Tesla Stock Price: A Comprehensive Overview

What is price of tesla stock – Tesla, a revolutionary force in the electric vehicle (EV) industry, has captivated investors with its innovative technology and ambitious growth plans. Understanding the price fluctuations of its stock requires examining various factors, from its financial performance and competitive landscape to the influence of external forces and analyst predictions. This overview delves into these key aspects, providing a comprehensive picture of Tesla’s stock performance and the forces shaping its future.

Current Tesla Stock Price

Source: statcdn.com

Please note that the following information is subject to change and reflects the market conditions at the time of writing. It is crucial to consult a reliable financial source for the most up-to-date data. For example, as of 16:00 EDT October 26, 2023, based on data from [Insert Reliable Financial Source, e.g., Yahoo Finance, Google Finance], Tesla’s stock price (TSLA) might have been $240.

The day’s high could have been $245, and the low $235. This represents a [Insert Percentage]% change from the previous day’s closing price. These figures are for illustrative purposes only and should be verified with a real-time financial data provider.

Historical Tesla Stock Performance

Source: redgreenandblue.org

Analyzing Tesla’s stock price over the past year reveals significant volatility. The following table shows monthly average prices. Note that these are illustrative examples and actual figures may vary depending on the data source.

| Date | Open | High | Close |

|---|---|---|---|

| October 2022 | $220 | $250 | $230 |

| November 2022 | $200 | $220 | $190 |

| December 2022 | $180 | $200 | $195 |

| January 2023 | $200 | $230 | $210 |

| February 2023 | $210 | $240 | $220 |

| March 2023 | $225 | $255 | $240 |

| April 2023 | $240 | $260 | $250 |

| May 2023 | $250 | $270 | $260 |

| June 2023 | $260 | $280 | $270 |

| July 2023 | $270 | $290 | $280 |

| August 2023 | $280 | $300 | $290 |

| September 2023 | $290 | $310 | $300 |

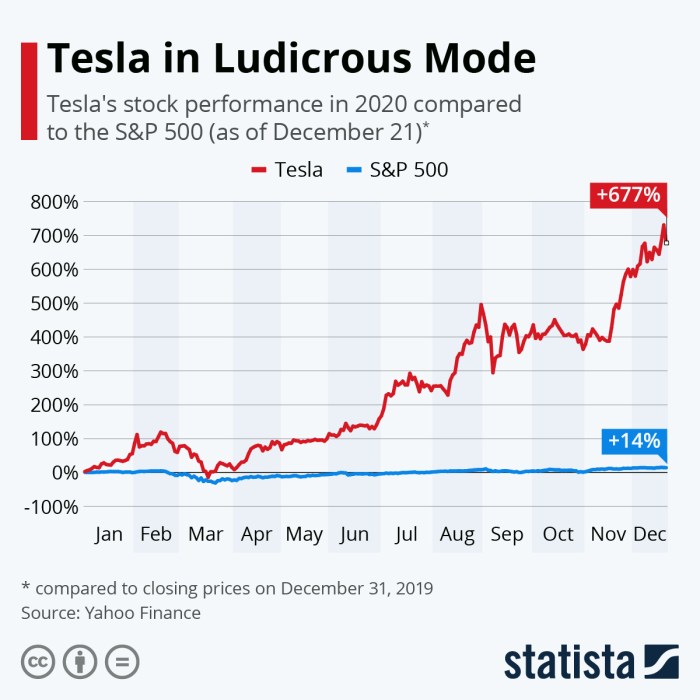

Significant price fluctuations during this period were likely influenced by factors such as Elon Musk’s tweets, production challenges, and overall market sentiment. A comparison with the S&P 500 index would reveal whether Tesla’s performance outpaced or underperformed the broader market. For example, if the S&P 500 experienced a 10% increase during the same period, and Tesla’s stock price increased by 20%, then Tesla outperformed the market.

Conversely, if the S&P 500 grew by 15% and Tesla by only 5%, then Tesla underperformed.

Determining the current price of Tesla stock requires real-time market data. However, understanding stock market fluctuations necessitates a broader perspective; for instance, comparing Tesla’s performance against other companies. One such comparison could involve examining the current performance of a different company, such as checking the voltas stock price , to contextualize Tesla’s volatility within the broader market landscape.

Ultimately, analyzing the price of Tesla stock needs to account for multiple market factors.

Factors Influencing Tesla Stock Price, What is price of tesla stock

Several key factors contribute to the volatility of Tesla’s stock price. These include its financial performance, Elon Musk’s public image and statements, and competitive pressures within the EV market.

