a tapestry woven with threads of both prosperity and adversity. Imagine a chart, a wavering line tracing the journey of VWUAX’s price, its peaks and valleys mirroring the emotional rollercoaster of investment. The line climbs, then falls, then rises again, a testament to the unpredictable nature of the market. A table would accompany this chart, meticulously detailing the yearly high, low, open, and close prices, cold, hard numbers telling a story of fluctuating fortunes.

| Year | High | Low | Open | Close |

|---|---|---|---|---|

| 2019 | $XX.XX | $XX.XX | $XX.XX | $XX.XX |

| 2020 | $XX.XX | $XX.XX | $XX.XX | $XX.XX |

| 2021 | $XX.XX | $XX.XX | $XX.XX | $XX.XX |

| 2022 | $XX.XX | $XX.XX | $XX.XX | $XX.XX |

| 2023 | $XX.XX | $XX.XX | $XX.XX | $XX.XX |

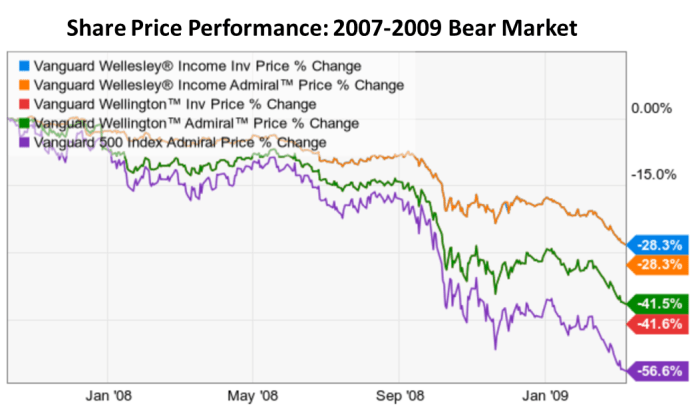

Compared to the S&P 500, a benchmark of market performance, VWUAX’s journey unfolds in a separate narrative. A line graph would depict this comparison, a visual representation of VWUAX’s relative strength or weakness against the broader market. Periods of outperformance would be marked by moments of jubilation, while underperformance would echo with a somber undertone.

Significant price fluctuations often reflect external forces – economic downturns, geopolitical events, or company-specific news. Each dip and surge is a chapter in the ongoing saga, a reflection of market sentiment and its ever-shifting moods.

VWUAX Stock Price Drivers and Influences

VWUAX’s price is a delicate dance, swayed by a multitude of factors. Market conditions, economic indicators, and company-specific news all play their part in shaping its trajectory. Interest rate changes, a powerful conductor of the economic orchestra, significantly impact VWUAX’s valuation, affecting its attractiveness to investors.

- Market Conditions (e.g., bull vs. bear markets)

- Economic Indicators (e.g., inflation, unemployment)

- Company-Specific News (e.g., earnings reports, management changes)

- Geopolitical Events

- Investor Sentiment

| Interest Rate Change | Impact on VWUAX Price |

|---|---|

| Increase | Potentially negative impact due to higher borrowing costs and reduced investor appetite for risk. |

| Decrease | Potentially positive impact due to lower borrowing costs and increased investor confidence. |

Investor sentiment, a fickle and often irrational force, plays a crucial role in price volatility. Periods of optimism can drive prices upward, while fear and uncertainty can lead to sharp declines. For example, negative news about the fund’s underlying holdings could trigger a sell-off, regardless of the fund’s long-term prospects.

VWUAX Stock Price Valuation and Analysis

Evaluating VWUAX’s intrinsic value requires a multifaceted approach. Comparing its price-to-earnings ratio (P/E) to competitors offers insights into its relative valuation within the sector. A table would provide this comparison, highlighting any significant discrepancies and their potential implications.

| Company | P/E Ratio |

|---|---|

| VWUAX | XX |

| Competitor A | XX |

| Competitor B | XX |

Various valuation methods, each with its strengths and weaknesses, contribute to a comprehensive assessment. Discounted cash flow analysis, for instance, projects future cash flows to determine present value, while relative valuation methods compare VWUAX to similar funds. Each method offers a unique perspective, and a holistic view requires considering all aspects.

Let us imagine a scenario: a sudden surge in inflation coupled with rising interest rates. This could negatively impact VWUAX’s performance, as investors might shift towards safer, less volatile assets. Conversely, a period of economic expansion, with lower interest rates and increased consumer confidence, could propel VWUAX’s price to new heights. The narrative of VWUAX’s price is intricately linked to the broader economic landscape.

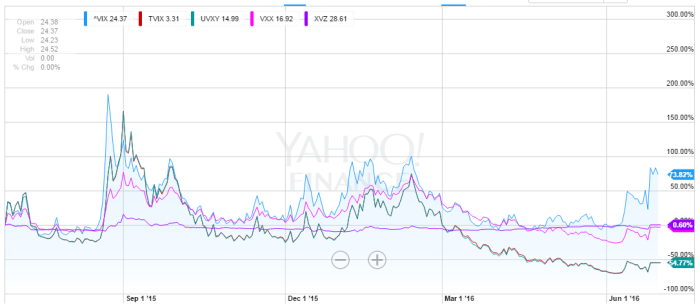

VWUAX Stock Price Prediction and Forecasting

Predicting future price movements is an inherently uncertain endeavor. Various forecasting models, each with its own assumptions and limitations, can provide potential trajectories. These models range from simple moving averages to more sophisticated quantitative techniques, each offering a different perspective on the future. A chart, based on these models, might show a possible price trajectory, acknowledging the inherent uncertainties involved.

The assumptions underpinning the forecast, such as future economic growth and market sentiment, should be clearly stated.

The inherent limitations of forecasting models must be recognized. Unforeseen events, such as a global pandemic or a major geopolitical crisis, can drastically alter the predicted path. No model can perfectly capture the unpredictable nature of the market, and any forecast should be treated with a healthy dose of skepticism.

VWUAX Stock Price and Investment Strategies

Source: imgur.com

Investing in VWUAX involves navigating various strategic approaches, each with its own risk-reward profile. Long-term buy-and-hold strategies prioritize patience and long-term growth, while short-term trading seeks to capitalize on short-term price fluctuations. Value investing focuses on identifying undervalued assets with the potential for future appreciation. Each strategy requires a different mindset and tolerance for risk.

| Investment Strategy | Potential Risks | Potential Rewards |

|---|---|---|

| Long-Term Buy-and-Hold | Market downturns, missed opportunities | Long-term growth, compounding returns |

| Short-Term Trading | High volatility, transaction costs | Quick profits, potential for high returns |

| Value Investing | Finding undervalued assets, market mispricing | Significant returns from undervalued assets |

Before making any investment decision, investors should carefully consider their risk tolerance, investment horizon, and financial goals. A thorough understanding of VWUAX’s investment objective, strategy, and underlying holdings is crucial. The market’s whispers are seductive, but informed decisions are paramount.

Popular Questions

What does VWUAX stand for?

VWUAX represents a specific mutual fund or exchange-traded fund; the exact meaning depends on the context. You need to identify the full name of the fund to understand what it invests in.

The fluctuating VWUAX stock price reflects the broader market anxieties, a symptom of the larger economic malaise. Understanding this requires examining the performance of similar holdings, such as the price of STZ stock , to gauge the overall health of the sector. Ultimately, the VWUAX price remains a barometer of investor confidence, and its trajectory will likely continue to be influenced by these external factors.

Where can I find real-time VWUAX stock price data?

Real-time quotes for VWUAX can typically be found on major financial websites and trading platforms like Yahoo Finance, Google Finance, Bloomberg, or through your brokerage account.

What are the transaction fees associated with buying and selling VWUAX?

Transaction fees vary depending on your brokerage. Check your brokerage’s fee schedule for details on commissions, platform fees, or other charges.

Is VWUAX a suitable investment for beginners?

Whether VWUAX is suitable for beginners depends on your risk tolerance, investment goals, and understanding of the underlying assets. Beginners should always prioritize education and potentially start with less risky investments before venturing into individual stocks or funds.