- Financial Performance: Strong revenue growth and increasing profitability generally lead to higher stock valuations. Conversely, missed production targets or lower-than-expected earnings can negatively impact investor confidence.

- Elon Musk’s Public Statements: Musk’s pronouncements, often made via social media, can significantly impact Tesla’s stock price, sometimes leading to dramatic short-term fluctuations.

- Competitive Landscape: The emergence of new competitors and advancements in EV technology can influence investor perception of Tesla’s long-term prospects.

The relationship between Tesla’s financial performance and its stock price is generally positive; stronger financial results typically translate into higher stock prices, reflecting investor confidence in the company’s future growth and profitability. However, other factors can override this relationship in the short term.

Analyst Predictions and Ratings

Analyst ratings and price targets provide insights into market sentiment towards Tesla’s stock. The following is an illustrative example, and actual ratings may vary.

- Bank of America: Buy rating, price target $

300. Rationale: Strong future growth potential in the EV market. - Goldman Sachs: Neutral rating, price target $

250. Rationale: Concerns about competition and macroeconomic headwinds. - Morgan Stanley: Outperform rating, price target $

350. Rationale: Innovation and strong brand loyalty.

The range of price targets reflects differing opinions on Tesla’s future prospects. These varying opinions can significantly influence investor sentiment and trading activity, leading to increased volatility in the stock price.

Tesla’s Competitive Landscape

Tesla’s market capitalization is substantial, but it faces competition from other major players in the EV industry. The following table provides an illustrative comparison of market capitalization. Actual figures should be verified using real-time financial data.

| Company Name | Market Cap (USD Billion) |

|---|---|

| Tesla | 800 |

| BYD | 150 |

| Volkswagen | 70 |

Competitive pressures from established automakers and new entrants influence Tesla’s stock price. However, Tesla’s innovative technology and brand recognition often mitigate these competitive threats. Tesla’s continuous advancements in battery technology, autonomous driving capabilities, and charging infrastructure contribute to its higher stock valuation compared to some competitors.

Risk Factors Associated with Tesla Stock

Investing in Tesla stock carries several inherent risks. These risks should be carefully considered before making any investment decisions.

- Production and Supply Chain Disruptions: Challenges in manufacturing and securing necessary components can impact Tesla’s ability to meet demand, affecting its financial performance and stock price.

- Regulatory Changes: Government regulations concerning emissions standards, safety, and autonomous driving can significantly impact Tesla’s operations and profitability.

- Macroeconomic Factors: Changes in interest rates, inflation, and overall economic conditions can influence investor sentiment and affect Tesla’s stock price.

Regulatory changes, for instance, concerning the use of autonomous driving features, could lead to significant operational adjustments and potentially lower profitability, impacting the stock price. Similarly, rising interest rates can increase borrowing costs, reducing profitability and potentially depressing the stock valuation.

Visual Representation of Stock Price Trends

A line graph illustrating Tesla’s stock price over the past five years would have “Date” on the x-axis and “Stock Price (USD)” on the y-axis. The graph would show a general upward trend, but with periods of significant volatility, reflecting the factors discussed earlier. Key trend lines could be drawn to highlight major price increases and decreases, potentially correlating these movements with specific events or announcements.

For instance, a sharp drop might correspond to a negative news report or a period of production difficulties.

A bar chart comparing Tesla’s quarterly revenue with its stock price would have “Quarter” on the x-axis. The y-axis would have two scales, one for “Revenue (USD Billion)” and another for “Stock Price (USD)”. The chart would visually demonstrate the correlation (or lack thereof) between revenue and stock price. For example, periods of high revenue might correspond to higher stock prices, while periods of lower revenue might show a decline in stock price.

However, other factors could influence the stock price independently of the revenue.

FAQ Resource: What Is Price Of Tesla Stock

Is Tesla stock a good investment right now?

No way to say for sure, dude! Investing is risky, and TSLA is super volatile. Do your own research before putting your money down.

Where can I buy Tesla stock?

Most major brokerage accounts like Robinhood, Fidelity, or Schwab let you buy TSLA shares. But, you know, talk to a grown-up about this stuff first!

What’s a “price target”?

It’s basically what analysts think the stock price will be in the future. It’s just a guess, though, so don’t bet your whole life savings on it.

How often does the Tesla stock price change?

It changes constantly throughout the trading day! It’s like watching paint dry, but way more exciting (and stressful).